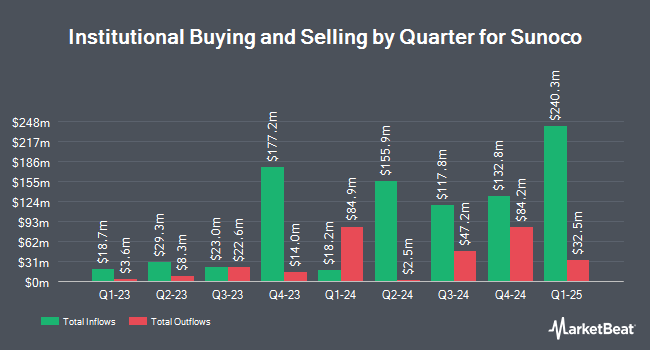

ING Groep NV grew its position in Sunoco LP (NYSE:SUN - Free Report) by 223.7% in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 513,715 shares of the oil and gas company's stock after buying an additional 355,000 shares during the period. ING Groep NV owned approximately 0.34% of Sunoco worth $26,426,000 at the end of the most recent quarter.

A number of other large investors have also made changes to their positions in the company. Independence Bank of Kentucky acquired a new stake in Sunoco during the 4th quarter worth approximately $53,000. Global Retirement Partners LLC raised its holdings in shares of Sunoco by 93.3% during the fourth quarter. Global Retirement Partners LLC now owns 1,633 shares of the oil and gas company's stock worth $84,000 after acquiring an additional 788 shares during the period. Allworth Financial LP raised its holdings in shares of Sunoco by 90.6% during the fourth quarter. Allworth Financial LP now owns 1,723 shares of the oil and gas company's stock worth $95,000 after acquiring an additional 819 shares during the period. Kieckhefer Group LLC bought a new stake in Sunoco in the 4th quarter valued at $129,000. Finally, Venturi Wealth Management LLC boosted its stake in Sunoco by 6,891.7% in the 4th quarter. Venturi Wealth Management LLC now owns 2,517 shares of the oil and gas company's stock worth $129,000 after purchasing an additional 2,481 shares during the period. Institutional investors own 24.29% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts recently issued reports on SUN shares. Barclays lifted their target price on Sunoco from $60.00 to $63.00 and gave the company an "overweight" rating in a research report on Tuesday, December 10th. Mizuho lifted their price objective on shares of Sunoco from $61.00 to $66.00 and gave the company an "outperform" rating in a report on Monday, February 3rd. Finally, Royal Bank of Canada increased their target price on shares of Sunoco from $63.00 to $64.00 and gave the stock an "outperform" rating in a report on Monday, December 9th. One analyst has rated the stock with a hold rating and six have issued a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $63.83.

Get Our Latest Stock Report on Sunoco

Sunoco Price Performance

SUN traded down $0.12 during trading on Tuesday, hitting $57.58. 150,826 shares of the stock traded hands, compared to its average volume of 545,010. The business has a 50 day moving average price of $54.58 and a 200 day moving average price of $53.62. The company has a debt-to-equity ratio of 1.84, a current ratio of 1.27 and a quick ratio of 0.66. Sunoco LP has a twelve month low of $49.45 and a twelve month high of $64.89. The company has a market cap of $8.79 billion, a price-to-earnings ratio of 8.72 and a beta of 1.36.

Sunoco (NYSE:SUN - Get Free Report) last issued its earnings results on Tuesday, February 11th. The oil and gas company reported $0.75 EPS for the quarter, missing the consensus estimate of $1.48 by ($0.73). Sunoco had a return on equity of 22.52% and a net margin of 3.85%. Equities research analysts forecast that Sunoco LP will post 10.65 earnings per share for the current fiscal year.

Sunoco Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Wednesday, February 19th. Investors of record on Friday, February 7th were given a dividend of $0.8865 per share. The ex-dividend date was Friday, February 7th. This is an increase from Sunoco's previous quarterly dividend of $0.88. This represents a $3.55 annualized dividend and a yield of 6.16%. Sunoco's dividend payout ratio (DPR) is currently 53.64%.

About Sunoco

(

Free Report)

Sunoco LP, together with its subsidiaries, distributes and retails motor fuels in the United States. It operates through two segments: Fuel Distribution and Marketing, and All Other. The Fuel Distribution and Marketing segment purchases motor fuel, as well as other petroleum products, such as propane and lubricating oil from independent refiners and oil companies and supplies it to company-operated retail stores, independently operated commission agents, and retail stores, as well as other commercial customers, including unbranded retail stores, other fuel distributors, school districts, municipalities, and other industrial customers.

Further Reading

Before you consider Sunoco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunoco wasn't on the list.

While Sunoco currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.