Blueshift Asset Management LLC lowered its position in shares of Sunrun Inc. (NASDAQ:RUN - Free Report) by 58.3% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 50,876 shares of the energy company's stock after selling 71,140 shares during the period. Blueshift Asset Management LLC's holdings in Sunrun were worth $919,000 at the end of the most recent reporting period.

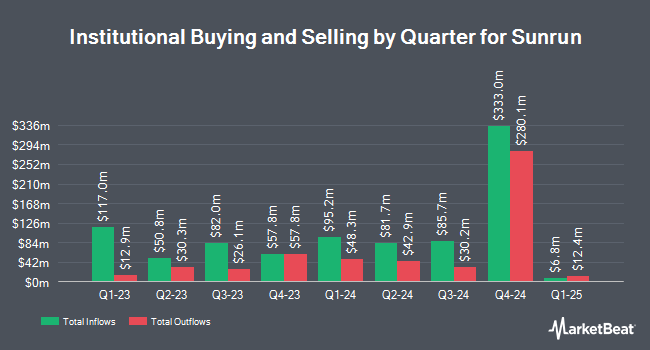

Several other hedge funds have also recently added to or reduced their stakes in RUN. Vanguard Group Inc. lifted its stake in shares of Sunrun by 14.0% in the 1st quarter. Vanguard Group Inc. now owns 22,325,106 shares of the energy company's stock valued at $294,245,000 after acquiring an additional 2,743,148 shares during the last quarter. Greenvale Capital LLP raised its position in Sunrun by 20.5% during the 2nd quarter. Greenvale Capital LLP now owns 11,750,000 shares of the energy company's stock valued at $139,355,000 after purchasing an additional 2,000,000 shares during the last quarter. Dimensional Fund Advisors LP raised its position in Sunrun by 20.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,385,218 shares of the energy company's stock valued at $52,025,000 after purchasing an additional 729,633 shares during the last quarter. FMR LLC raised its position in Sunrun by 83.6% during the 3rd quarter. FMR LLC now owns 3,430,327 shares of the energy company's stock valued at $61,952,000 after purchasing an additional 1,562,163 shares during the last quarter. Finally, Handelsbanken Fonder AB raised its position in Sunrun by 0.6% during the 3rd quarter. Handelsbanken Fonder AB now owns 3,123,059 shares of the energy company's stock valued at $56,402,000 after purchasing an additional 18,000 shares during the last quarter. Institutional investors own 91.69% of the company's stock.

Insider Activity

In other news, Director Lynn Michelle Jurich sold 1,937 shares of the stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $18.23, for a total value of $35,311.51. Following the transaction, the director now owns 1,242,446 shares in the company, valued at $22,649,790.58. This represents a 0.16 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, insider Jeanna Steele sold 2,357 shares of the business's stock in a transaction that occurred on Friday, September 6th. The shares were sold at an average price of $18.23, for a total transaction of $42,968.11. Following the sale, the insider now owns 308,260 shares of the company's stock, valued at $5,619,579.80. This trade represents a 0.76 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 196,795 shares of company stock valued at $3,071,225 over the last three months. Insiders own 3.77% of the company's stock.

Sunrun Stock Performance

NASDAQ:RUN traded up $0.06 during mid-day trading on Wednesday, reaching $11.55. The company's stock had a trading volume of 7,667,528 shares, compared to its average volume of 11,944,778. The firm's fifty day moving average price is $14.54 and its two-hundred day moving average price is $15.41. The company has a current ratio of 1.47, a quick ratio of 1.15 and a debt-to-equity ratio of 1.92. The stock has a market cap of $2.59 billion, a P/E ratio of -6.47 and a beta of 2.61. Sunrun Inc. has a 12-month low of $9.23 and a 12-month high of $22.26.

Wall Street Analyst Weigh In

A number of research analysts have commented on RUN shares. Wells Fargo & Company lowered their price target on Sunrun from $20.00 to $15.00 and set an "overweight" rating for the company in a research report on Friday, November 8th. Guggenheim lowered Sunrun from a "buy" rating to a "neutral" rating in a research report on Thursday, November 7th. Truist Financial reiterated a "hold" rating and set a $12.00 target price (down previously from $18.00) on shares of Sunrun in a report on Tuesday, November 12th. Piper Sandler downgraded Sunrun from an "overweight" rating to a "neutral" rating and reduced their target price for the stock from $23.00 to $11.00 in a report on Friday, November 22nd. Finally, Susquehanna reduced their target price on Sunrun from $24.00 to $23.00 and set a "positive" rating on the stock in a report on Wednesday, October 16th. Two equities research analysts have rated the stock with a sell rating, ten have issued a hold rating and eleven have issued a buy rating to the company's stock. According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $19.28.

Check Out Our Latest Stock Analysis on Sunrun

Sunrun Company Profile

(

Free Report)

Sunrun Inc designs, develops, installs, sells, owns, and maintains residential solar energy systems in the United States. It also sells solar energy systems and products, such as panels and racking; and solar leads generated to customers. In addition, the company offers battery storage along with solar energy systems; and sells services to commercial developers through multi-family and new homes.

Recommended Stories

Before you consider Sunrun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunrun wasn't on the list.

While Sunrun currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.