Sunrun (NASDAQ:RUN - Get Free Report)'s stock had its "sell" rating reiterated by equities researchers at Glj Research in a report issued on Thursday,Benzinga reports. They presently have a $7.78 target price on the energy company's stock. Glj Research's price target would indicate a potential downside of 33.28% from the stock's previous close.

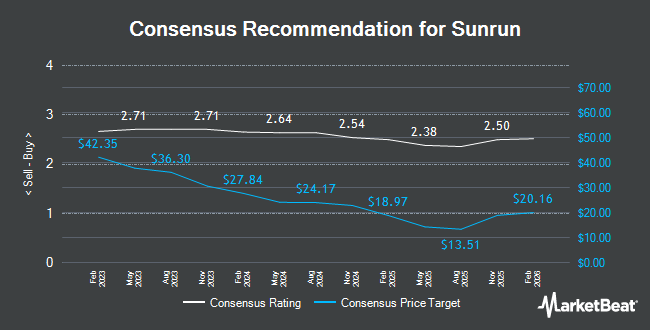

Several other research firms have also recently commented on RUN. BMO Capital Markets lifted their target price on Sunrun from $17.00 to $20.00 and gave the company a "market perform" rating in a research note on Wednesday, August 7th. Piper Sandler increased their price target on Sunrun from $20.00 to $23.00 and gave the company an "overweight" rating in a research report on Wednesday, August 7th. JPMorgan Chase & Co. raised their price target on Sunrun from $19.00 to $22.00 and gave the company an "overweight" rating in a report on Wednesday, August 7th. UBS Group boosted their price objective on shares of Sunrun from $14.00 to $18.00 and gave the company a "neutral" rating in a report on Wednesday, August 7th. Finally, Barclays lowered their price target on Sunrun from $19.00 to $18.00 and set an "equal weight" rating for the company in a report on Wednesday, October 16th. Two analysts have rated the stock with a sell rating, eight have assigned a hold rating and ten have given a buy rating to the company. According to data from MarketBeat, Sunrun currently has an average rating of "Hold" and a consensus price target of $21.77.

Get Our Latest Report on Sunrun

Sunrun Trading Down 2.0 %

NASDAQ:RUN traded down $0.24 on Thursday, reaching $11.66. The stock had a trading volume of 12,354,722 shares, compared to its average volume of 11,894,493. The company has a debt-to-equity ratio of 1.84, a current ratio of 1.66 and a quick ratio of 1.31. The company has a market cap of $2.61 billion, a price-to-earnings ratio of -1.84 and a beta of 2.61. Sunrun has a 12-month low of $8.82 and a 12-month high of $22.26. The firm's fifty day moving average is $16.97 and its two-hundred day moving average is $15.42.

Sunrun (NASDAQ:RUN - Get Free Report) last released its earnings results on Tuesday, August 6th. The energy company reported $0.55 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.33) by $0.88. Sunrun had a negative return on equity of 2.41% and a negative net margin of 66.36%. The company had revenue of $523.87 million during the quarter, compared to analyst estimates of $516.76 million. During the same quarter in the prior year, the company earned $0.25 earnings per share. The company's revenue for the quarter was down 11.2% on a year-over-year basis. Equities analysts expect that Sunrun will post -0.17 EPS for the current fiscal year.

Insider Activity

In related news, Director Gerald Alan Risk sold 9,045 shares of Sunrun stock in a transaction dated Monday, August 19th. The stock was sold at an average price of $20.04, for a total value of $181,261.80. Following the sale, the director now owns 334,761 shares of the company's stock, valued at approximately $6,708,610.44. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other news, Director Gerald Alan Risk sold 9,045 shares of the business's stock in a transaction dated Monday, August 19th. The stock was sold at an average price of $20.04, for a total transaction of $181,261.80. Following the sale, the director now directly owns 334,761 shares in the company, valued at approximately $6,708,610.44. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CFO Danny Abajian sold 9,694 shares of the firm's stock in a transaction that occurred on Wednesday, September 4th. The stock was sold at an average price of $19.75, for a total value of $191,456.50. Following the sale, the chief financial officer now directly owns 278,260 shares of the company's stock, valued at $5,495,635. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 155,840 shares of company stock worth $2,755,487. Corporate insiders own 3.77% of the company's stock.

Institutional Trading of Sunrun

Several institutional investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. increased its holdings in shares of Sunrun by 14.0% in the first quarter. Vanguard Group Inc. now owns 22,325,106 shares of the energy company's stock worth $294,245,000 after purchasing an additional 2,743,148 shares during the last quarter. Greenvale Capital LLP lifted its holdings in Sunrun by 20.5% during the second quarter. Greenvale Capital LLP now owns 11,750,000 shares of the energy company's stock worth $139,355,000 after buying an additional 2,000,000 shares during the period. Dimensional Fund Advisors LP grew its position in shares of Sunrun by 20.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 4,385,218 shares of the energy company's stock worth $52,025,000 after buying an additional 729,633 shares during the last quarter. Handelsbanken Fonder AB raised its stake in Sunrun by 0.6% in the third quarter. Handelsbanken Fonder AB now owns 3,123,059 shares of the energy company's stock valued at $56,402,000 after buying an additional 18,000 shares during the last quarter. Finally, Sylebra Capital LLC acquired a new position in shares of Sunrun in the 2nd quarter valued at $35,387,000. 91.69% of the stock is currently owned by hedge funds and other institutional investors.

About Sunrun

(

Get Free Report)

Sunrun Inc designs, develops, installs, sells, owns, and maintains residential solar energy systems in the United States. It also sells solar energy systems and products, such as panels and racking; and solar leads generated to customers. In addition, the company offers battery storage along with solar energy systems; and sells services to commercial developers through multi-family and new homes.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Sunrun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunrun wasn't on the list.

While Sunrun currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.