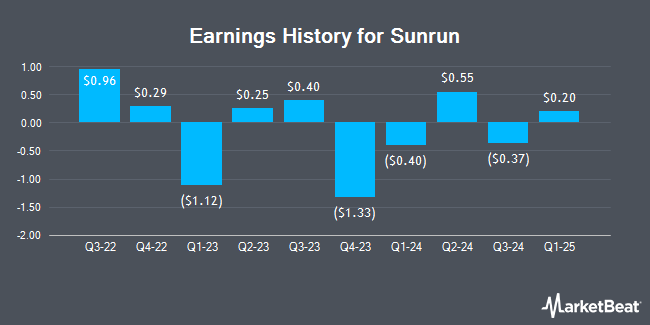

Sunrun (NASDAQ:RUN - Get Free Report) will likely be posting its quarterly earnings results before the market opens on Wednesday, February 19th. Analysts expect Sunrun to post earnings of ($0.25) per share and revenue of $540.47 million for the quarter. Individual that are interested in registering for the company's earnings conference call can do so using this link.

Sunrun Price Performance

NASDAQ:RUN traded down $0.07 during trading hours on Thursday, reaching $8.54. 6,131,819 shares of the company traded hands, compared to its average volume of 10,049,338. Sunrun has a 1-year low of $7.87 and a 1-year high of $22.26. The stock has a market cap of $1.92 billion, a P/E ratio of -4.69 and a beta of 2.59. The firm's 50-day moving average is $9.50 and its 200-day moving average is $13.55. The company has a debt-to-equity ratio of 1.92, a current ratio of 1.47 and a quick ratio of 1.15.

Analyst Ratings Changes

A number of equities analysts have recently weighed in on RUN shares. Piper Sandler lowered shares of Sunrun from an "overweight" rating to a "neutral" rating and cut their price objective for the company from $23.00 to $11.00 in a research report on Friday, November 22nd. Barclays decreased their price objective on Sunrun from $18.00 to $15.00 and set an "equal weight" rating on the stock in a report on Tuesday, January 28th. Jefferies Financial Group dropped their target price on Sunrun from $19.00 to $17.00 and set a "buy" rating for the company in a research note on Tuesday, January 28th. Guggenheim cut Sunrun from a "buy" rating to a "neutral" rating in a report on Thursday, November 7th. Finally, Oppenheimer cut their price objective on shares of Sunrun from $22.00 to $20.00 and set an "outperform" rating on the stock in a report on Friday, November 8th. Two research analysts have rated the stock with a sell rating, seven have assigned a hold rating and fourteen have given a buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $18.36.

Check Out Our Latest Report on Sunrun

Insider Buying and Selling at Sunrun

In other Sunrun news, CRO Paul S. Dickson sold 2,968 shares of the stock in a transaction on Monday, January 6th. The shares were sold at an average price of $11.18, for a total transaction of $33,182.24. Following the transaction, the executive now directly owns 418,492 shares in the company, valued at $4,678,740.56. This represents a 0.70 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available through this link. Also, Director Lynn Michelle Jurich sold 50,000 shares of the business's stock in a transaction dated Thursday, December 19th. The stock was sold at an average price of $9.42, for a total transaction of $471,000.00. Following the completion of the sale, the director now directly owns 1,041,753 shares of the company's stock, valued at $9,813,313.26. The trade was a 4.58 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 114,830 shares of company stock valued at $1,117,147 in the last ninety days. Insiders own 3.77% of the company's stock.

Sunrun Company Profile

(

Get Free Report)

Sunrun Inc designs, develops, installs, sells, owns, and maintains residential solar energy systems in the United States. It also sells solar energy systems and products, such as panels and racking; and solar leads generated to customers. In addition, the company offers battery storage along with solar energy systems; and sells services to commercial developers through multi-family and new homes.

Further Reading

Before you consider Sunrun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunrun wasn't on the list.

While Sunrun currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.