Sumitomo Mitsui Trust Group Inc. lowered its holdings in Sunstone Hotel Investors, Inc. (NYSE:SHO - Free Report) by 21.8% during the fourth quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 331,698 shares of the real estate investment trust's stock after selling 92,541 shares during the quarter. Sumitomo Mitsui Trust Group Inc. owned 0.17% of Sunstone Hotel Investors worth $3,927,000 as of its most recent SEC filing.

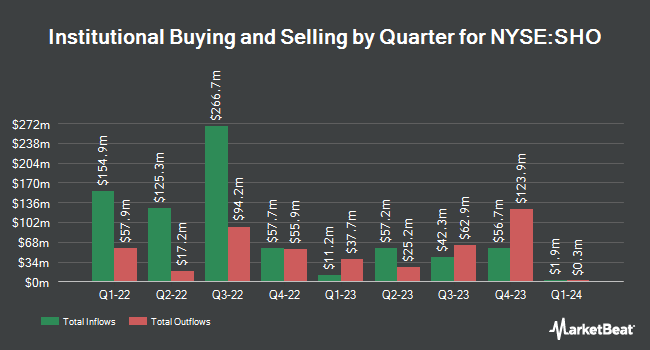

A number of other hedge funds and other institutional investors have also recently made changes to their positions in the business. JPMorgan Chase & Co. grew its position in Sunstone Hotel Investors by 31.0% during the third quarter. JPMorgan Chase & Co. now owns 4,775,533 shares of the real estate investment trust's stock valued at $49,284,000 after buying an additional 1,130,558 shares during the period. Principal Financial Group Inc. grew its position in Sunstone Hotel Investors by 11.6% during the third quarter. Principal Financial Group Inc. now owns 1,120,710 shares of the real estate investment trust's stock valued at $11,566,000 after buying an additional 116,058 shares during the period. Intech Investment Management LLC acquired a new stake in Sunstone Hotel Investors during the third quarter valued at $573,000. NFJ Investment Group LLC acquired a new stake in Sunstone Hotel Investors during the third quarter valued at $3,220,000. Finally, Geode Capital Management LLC grew its position in Sunstone Hotel Investors by 2.1% during the third quarter. Geode Capital Management LLC now owns 5,247,927 shares of the real estate investment trust's stock valued at $54,169,000 after buying an additional 109,327 shares during the period. Institutional investors and hedge funds own 99.37% of the company's stock.

Sunstone Hotel Investors Stock Up 0.6 %

Shares of SHO stock traded up $0.07 during trading on Monday, reaching $11.20. The company's stock had a trading volume of 947,604 shares, compared to its average volume of 1,983,473. The company has a debt-to-equity ratio of 0.44, a current ratio of 2.98 and a quick ratio of 2.98. The company has a market capitalization of $2.25 billion, a price-to-earnings ratio of 14.73, a P/E/G ratio of 3.78 and a beta of 1.20. The stock's 50-day moving average price is $11.72 and its 200 day moving average price is $10.84. Sunstone Hotel Investors, Inc. has a 1-year low of $9.39 and a 1-year high of $12.41.

Wall Street Analysts Forecast Growth

SHO has been the topic of several recent analyst reports. Wells Fargo & Company increased their price objective on shares of Sunstone Hotel Investors from $11.00 to $13.00 and gave the company an "equal weight" rating in a report on Monday, December 9th. Jefferies Financial Group increased their price objective on shares of Sunstone Hotel Investors from $10.00 to $12.00 and gave the company a "hold" rating in a report on Thursday, January 2nd. Finally, Morgan Stanley reaffirmed an "underweight" rating and set a $10.00 price objective on shares of Sunstone Hotel Investors in a report on Tuesday, January 14th. Two equities research analysts have rated the stock with a sell rating, four have given a hold rating, two have issued a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $11.86.

Get Our Latest Stock Report on SHO

Sunstone Hotel Investors Company Profile

(

Free Report)

Sunstone Hotel Investors, Inc is a lodging real estate investment trust ("REIT") that as of the date of this release owns 14 hotels comprised of 6,675 rooms, the majority of which are operated under nationally recognized brands. Sunstone's strategy is to create long-term stakeholder value through the acquisition, active ownership, and disposition of well-located hotel and resort real estate.

Further Reading

Before you consider Sunstone Hotel Investors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunstone Hotel Investors wasn't on the list.

While Sunstone Hotel Investors currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.