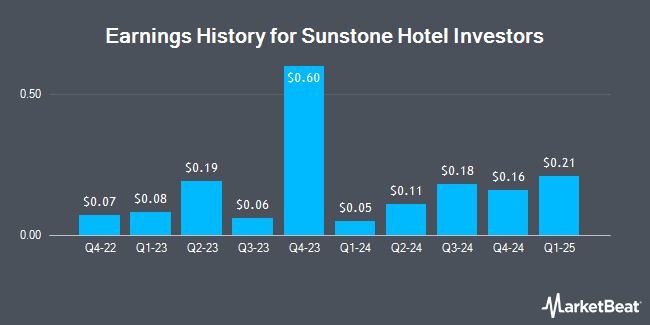

Sunstone Hotel Investors (NYSE:SHO - Get Free Report) posted its earnings results on Tuesday. The real estate investment trust reported $0.18 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.20 by ($0.02), Briefing.com reports. The business had revenue of $226.40 million for the quarter, compared to analyst estimates of $224.61 million. Sunstone Hotel Investors had a net margin of 18.61% and a return on equity of 9.04%. The company's revenue for the quarter was down 8.6% on a year-over-year basis. During the same quarter in the prior year, the firm earned $0.23 earnings per share. Sunstone Hotel Investors updated its FY24 guidance to $0.75-0.80 EPS.

Sunstone Hotel Investors Price Performance

Shares of NYSE:SHO traded down $0.07 during midday trading on Wednesday, hitting $10.44. The company's stock had a trading volume of 3,007,017 shares, compared to its average volume of 2,046,712. Sunstone Hotel Investors has a 12-month low of $9.39 and a 12-month high of $11.59. The company has a market cap of $2.12 billion, a P/E ratio of 13.91, a price-to-earnings-growth ratio of 6.11 and a beta of 1.25. The company has a debt-to-equity ratio of 0.44, a quick ratio of 3.75 and a current ratio of 2.98. The business's 50 day simple moving average is $10.33 and its 200 day simple moving average is $10.25.

Sunstone Hotel Investors Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be given a $0.09 dividend. This represents a $0.36 dividend on an annualized basis and a dividend yield of 3.45%. The ex-dividend date is Tuesday, December 31st. Sunstone Hotel Investors's dividend payout ratio (DPR) is 42.11%.

Analyst Upgrades and Downgrades

A number of equities research analysts recently issued reports on SHO shares. Wells Fargo & Company raised shares of Sunstone Hotel Investors from an "underweight" rating to an "equal weight" rating and set a $10.50 price target on the stock in a research note on Friday, September 13th. StockNews.com cut shares of Sunstone Hotel Investors from a "hold" rating to a "sell" rating in a research note on Thursday, August 1st. One investment analyst has rated the stock with a sell rating, four have given a hold rating, two have given a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $11.42.

View Our Latest Report on Sunstone Hotel Investors

About Sunstone Hotel Investors

(

Get Free Report)

Sunstone Hotel Investors, Inc is a lodging real estate investment trust ("REIT") that as of the date of this release owns 14 hotels comprised of 6,675 rooms, the majority of which are operated under nationally recognized brands. Sunstone's strategy is to create long-term stakeholder value through the acquisition, active ownership, and disposition of well-located hotel and resort real estate.

Further Reading

Before you consider Sunstone Hotel Investors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sunstone Hotel Investors wasn't on the list.

While Sunstone Hotel Investors currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.