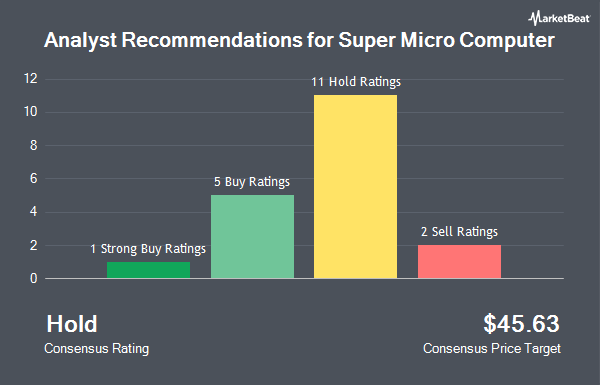

Shares of Super Micro Computer, Inc. (NASDAQ:SMCI - Get Free Report) have earned an average recommendation of "Hold" from the eighteen research firms that are currently covering the firm, Marketbeat reports. Two research analysts have rated the stock with a sell recommendation, ten have given a hold recommendation, five have given a buy recommendation and one has issued a strong buy recommendation on the company. The average 1 year price target among brokerages that have covered the stock in the last year is $60.20.

Several equities research analysts have recently commented on SMCI shares. Northland Capmk raised shares of Super Micro Computer to a "strong-buy" rating in a research report on Friday, December 20th. Northland Securities reaffirmed an "outperform" rating and set a $57.00 price target (up previously from $54.00) on shares of Super Micro Computer in a research report on Wednesday, February 12th. The Goldman Sachs Group cut their price objective on Super Micro Computer from $67.50 to $28.00 and set a "neutral" rating for the company in a research note on Wednesday, November 6th. Argus downgraded Super Micro Computer from a "buy" rating to a "hold" rating in a research note on Thursday, October 31st. Finally, Wedbush boosted their price objective on Super Micro Computer from $24.00 to $40.00 and gave the company a "neutral" rating in a research note on Wednesday, February 12th.

Get Our Latest Research Report on Super Micro Computer

Institutional Trading of Super Micro Computer

Several hedge funds have recently modified their holdings of SMCI. Emerald Mutual Fund Advisers Trust purchased a new stake in Super Micro Computer during the 3rd quarter valued at $87,000. Retirement Systems of Alabama increased its stake in Super Micro Computer by 2.3% in the third quarter. Retirement Systems of Alabama now owns 11,367 shares of the company's stock worth $4,733,000 after purchasing an additional 258 shares during the period. TrueWealth Advisors LLC increased its stake in Super Micro Computer by 99.0% in the third quarter. TrueWealth Advisors LLC now owns 593 shares of the company's stock worth $247,000 after purchasing an additional 295 shares during the period. Wahed Invest LLC increased its stake in Super Micro Computer by 2.9% in the fourth quarter. Wahed Invest LLC now owns 12,362 shares of the company's stock worth $377,000 after purchasing an additional 352 shares during the period. Finally, Miller Wealth Advisors LLC purchased a new stake in Super Micro Computer in the third quarter worth $152,000. 84.06% of the stock is owned by hedge funds and other institutional investors.

Super Micro Computer Stock Performance

NASDAQ:SMCI traded down $3.23 during mid-day trading on Thursday, reaching $56.04. The company's stock had a trading volume of 82,892,945 shares, compared to its average volume of 71,064,023. Super Micro Computer has a 12-month low of $17.25 and a 12-month high of $122.90. The firm's fifty day moving average price is $34.83 and its two-hundred day moving average price is $39.86. The company has a current ratio of 3.77, a quick ratio of 1.93 and a debt-to-equity ratio of 0.32. The stock has a market cap of $32.81 billion, a P/E ratio of 28.09 and a beta of 1.30.

About Super Micro Computer

(

Get Free ReportSuper Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Featured Stories

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.