Trust Point Inc. lessened its stake in shares of Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN - Free Report) by 47.8% in the fourth quarter, according to its most recent filing with the SEC. The fund owned 8,521 shares of the specialty pharmaceutical company's stock after selling 7,812 shares during the period. Trust Point Inc.'s holdings in Supernus Pharmaceuticals were worth $308,000 at the end of the most recent reporting period.

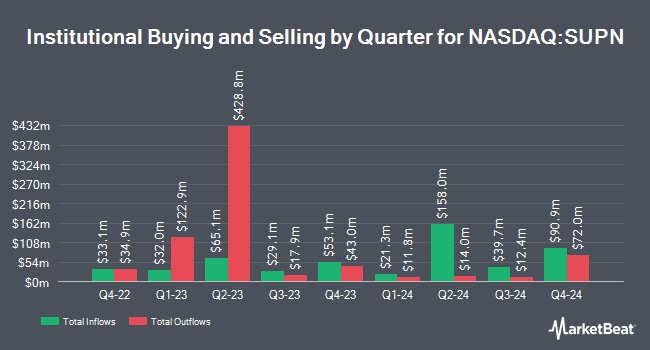

Other institutional investors and hedge funds also recently modified their holdings of the company. GAMMA Investing LLC raised its holdings in shares of Supernus Pharmaceuticals by 97.1% during the third quarter. GAMMA Investing LLC now owns 808 shares of the specialty pharmaceutical company's stock valued at $25,000 after acquiring an additional 398 shares during the period. Mirae Asset Global Investments Co. Ltd. grew its position in Supernus Pharmaceuticals by 21.5% during the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 1,993 shares of the specialty pharmaceutical company's stock worth $61,000 after purchasing an additional 352 shares in the last quarter. KBC Group NV raised its stake in Supernus Pharmaceuticals by 53.1% during the 4th quarter. KBC Group NV now owns 2,679 shares of the specialty pharmaceutical company's stock valued at $97,000 after purchasing an additional 929 shares during the period. Kennebec Savings Bank purchased a new stake in shares of Supernus Pharmaceuticals in the third quarter valued at $103,000. Finally, Janney Montgomery Scott LLC acquired a new stake in shares of Supernus Pharmaceuticals in the fourth quarter worth $211,000.

Insider Transactions at Supernus Pharmaceuticals

In related news, VP Padmanabh P. Bhatt sold 9,477 shares of the stock in a transaction that occurred on Tuesday, February 4th. The stock was sold at an average price of $39.70, for a total value of $376,236.90. Following the transaction, the vice president now owns 10,149 shares in the company, valued at approximately $402,915.30. This represents a 48.29 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through this link. Company insiders own 9.30% of the company's stock.

Supernus Pharmaceuticals Stock Performance

Shares of NASDAQ:SUPN traded down $0.47 during midday trading on Monday, hitting $37.93. 275,381 shares of the stock were exchanged, compared to its average volume of 360,999. The company has a market capitalization of $2.09 billion, a PE ratio of 35.45 and a beta of 0.90. Supernus Pharmaceuticals, Inc. has a 52-week low of $25.53 and a 52-week high of $40.28. The business's fifty day simple moving average is $37.38 and its two-hundred day simple moving average is $34.90.

Analyst Ratings Changes

Several research firms recently weighed in on SUPN. Cantor Fitzgerald started coverage on Supernus Pharmaceuticals in a research report on Monday, January 6th. They set an "overweight" rating and a $57.00 price target on the stock. Piper Sandler reiterated a "neutral" rating on shares of Supernus Pharmaceuticals in a report on Friday, October 18th. Finally, Cowen restated a "buy" rating on shares of Supernus Pharmaceuticals in a report on Friday, October 18th.

Read Our Latest Research Report on SUPN

Supernus Pharmaceuticals Profile

(

Free Report)

Supernus Pharmaceuticals, Inc, a biopharmaceutical company, focuses on the development and commercialization of products for the treatment of central nervous system (CNS) diseases in the United States. The company's commercial products are Trokendi XR, an extended release topiramate product indicated for the treatment of epilepsy, as well as for the prophylaxis of migraine headache; and Oxtellar XR, an extended release oxcarbazepine for the monotherapy treatment of partial onset seizures in adults and children between 6 to 17 years of age.

See Also

Before you consider Supernus Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Supernus Pharmaceuticals wasn't on the list.

While Supernus Pharmaceuticals currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.