Occidental Petroleum (NYSE:OXY - Free Report) had its price objective trimmed by Susquehanna from $77.00 to $65.00 in a report issued on Thursday,Benzinga reports. The firm currently has a positive rating on the oil and gas producer's stock.

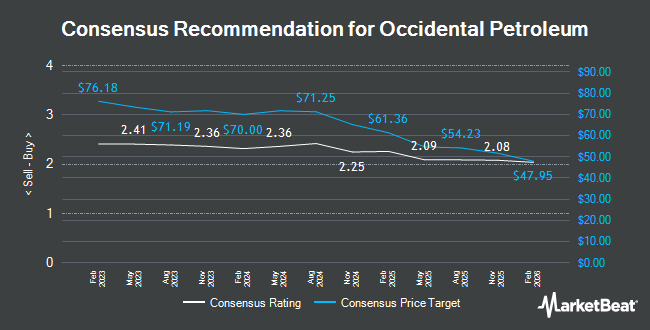

Several other brokerages also recently issued reports on OXY. Mizuho decreased their price target on Occidental Petroleum from $76.00 to $72.00 and set a "neutral" rating for the company in a report on Monday, September 16th. BMO Capital Markets reduced their price objective on Occidental Petroleum from $70.00 to $65.00 and set a "market perform" rating for the company in a research note on Friday, October 4th. Jefferies Financial Group upped their price objective on Occidental Petroleum from $53.00 to $54.00 and gave the company a "hold" rating in a research note on Tuesday. Bank of America assumed coverage on Occidental Petroleum in a research note on Thursday, October 17th. They issued a "neutral" rating and a $57.00 price objective for the company. Finally, Wolfe Research upped their price target on Occidental Petroleum from $73.00 to $75.00 and gave the company a "buy" rating in a research report on Tuesday. One equities research analyst has rated the stock with a sell rating, thirteen have issued a hold rating and seven have issued a buy rating to the stock. According to MarketBeat.com, Occidental Petroleum presently has an average rating of "Hold" and a consensus target price of $63.70.

Get Our Latest Stock Analysis on Occidental Petroleum

Occidental Petroleum Stock Down 1.7 %

Occidental Petroleum stock traded down $0.86 during trading on Thursday, hitting $50.26. 8,954,644 shares of the company were exchanged, compared to its average volume of 9,332,924. The business's 50 day moving average is $51.90 and its 200 day moving average is $57.67. Occidental Petroleum has a 52 week low of $48.42 and a 52 week high of $71.18. The company has a market capitalization of $45.52 billion, a P/E ratio of 13.35 and a beta of 1.58. The company has a current ratio of 1.04, a quick ratio of 0.75 and a debt-to-equity ratio of 0.77.

Occidental Petroleum Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 10th will be given a $0.22 dividend. The ex-dividend date of this dividend is Tuesday, December 10th. This represents a $0.88 dividend on an annualized basis and a dividend yield of 1.75%. Occidental Petroleum's dividend payout ratio is currently 22.92%.

Hedge Funds Weigh In On Occidental Petroleum

A number of hedge funds and other institutional investors have recently made changes to their positions in the business. Banco Santander S.A. grew its stake in Occidental Petroleum by 75.0% in the first quarter. Banco Santander S.A. now owns 138,584 shares of the oil and gas producer's stock worth $9,007,000 after purchasing an additional 59,402 shares during the period. Councilmark Asset Management LLC bought a new position in shares of Occidental Petroleum during the first quarter valued at $254,000. Nicolet Advisory Services LLC purchased a new position in shares of Occidental Petroleum in the 1st quarter worth about $205,000. South Street Advisors LLC grew its position in Occidental Petroleum by 28.3% during the 1st quarter. South Street Advisors LLC now owns 156,920 shares of the oil and gas producer's stock valued at $10,198,000 after purchasing an additional 34,645 shares during the last quarter. Finally, Trustmark National Bank Trust Department increased its stake in Occidental Petroleum by 10.8% during the 1st quarter. Trustmark National Bank Trust Department now owns 33,098 shares of the oil and gas producer's stock valued at $2,151,000 after purchasing an additional 3,238 shares in the last quarter. Institutional investors own 88.70% of the company's stock.

About Occidental Petroleum

(

Get Free Report)

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, and North Africa. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas.

Featured Stories

Before you consider Occidental Petroleum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Occidental Petroleum wasn't on the list.

While Occidental Petroleum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.