Baillie Gifford & Co. decreased its holdings in Sutro Biopharma, Inc. (NASDAQ:STRO - Free Report) by 17.8% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 1,519,341 shares of the company's stock after selling 329,410 shares during the period. Baillie Gifford & Co. owned about 1.85% of Sutro Biopharma worth $5,257,000 as of its most recent filing with the Securities & Exchange Commission.

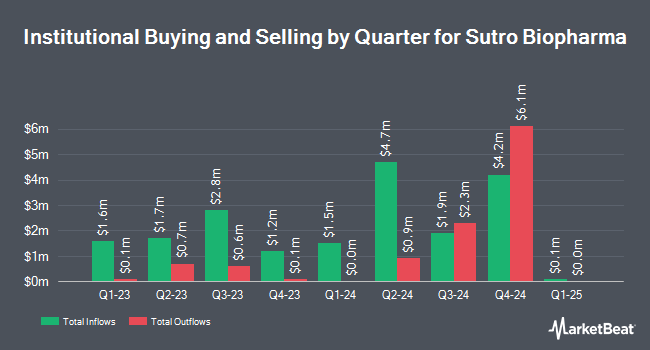

Several other hedge funds and other institutional investors have also made changes to their positions in the stock. Mirae Asset Global Investments Co. Ltd. purchased a new stake in Sutro Biopharma during the first quarter worth approximately $249,000. BNP Paribas Financial Markets lifted its stake in Sutro Biopharma by 500.1% in the first quarter. BNP Paribas Financial Markets now owns 98,227 shares of the company's stock valued at $555,000 after buying an additional 81,858 shares during the last quarter. Russell Investments Group Ltd. boosted its stake in Sutro Biopharma by 192.9% during the 1st quarter. Russell Investments Group Ltd. now owns 111,955 shares of the company's stock worth $633,000 after purchasing an additional 73,731 shares during the period. Vanguard Group Inc. increased its position in Sutro Biopharma by 4.6% in the 1st quarter. Vanguard Group Inc. now owns 3,022,790 shares of the company's stock valued at $17,079,000 after acquiring an additional 132,790 shares during the period. Finally, Acadian Asset Management LLC raised its stake in shares of Sutro Biopharma by 30.5% during the first quarter. Acadian Asset Management LLC now owns 1,204,253 shares of the company's stock worth $6,803,000 after purchasing an additional 281,224 shares during the last quarter. Hedge funds and other institutional investors own 96.99% of the company's stock.

Sutro Biopharma Price Performance

STRO stock traded down $0.46 during trading on Thursday, reaching $3.50. 366,373 shares of the stock traded hands, compared to its average volume of 801,526. The business's 50 day moving average price is $3.78 and its 200-day moving average price is $3.84. The firm has a market capitalization of $286.87 million, a PE ratio of -2.01 and a beta of 1.17. Sutro Biopharma, Inc. has a 52-week low of $2.13 and a 52-week high of $6.13.

Sutro Biopharma (NASDAQ:STRO - Get Free Report) last posted its earnings results on Tuesday, August 13th. The company reported ($0.59) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.79) by $0.20. Sutro Biopharma had a negative return on equity of 102.06% and a negative net margin of 73.48%. The business had revenue of $25.71 million during the quarter, compared to analyst estimates of $26.28 million. On average, equities research analysts predict that Sutro Biopharma, Inc. will post -2.96 earnings per share for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages recently weighed in on STRO. JMP Securities reaffirmed a "market outperform" rating and set a $17.00 price objective on shares of Sutro Biopharma in a report on Monday, September 16th. HC Wainwright reiterated a "buy" rating and issued a $12.00 price objective on shares of Sutro Biopharma in a research note on Friday, October 11th. Piper Sandler restated an "overweight" rating and set a $11.00 target price on shares of Sutro Biopharma in a research report on Friday, October 11th. Finally, Truist Financial lowered their target price on Sutro Biopharma from $18.00 to $15.00 and set a "buy" rating on the stock in a report on Friday, August 16th. Seven analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus price target of $12.14.

View Our Latest Stock Report on Sutro Biopharma

Sutro Biopharma Profile

(

Free Report)

Sutro Biopharma, Inc operates as a clinical-stage oncology company. The company develops site-specific and novel-format antibody drug conjugates (ADCs) that enables its proprietary integrated cell-free protein synthesis platform, XpressCF and XpressCF+. Its product candidates include STRO-002, an ADC directed against folate receptor-alpha, which is in Phase II/III clinical trials for patients with ovarian and endometrial cancers; VAX-24 and Vax-31 pneumococcal conjugate vaccine candidates that is in Phase II/III clinical trials for the treatment of invasive pneumococcal disease; and MK-1484, a distinct cytokine derivative molecule that is in Phase I clinical study for the treatment of cancer.

Recommended Stories

Before you consider Sutro Biopharma, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sutro Biopharma wasn't on the list.

While Sutro Biopharma currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.