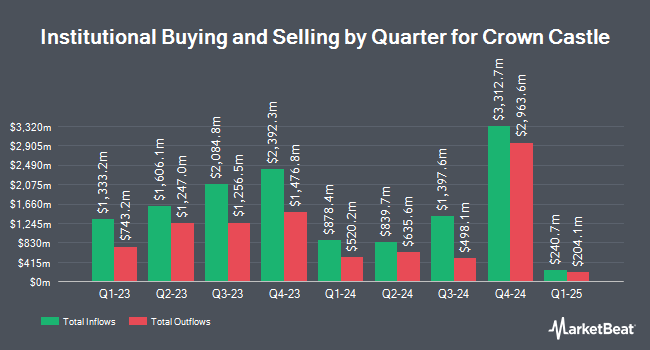

SVB Wealth LLC bought a new stake in Crown Castle Inc. (NYSE:CCI - Free Report) in the fourth quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor bought 2,948 shares of the real estate investment trust's stock, valued at approximately $268,000.

A number of other hedge funds have also modified their holdings of CCI. Wellington Management Group LLP raised its position in shares of Crown Castle by 23.8% in the third quarter. Wellington Management Group LLP now owns 17,528,597 shares of the real estate investment trust's stock valued at $2,079,417,000 after buying an additional 3,371,186 shares during the last quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its position in shares of Crown Castle by 433.8% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 3,968,959 shares of the real estate investment trust's stock valued at $470,838,000 after buying an additional 3,225,460 shares during the last quarter. State Street Corp raised its position in shares of Crown Castle by 3.7% in the third quarter. State Street Corp now owns 20,875,581 shares of the real estate investment trust's stock valued at $2,476,470,000 after buying an additional 747,390 shares during the last quarter. Proficio Capital Partners LLC raised its position in shares of Crown Castle by 9,471.0% in the fourth quarter. Proficio Capital Partners LLC now owns 747,590 shares of the real estate investment trust's stock valued at $748,000 after buying an additional 739,779 shares during the last quarter. Finally, Daiwa Securities Group Inc. raised its position in shares of Crown Castle by 25.4% in the third quarter. Daiwa Securities Group Inc. now owns 3,166,236 shares of the real estate investment trust's stock valued at $375,610,000 after buying an additional 642,010 shares during the last quarter. 90.77% of the stock is currently owned by institutional investors and hedge funds.

Crown Castle Trading Up 0.6 %

NYSE CCI opened at $94.79 on Thursday. The firm has a 50 day simple moving average of $90.00 and a 200-day simple moving average of $102.07. The company has a debt-to-equity ratio of 4.43, a quick ratio of 0.54 and a current ratio of 0.54. Crown Castle Inc. has a one year low of $84.20 and a one year high of $120.92. The firm has a market cap of $41.20 billion, a price-to-earnings ratio of 33.61 and a beta of 0.88.

Crown Castle Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, March 31st. Stockholders of record on Friday, March 14th will be paid a $1.565 dividend. This represents a $6.26 annualized dividend and a dividend yield of 6.60%. The ex-dividend date is Friday, March 14th. Crown Castle's payout ratio is 221.99%.

Wall Street Analysts Forecast Growth

Several equities research analysts recently issued reports on CCI shares. Scotiabank cut their price objective on shares of Crown Castle from $118.00 to $102.00 and set a "sector perform" rating for the company in a research report on Thursday, January 23rd. Wells Fargo & Company cut their price objective on shares of Crown Castle from $100.00 to $85.00 and set an "underweight" rating for the company in a research report on Thursday, January 23rd. Jefferies Financial Group cut shares of Crown Castle from a "buy" rating to a "hold" rating and cut their price objective for the stock from $127.00 to $84.00 in a research report on Thursday, January 2nd. JMP Securities started coverage on shares of Crown Castle in a research report on Monday, January 27th. They set an "outperform" rating and a $115.00 price objective for the company. Finally, Deutsche Bank Aktiengesellschaft cut their price objective on shares of Crown Castle from $116.00 to $96.00 and set a "hold" rating for the company in a research report on Thursday, January 23rd. One research analyst has rated the stock with a sell rating, ten have issued a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, the stock has an average rating of "Hold" and an average price target of $108.75.

Get Our Latest Research Report on CCI

Crown Castle Company Profile

(

Free Report)

Crown Castle owns, operates and leases more than 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S. market. This nationwide portfolio of communications infrastructure connects cities and communities to essential data, technology and wireless service - bringing information, ideas and innovations to the people and businesses that need them.

Featured Stories

Want to see what other hedge funds are holding CCI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Crown Castle Inc. (NYSE:CCI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Crown Castle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crown Castle wasn't on the list.

While Crown Castle currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.