Swedbank AB increased its stake in shares of Waters Co. (NYSE:WAT - Free Report) by 6.6% during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 31,288 shares of the medical instruments supplier's stock after buying an additional 1,929 shares during the quarter. Swedbank AB owned about 0.05% of Waters worth $11,260,000 at the end of the most recent quarter.

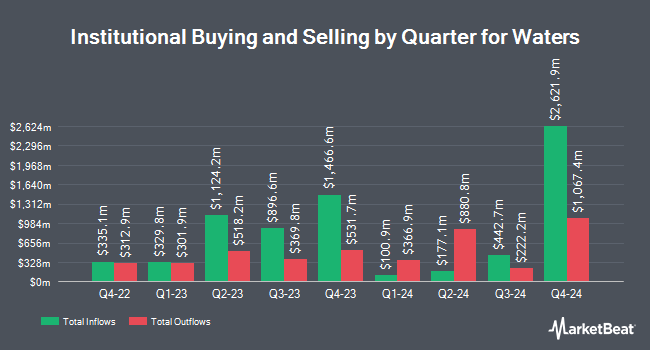

Other institutional investors have also recently added to or reduced their stakes in the company. Kennebec Savings Bank acquired a new position in shares of Waters during the third quarter worth about $33,000. Ashton Thomas Securities LLC purchased a new position in shares of Waters during the 3rd quarter worth approximately $35,000. Itau Unibanco Holding S.A. acquired a new stake in shares of Waters in the 2nd quarter valued at approximately $33,000. Blue Trust Inc. lifted its holdings in shares of Waters by 190.2% in the 2nd quarter. Blue Trust Inc. now owns 119 shares of the medical instruments supplier's stock valued at $35,000 after buying an additional 78 shares during the period. Finally, TFC Financial Management Inc. boosted its stake in shares of Waters by 19,900.0% in the second quarter. TFC Financial Management Inc. now owns 200 shares of the medical instruments supplier's stock valued at $58,000 after buying an additional 199 shares in the last quarter. Institutional investors and hedge funds own 94.01% of the company's stock.

Waters Stock Up 2.6 %

NYSE WAT opened at $388.15 on Wednesday. The stock has a market cap of $23.05 billion, a PE ratio of 37.04, a P/E/G ratio of 6.92 and a beta of 0.97. The business has a 50 day moving average price of $355.03 and a two-hundred day moving average price of $332.34. Waters Co. has a fifty-two week low of $273.60 and a fifty-two week high of $393.38. The company has a quick ratio of 1.38, a current ratio of 2.02 and a debt-to-equity ratio of 1.14.

Waters (NYSE:WAT - Get Free Report) last issued its quarterly earnings data on Friday, November 1st. The medical instruments supplier reported $2.93 earnings per share for the quarter, beating analysts' consensus estimates of $2.68 by $0.25. Waters had a return on equity of 49.93% and a net margin of 21.43%. The firm had revenue of $740.30 million during the quarter, compared to analyst estimates of $712.99 million. During the same quarter last year, the firm earned $2.84 EPS. Waters's quarterly revenue was up 4.0% on a year-over-year basis. As a group, sell-side analysts predict that Waters Co. will post 11.79 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

A number of equities research analysts have commented on the company. Cfra set a $389.00 target price on Waters in a report on Thursday, October 17th. Deutsche Bank Aktiengesellschaft increased their target price on shares of Waters from $310.00 to $325.00 and gave the company a "hold" rating in a report on Monday, November 4th. Evercore ISI upped their price target on Waters from $335.00 to $355.00 and gave the stock an "in-line" rating in a report on Tuesday, October 1st. Leerink Partners upgraded Waters from a "market perform" rating to an "outperform" rating and boosted their target price for the stock from $325.00 to $375.00 in a research report on Thursday, August 1st. Finally, Jefferies Financial Group upgraded shares of Waters from a "hold" rating to a "buy" rating and boosted their price objective for the stock from $355.00 to $415.00 in a research report on Tuesday, October 8th. One research analyst has rated the stock with a sell rating, ten have issued a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat.com, Waters has a consensus rating of "Hold" and a consensus target price of $365.85.

Check Out Our Latest Report on Waters

About Waters

(

Free Report)

Waters Corporation provides analytical workflow solutions in Asia, the Americas, and Europe. It operates through two segments: Waters and TA. The company designs, manufactures, sells, and services high and ultra-performance liquid chromatography, as well as mass spectrometry (MS) technology systems and support products, including chromatography columns, other consumable products, and post-warranty service plans.

Further Reading

Before you consider Waters, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waters wasn't on the list.

While Waters currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.