Swedbank AB decreased its stake in Avery Dennison Co. (NYSE:AVY - Free Report) by 33.6% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 306,959 shares of the industrial products company's stock after selling 155,124 shares during the period. Swedbank AB owned 0.38% of Avery Dennison worth $67,764,000 at the end of the most recent reporting period.

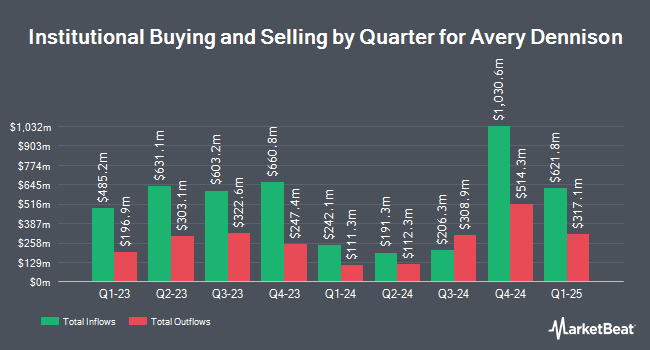

Several other large investors have also modified their holdings of AVY. Cetera Investment Advisers raised its position in Avery Dennison by 195.2% during the 1st quarter. Cetera Investment Advisers now owns 17,863 shares of the industrial products company's stock worth $3,988,000 after buying an additional 11,811 shares during the last quarter. SG Americas Securities LLC raised its holdings in Avery Dennison by 86.5% in the second quarter. SG Americas Securities LLC now owns 32,538 shares of the industrial products company's stock valued at $7,114,000 after buying an additional 15,092 shares during the period. McElhenny Sheffield Capital Management LLC purchased a new stake in shares of Avery Dennison during the second quarter valued at approximately $543,000. Jane Street Group LLC raised its stake in shares of Avery Dennison by 11.0% during the first quarter. Jane Street Group LLC now owns 47,420 shares of the industrial products company's stock valued at $10,587,000 after purchasing an additional 4,697 shares during the period. Finally, Cetera Advisors LLC grew its position in shares of Avery Dennison by 204.2% during the first quarter. Cetera Advisors LLC now owns 4,225 shares of the industrial products company's stock worth $943,000 after buying an additional 2,836 shares in the last quarter. Institutional investors and hedge funds own 94.17% of the company's stock.

Analyst Ratings Changes

A number of research firms have commented on AVY. BMO Capital Markets decreased their price objective on shares of Avery Dennison from $252.00 to $247.00 and set an "outperform" rating for the company in a report on Thursday, October 24th. Barclays dropped their price target on shares of Avery Dennison from $250.00 to $245.00 and set an "overweight" rating on the stock in a research report on Monday, October 28th. Bank of America upgraded shares of Avery Dennison from an "underperform" rating to a "buy" rating and boosted their price target for the stock from $207.00 to $250.00 in a research report on Thursday, October 17th. JPMorgan Chase & Co. cut Avery Dennison from an "overweight" rating to a "neutral" rating and dropped their price target for the stock from $230.00 to $210.00 in a research note on Thursday, October 24th. Finally, StockNews.com cut Avery Dennison from a "buy" rating to a "hold" rating in a research note on Thursday, October 24th. Four research analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat, Avery Dennison has a consensus rating of "Moderate Buy" and a consensus target price of $244.96.

Get Our Latest Stock Report on AVY

Avery Dennison Stock Up 2.6 %

Shares of NYSE:AVY traded up $5.31 during trading on Monday, hitting $207.90. 1,072,266 shares of the company were exchanged, compared to its average volume of 472,073. The stock has a market cap of $16.70 billion, a price-to-earnings ratio of 24.96, a P/E/G ratio of 1.56 and a beta of 0.89. Avery Dennison Co. has a fifty-two week low of $187.93 and a fifty-two week high of $233.48. The firm has a fifty day moving average price of $210.78 and a two-hundred day moving average price of $216.69. The company has a current ratio of 0.92, a quick ratio of 0.62 and a debt-to-equity ratio of 0.85.

Avery Dennison (NYSE:AVY - Get Free Report) last released its earnings results on Wednesday, October 23rd. The industrial products company reported $2.33 earnings per share for the quarter, beating analysts' consensus estimates of $2.32 by $0.01. The firm had revenue of $2.18 billion during the quarter, compared to the consensus estimate of $2.20 billion. Avery Dennison had a return on equity of 33.01% and a net margin of 7.76%. The company's revenue was up 4.1% compared to the same quarter last year. During the same period in the prior year, the company posted $2.10 EPS. As a group, research analysts anticipate that Avery Dennison Co. will post 9.42 earnings per share for the current fiscal year.

Avery Dennison Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Wednesday, December 4th will be given a dividend of $0.88 per share. This represents a $3.52 dividend on an annualized basis and a dividend yield of 1.69%. The ex-dividend date of this dividend is Wednesday, December 4th. Avery Dennison's payout ratio is 42.26%.

About Avery Dennison

(

Free Report)

Avery Dennison Corporation operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin, America, and internationally. It provides pressure-sensitive materials comprising papers, plastic films, metal foils, and fabrics; performance tapes products, including tapes for wire harnessing, as well as cable wrapping for automotive, electrical, and general industrial applications; mechanical fasteners, which are precision-extruded and injection-molded plastic devices used in various automotive, general industrial, and retail applications; and other pressure-sensitive adhesive-based materials and converted products under the Fasson, JAC, Yongle, and Avery Dennison brands.

See Also

Before you consider Avery Dennison, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avery Dennison wasn't on the list.

While Avery Dennison currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.