Spyglass Capital Management LLC lowered its stake in Sweetgreen, Inc. (NYSE:SG - Free Report) by 18.3% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The firm owned 2,050,611 shares of the company's stock after selling 459,004 shares during the quarter. Sweetgreen comprises 4.8% of Spyglass Capital Management LLC's portfolio, making the stock its 6th biggest holding. Spyglass Capital Management LLC owned 1.80% of Sweetgreen worth $72,694,000 as of its most recent filing with the Securities & Exchange Commission.

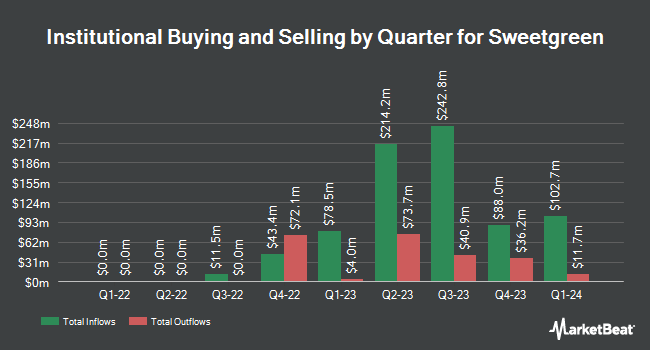

Other institutional investors have also recently made changes to their positions in the company. Baillie Gifford & Co. boosted its holdings in Sweetgreen by 6.2% in the 2nd quarter. Baillie Gifford & Co. now owns 12,326,336 shares of the company's stock worth $371,516,000 after buying an additional 721,740 shares during the period. Vanguard Group Inc. boosted its stake in shares of Sweetgreen by 0.8% in the first quarter. Vanguard Group Inc. now owns 8,420,947 shares of the company's stock worth $212,713,000 after acquiring an additional 70,395 shares during the period. Driehaus Capital Management LLC raised its stake in Sweetgreen by 231.8% during the 2nd quarter. Driehaus Capital Management LLC now owns 2,688,403 shares of the company's stock valued at $81,028,000 after purchasing an additional 1,878,216 shares during the period. Dimensional Fund Advisors LP lifted its holdings in Sweetgreen by 2.3% in the 2nd quarter. Dimensional Fund Advisors LP now owns 1,763,572 shares of the company's stock worth $53,151,000 after purchasing an additional 39,823 shares in the last quarter. Finally, Hood River Capital Management LLC lifted its holdings in Sweetgreen by 42.6% in the 2nd quarter. Hood River Capital Management LLC now owns 1,643,028 shares of the company's stock worth $49,521,000 after purchasing an additional 490,806 shares in the last quarter. Institutional investors own 95.75% of the company's stock.

Insider Buying and Selling at Sweetgreen

In other Sweetgreen news, insider Adrienne Gemperle sold 5,372 shares of the business's stock in a transaction dated Monday, November 18th. The shares were sold at an average price of $34.05, for a total value of $182,916.60. Following the completion of the sale, the insider now directly owns 107,313 shares of the company's stock, valued at $3,654,007.65. The trade was a 4.77 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, insider Nathaniel Ru sold 9,250 shares of the firm's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $28.74, for a total transaction of $265,845.00. Following the transaction, the insider now directly owns 1,952,129 shares in the company, valued at approximately $56,104,187.46. This trade represents a 0.47 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 197,892 shares of company stock worth $7,499,763 over the last 90 days. Company insiders own 21.52% of the company's stock.

Analyst Ratings Changes

SG has been the subject of several research analyst reports. UBS Group raised their target price on shares of Sweetgreen from $37.00 to $45.00 and gave the company a "buy" rating in a research note on Friday, November 8th. Piper Sandler reiterated a "neutral" rating and set a $39.00 target price (up from $33.00) on shares of Sweetgreen in a research report on Monday, August 19th. Morgan Stanley boosted their price target on shares of Sweetgreen from $25.00 to $27.00 and gave the stock an "equal weight" rating in a research report on Friday, August 9th. The Goldman Sachs Group reaffirmed a "neutral" rating and set a $40.00 price target on shares of Sweetgreen in a research note on Friday, November 8th. Finally, TD Cowen reissued a "buy" rating and issued a $45.00 price objective on shares of Sweetgreen in a research note on Monday, November 18th. Four research analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $39.80.

Check Out Our Latest Analysis on SG

Sweetgreen Stock Down 3.4 %

NYSE:SG traded down $1.45 during mid-day trading on Friday, hitting $40.98. 1,460,897 shares of the stock traded hands, compared to its average volume of 2,875,165. Sweetgreen, Inc. has a 52 week low of $9.31 and a 52 week high of $45.12. The stock has a market capitalization of $4.74 billion, a price-to-earnings ratio of -52.54 and a beta of 2.32. The firm's 50 day moving average is $37.69 and its two-hundred day moving average is $32.93.

About Sweetgreen

(

Free Report)

Sweetgreen, Inc, together with its subsidiaries, operates fast food restaurants serving healthy foods at scale in the United States. The company also accepts orders through its online and mobile ordering platforms, as well as sells gift cards that do not have an expiration date and can be redeemed. The company was founded in 2006 and is headquartered in Los Angeles, California.

Further Reading

Before you consider Sweetgreen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sweetgreen wasn't on the list.

While Sweetgreen currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.