Swiss National Bank grew its position in shares of General Dynamics Co. (NYSE:GD - Free Report) by 0.4% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 692,146 shares of the aerospace company's stock after purchasing an additional 2,600 shares during the quarter. Swiss National Bank owned approximately 0.25% of General Dynamics worth $209,167,000 as of its most recent SEC filing.

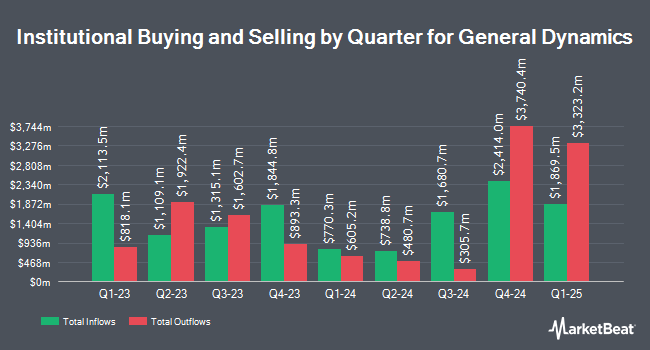

Other hedge funds have also recently made changes to their positions in the company. BNP PARIBAS ASSET MANAGEMENT Holding S.A. bought a new stake in General Dynamics in the first quarter worth approximately $361,000. Acadian Asset Management LLC increased its holdings in General Dynamics by 59.1% in the first quarter. Acadian Asset Management LLC now owns 2,377 shares of the aerospace company's stock worth $670,000 after purchasing an additional 883 shares in the last quarter. Edgestream Partners L.P. increased its holdings in General Dynamics by 116.2% in the first quarter. Edgestream Partners L.P. now owns 2,662 shares of the aerospace company's stock worth $752,000 after purchasing an additional 1,431 shares in the last quarter. O Shaughnessy Asset Management LLC increased its holdings in General Dynamics by 18.2% in the first quarter. O Shaughnessy Asset Management LLC now owns 49,921 shares of the aerospace company's stock worth $14,102,000 after purchasing an additional 7,670 shares in the last quarter. Finally, Clearbridge Investments LLC bought a new stake in General Dynamics in the first quarter worth approximately $493,000. 86.14% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several equities research analysts have recently commented on the company. Barclays boosted their price objective on General Dynamics from $325.00 to $330.00 and gave the company an "overweight" rating in a report on Tuesday, October 29th. Susquehanna boosted their price objective on General Dynamics from $333.00 to $352.00 and gave the company a "positive" rating in a report on Thursday, October 17th. Deutsche Bank Aktiengesellschaft decreased their price target on General Dynamics from $309.00 to $306.00 and set a "hold" rating for the company in a report on Friday, November 1st. Royal Bank of Canada upped their price target on General Dynamics from $320.00 to $330.00 and gave the stock an "outperform" rating in a report on Thursday, October 24th. Finally, Sanford C. Bernstein cut their price objective on General Dynamics from $343.00 to $331.00 and set a "market perform" rating on the stock in a research report on Thursday, October 24th. Seven analysts have rated the stock with a hold rating, eleven have given a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $323.69.

Read Our Latest Research Report on General Dynamics

Insider Transactions at General Dynamics

In related news, Director Peter A. Wall sold 1,320 shares of the business's stock in a transaction on Monday, September 16th. The shares were sold at an average price of $308.05, for a total transaction of $406,626.00. Following the completion of the transaction, the director now directly owns 3,592 shares in the company, valued at $1,106,515.60. The trade was a 26.87 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders own 1.52% of the company's stock.

General Dynamics Trading Down 0.7 %

General Dynamics stock traded down $1.99 during midday trading on Monday, reaching $286.00. The stock had a trading volume of 1,286,492 shares, compared to its average volume of 1,101,693. The firm has a market cap of $78.64 billion, a price-to-earnings ratio of 21.76, a price-to-earnings-growth ratio of 1.74 and a beta of 0.61. The company has a fifty day moving average of $302.45 and a 200 day moving average of $296.34. General Dynamics Co. has a 52-week low of $243.87 and a 52-week high of $316.90. The company has a quick ratio of 0.80, a current ratio of 1.32 and a debt-to-equity ratio of 0.32.

General Dynamics (NYSE:GD - Get Free Report) last announced its earnings results on Wednesday, October 23rd. The aerospace company reported $3.35 earnings per share for the quarter, missing the consensus estimate of $3.48 by ($0.13). The firm had revenue of $11.67 billion during the quarter, compared to analyst estimates of $11.65 billion. General Dynamics had a net margin of 7.90% and a return on equity of 16.59%. General Dynamics's revenue was up 10.4% on a year-over-year basis. During the same quarter last year, the business earned $3.04 earnings per share. On average, analysts anticipate that General Dynamics Co. will post 13.98 earnings per share for the current fiscal year.

About General Dynamics

(

Free Report)

General Dynamics Corporation operates as an aerospace and defense company worldwide. It operates through four segments: Aerospace, Marine Systems, Combat Systems, and Technologies. The Aerospace segment produces and sells business jets; and offers aircraft maintenance and repair, management, aircraft-on-ground support and completion, charter, staffing, and fixed-base operator services.

Featured Articles

Before you consider General Dynamics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and General Dynamics wasn't on the list.

While General Dynamics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.