Swiss National Bank lifted its stake in shares of Ultragenyx Pharmaceutical Inc. (NASDAQ:RARE - Free Report) by 9.1% in the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 159,152 shares of the biopharmaceutical company's stock after acquiring an additional 13,300 shares during the quarter. Swiss National Bank owned approximately 0.17% of Ultragenyx Pharmaceutical worth $8,841,000 at the end of the most recent reporting period.

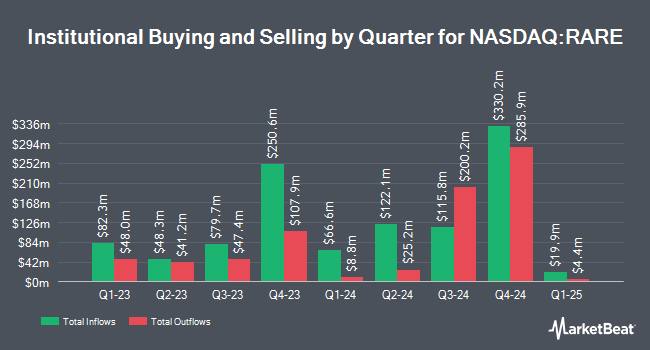

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in RARE. UMB Bank n.a. grew its position in shares of Ultragenyx Pharmaceutical by 58.1% during the second quarter. UMB Bank n.a. now owns 958 shares of the biopharmaceutical company's stock worth $39,000 after purchasing an additional 352 shares in the last quarter. Arizona State Retirement System increased its holdings in Ultragenyx Pharmaceutical by 2.1% in the 2nd quarter. Arizona State Retirement System now owns 20,744 shares of the biopharmaceutical company's stock valued at $853,000 after acquiring an additional 434 shares during the last quarter. KBC Group NV lifted its position in shares of Ultragenyx Pharmaceutical by 24.5% in the third quarter. KBC Group NV now owns 2,568 shares of the biopharmaceutical company's stock worth $143,000 after buying an additional 506 shares in the last quarter. Amalgamated Bank boosted its position in shares of Ultragenyx Pharmaceutical by 13.4% during the 2nd quarter. Amalgamated Bank now owns 5,896 shares of the biopharmaceutical company's stock valued at $242,000 after acquiring an additional 696 shares during the last quarter. Finally, nVerses Capital LLC bought a new position in Ultragenyx Pharmaceutical during the second quarter valued at $33,000. Institutional investors own 97.67% of the company's stock.

Wall Street Analyst Weigh In

Several equities research analysts have recently issued reports on the company. TD Cowen raised their price objective on Ultragenyx Pharmaceutical from $61.00 to $73.00 and gave the company a "buy" rating in a research note on Monday, October 21st. HC Wainwright lifted their price objective on shares of Ultragenyx Pharmaceutical from $82.00 to $95.00 and gave the stock a "buy" rating in a research note on Wednesday, November 6th. Canaccord Genuity Group restated a "buy" rating and issued a $121.00 target price on shares of Ultragenyx Pharmaceutical in a report on Tuesday, November 12th. Wedbush upped their price target on shares of Ultragenyx Pharmaceutical from $43.00 to $46.00 and gave the company a "neutral" rating in a report on Friday, August 2nd. Finally, Cantor Fitzgerald reissued an "overweight" rating and issued a $116.00 price objective on shares of Ultragenyx Pharmaceutical in a research note on Wednesday, November 6th. Two investment analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the stock. According to data from MarketBeat.com, Ultragenyx Pharmaceutical currently has a consensus rating of "Moderate Buy" and an average price target of $87.46.

View Our Latest Stock Analysis on RARE

Insider Activity at Ultragenyx Pharmaceutical

In related news, CFO Howard Horn sold 7,465 shares of the business's stock in a transaction on Thursday, October 10th. The shares were sold at an average price of $52.76, for a total transaction of $393,853.40. Following the completion of the transaction, the chief financial officer now directly owns 92,301 shares in the company, valued at $4,869,800.76. The trade was a 7.48 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Emil D. Kakkis sold 20,000 shares of the stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $55.85, for a total value of $1,117,000.00. Following the sale, the chief executive officer now directly owns 2,223,985 shares in the company, valued at $124,209,562.25. This represents a 0.89 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 27,556 shares of company stock valued at $1,515,967 in the last ninety days. Company insiders own 5.80% of the company's stock.

Ultragenyx Pharmaceutical Stock Up 0.5 %

Shares of NASDAQ RARE traded up $0.24 during mid-day trading on Tuesday, reaching $47.36. 280,727 shares of the company were exchanged, compared to its average volume of 782,620. The firm has a 50-day moving average of $52.89 and a 200 day moving average of $48.53. Ultragenyx Pharmaceutical Inc. has a 1 year low of $37.02 and a 1 year high of $60.37. The stock has a market cap of $4.37 billion, a price-to-earnings ratio of -7.28 and a beta of 0.58.

Ultragenyx Pharmaceutical (NASDAQ:RARE - Get Free Report) last posted its quarterly earnings data on Tuesday, November 5th. The biopharmaceutical company reported ($1.40) EPS for the quarter, topping the consensus estimate of ($1.45) by $0.05. Ultragenyx Pharmaceutical had a negative net margin of 106.93% and a negative return on equity of 187.12%. The firm had revenue of $139.49 million during the quarter, compared to analyst estimates of $135.28 million. During the same quarter in the previous year, the business posted ($2.23) EPS. Ultragenyx Pharmaceutical's revenue was up 42.3% on a year-over-year basis. On average, equities analysts forecast that Ultragenyx Pharmaceutical Inc. will post -6.21 earnings per share for the current year.

About Ultragenyx Pharmaceutical

(

Free Report)

Ultragenyx Pharmaceutical Inc, a biopharmaceutical company, focuses on the identification, acquisition, development, and commercialization of novel products for the treatment of rare and ultra-rare genetic diseases in North America, Latin America, Japan, Europe, and internationally. Its biologic products include Crysvita (burosumab), an antibody targeting fibroblast growth factor 23 for the treatment of X-linked hypophosphatemia, as well as tumor-induced osteomalacia; Mepsevii, an enzyme replacement therapy for the treatment of children and adults with Mucopolysaccharidosis VII; Dojolvi for treating long-chain fatty acid oxidation disorders; and Evkeeza (evinacumab) for the treatment of homozygous familial hypercholesterolemia.

Featured Stories

Before you consider Ultragenyx Pharmaceutical, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ultragenyx Pharmaceutical wasn't on the list.

While Ultragenyx Pharmaceutical currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.