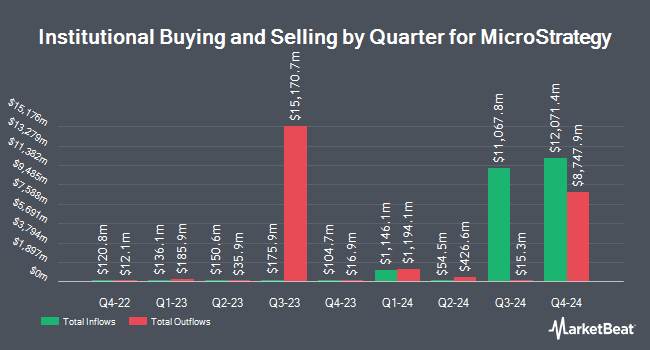

Swiss National Bank boosted its position in shares of MicroStrategy Incorporated (NASDAQ:MSTR - Free Report) by 904.7% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 468,200 shares of the software maker's stock after purchasing an additional 421,600 shares during the quarter. Swiss National Bank owned about 0.26% of MicroStrategy worth $78,939,000 as of its most recent filing with the Securities and Exchange Commission.

Other large investors have also bought and sold shares of the company. UMB Bank n.a. lifted its holdings in MicroStrategy by 900.0% during the 3rd quarter. UMB Bank n.a. now owns 150 shares of the software maker's stock valued at $25,000 after purchasing an additional 135 shares during the last quarter. AlphaMark Advisors LLC lifted its holdings in MicroStrategy by 2,900.0% during the 3rd quarter. AlphaMark Advisors LLC now owns 150 shares of the software maker's stock valued at $25,000 after purchasing an additional 145 shares during the last quarter. Capital Performance Advisors LLP acquired a new stake in MicroStrategy during the 3rd quarter valued at $27,000. ST Germain D J Co. Inc. lifted its holdings in MicroStrategy by 900.0% during the 3rd quarter. ST Germain D J Co. Inc. now owns 170 shares of the software maker's stock valued at $29,000 after purchasing an additional 153 shares during the last quarter. Finally, Fairman Group LLC increased its position in MicroStrategy by 900.0% during the 3rd quarter. Fairman Group LLC now owns 200 shares of the software maker's stock worth $34,000 after buying an additional 180 shares during the period. 72.03% of the stock is owned by institutional investors.

Insider Activity at MicroStrategy

In related news, CAO Jeanine Montgomery sold 56,250 shares of the firm's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $257.41, for a total value of $14,479,312.50. Following the transaction, the chief accounting officer now owns 5,670 shares of the company's stock, valued at $1,459,514.70. This trade represents a 90.84 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, EVP Wei-Ming Shao sold 3,000 shares of the firm's stock in a transaction dated Thursday, August 22nd. The stock was sold at an average price of $141.20, for a total transaction of $423,600.00. Following the completion of the transaction, the executive vice president now directly owns 6,460 shares in the company, valued at $912,152. This represents a 31.71 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders sold 135,000 shares of company stock worth $30,569,577. 13.18% of the stock is owned by company insiders.

Analysts Set New Price Targets

MSTR has been the topic of a number of recent analyst reports. TD Cowen raised their price target on MicroStrategy from $200.00 to $300.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Benchmark boosted their price target on shares of MicroStrategy from $300.00 to $450.00 and gave the company a "buy" rating in a research note on Tuesday. Sanford C. Bernstein reduced their price objective on shares of MicroStrategy from $2,890.00 to $290.00 and set an "outperform" rating for the company in a research report on Wednesday, October 9th. Barclays increased their target price on shares of MicroStrategy from $225.00 to $275.00 and gave the company an "overweight" rating in a research report on Monday, November 4th. Finally, Maxim Group increased their target price on shares of MicroStrategy from $193.00 to $270.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. One investment analyst has rated the stock with a sell rating and eight have assigned a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $289.88.

View Our Latest Analysis on MicroStrategy

MicroStrategy Trading Up 10.1 %

MicroStrategy stock traded up $43.56 during trading hours on Wednesday, reaching $474.10. The stock had a trading volume of 63,988,188 shares, compared to its average volume of 17,598,238. The stock has a market cap of $96.07 billion, a PE ratio of -235.77 and a beta of 3.05. MicroStrategy Incorporated has a 52 week low of $43.87 and a 52 week high of $504.83. The company has a debt-to-equity ratio of 1.12, a current ratio of 0.65 and a quick ratio of 0.65. The company has a fifty day simple moving average of $216.04 and a 200-day simple moving average of $170.24.

MicroStrategy (NASDAQ:MSTR - Get Free Report) last announced its earnings results on Wednesday, October 30th. The software maker reported ($1.56) earnings per share for the quarter, missing analysts' consensus estimates of ($0.12) by ($1.44). MicroStrategy had a negative net margin of 87.05% and a negative return on equity of 17.31%. The company had revenue of $116.07 million for the quarter, compared to the consensus estimate of $121.45 million. During the same period in the previous year, the firm posted ($8.98) EPS. The company's revenue for the quarter was down 10.3% on a year-over-year basis.

MicroStrategy Profile

(

Free Report)

MicroStrategy Incorporated provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers MicroStrategy ONE, which provides non-technical users with the ability to directly access novel and actionable insights for decision-making; and MicroStrategy Cloud for Government service, which offers always-on threat monitoring that meets the rigorous technical and regulatory needs of governments and financial institutions.

Featured Articles

Before you consider MicroStrategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MicroStrategy wasn't on the list.

While MicroStrategy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.