Swiss National Bank lifted its holdings in OneMain Holdings, Inc. (NYSE:OMF - Free Report) by 4.5% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 234,000 shares of the financial services provider's stock after buying an additional 10,100 shares during the quarter. Swiss National Bank owned approximately 0.20% of OneMain worth $11,014,000 at the end of the most recent quarter.

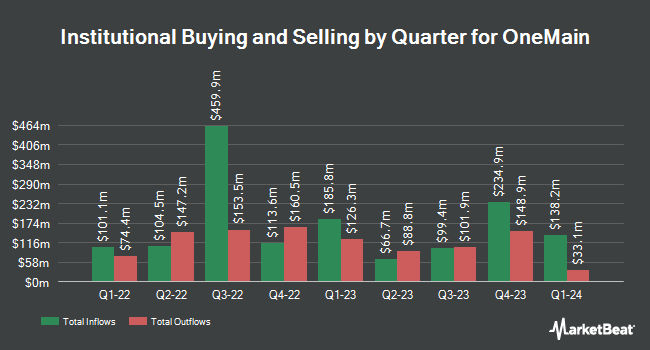

A number of other institutional investors and hedge funds have also recently modified their holdings of the business. Dimensional Fund Advisors LP grew its stake in OneMain by 9.0% in the 2nd quarter. Dimensional Fund Advisors LP now owns 3,288,643 shares of the financial services provider's stock worth $159,465,000 after acquiring an additional 270,207 shares in the last quarter. Clearbridge Investments LLC increased its holdings in OneMain by 1.3% during the 2nd quarter. Clearbridge Investments LLC now owns 1,914,355 shares of the financial services provider's stock worth $92,827,000 after purchasing an additional 24,338 shares during the period. Bank of New York Mellon Corp raised its position in OneMain by 1.1% during the 2nd quarter. Bank of New York Mellon Corp now owns 1,169,590 shares of the financial services provider's stock valued at $56,713,000 after purchasing an additional 12,938 shares in the last quarter. Argent Capital Management LLC raised its position in OneMain by 20.2% during the 3rd quarter. Argent Capital Management LLC now owns 809,176 shares of the financial services provider's stock valued at $38,088,000 after purchasing an additional 136,224 shares in the last quarter. Finally, Principal Financial Group Inc. grew its position in shares of OneMain by 12.1% during the 3rd quarter. Principal Financial Group Inc. now owns 805,256 shares of the financial services provider's stock worth $37,903,000 after buying an additional 87,084 shares in the last quarter. 85.82% of the stock is owned by institutional investors.

OneMain Trading Up 1.4 %

NYSE OMF traded up $0.78 on Monday, hitting $57.38. 1,309,140 shares of the company's stock traded hands, compared to its average volume of 1,014,969. The firm has a market capitalization of $6.85 billion, a PE ratio of 12.56, a P/E/G ratio of 0.70 and a beta of 1.54. OneMain Holdings, Inc. has a 1-year low of $37.93 and a 1-year high of $57.97. The firm's 50-day moving average price is $49.39 and its two-hundred day moving average price is $48.76.

OneMain Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, November 18th. Investors of record on Tuesday, November 12th were paid a $1.04 dividend. The ex-dividend date of this dividend was Tuesday, November 12th. This represents a $4.16 annualized dividend and a dividend yield of 7.25%. OneMain's dividend payout ratio is presently 91.03%.

Analyst Ratings Changes

Several analysts recently weighed in on OMF shares. Barclays downgraded OneMain from an "overweight" rating to an "equal weight" rating and decreased their price objective for the company from $52.00 to $46.00 in a report on Tuesday, October 8th. Northland Securities upped their price target on shares of OneMain from $53.00 to $55.00 and gave the stock a "market perform" rating in a research report on Thursday, August 1st. StockNews.com lowered shares of OneMain from a "buy" rating to a "hold" rating in a report on Tuesday, November 5th. Stephens started coverage on OneMain in a report on Wednesday, November 13th. They set an "overweight" rating and a $62.00 target price for the company. Finally, JMP Securities increased their target price on OneMain from $60.00 to $62.00 and gave the company a "market outperform" rating in a research report on Thursday, October 31st. Seven research analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $55.46.

Read Our Latest Report on OneMain

Insider Buying and Selling at OneMain

In other OneMain news, SVP Michael A. Hedlund sold 2,400 shares of the firm's stock in a transaction on Monday, September 16th. The stock was sold at an average price of $46.00, for a total value of $110,400.00. Following the completion of the sale, the senior vice president now directly owns 25,747 shares of the company's stock, valued at $1,184,362. This trade represents a 8.53 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, COO Micah R. Conrad sold 886 shares of the firm's stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $50.00, for a total transaction of $44,300.00. Following the sale, the chief operating officer now owns 104,739 shares of the company's stock, valued at approximately $5,236,950. The trade was a 0.84 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 41,792 shares of company stock valued at $2,187,784. Company insiders own 0.45% of the company's stock.

OneMain Profile

(

Free Report)

OneMain Holdings, Inc, a financial service holding company, engages in the consumer finance and insurance businesses in the United States. It originates, underwrites, and services personal loans secured by automobiles, other titled collateral, or unsecured. The company also offers credit cards; optional credit insurance products, including life, disability, and involuntary unemployment insurance; optional non-credit insurance; guaranteed asset protection coverage as a waiver product or insurance; and membership plans.

Read More

Before you consider OneMain, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OneMain wasn't on the list.

While OneMain currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.