Synaptics (NASDAQ:SYNA - Get Free Report) had its price objective upped by equities research analysts at TD Cowen from $90.00 to $100.00 in a report released on Friday, MarketBeat Ratings reports. The firm currently has a "buy" rating on the software maker's stock. TD Cowen's price target suggests a potential upside of 23.62% from the company's current price.

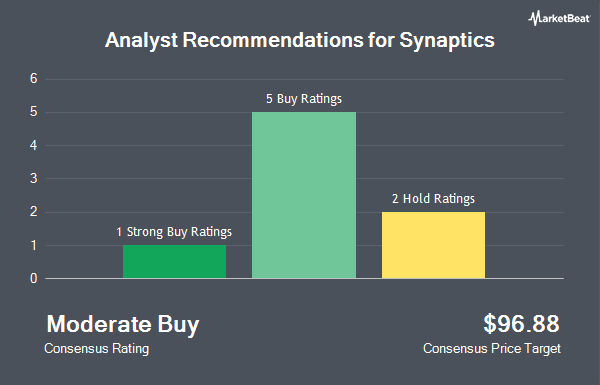

A number of other research analysts also recently weighed in on SYNA. Craig Hallum lowered their price target on Synaptics from $105.00 to $80.00 and set a "hold" rating on the stock in a report on Friday, August 9th. Susquehanna lowered their target price on Synaptics from $110.00 to $95.00 and set a "positive" rating on the stock in a research note on Monday, October 21st. JPMorgan Chase & Co. reduced their price target on shares of Synaptics from $120.00 to $100.00 and set an "overweight" rating for the company in a research report on Friday, August 9th. Rosenblatt Securities reaffirmed a "buy" rating and set a $130.00 price objective on shares of Synaptics in a research report on Thursday, October 31st. Finally, Needham & Company LLC decreased their target price on shares of Synaptics from $110.00 to $95.00 and set a "buy" rating for the company in a research note on Friday, August 9th. Four investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to data from MarketBeat.com, Synaptics has a consensus rating of "Moderate Buy" and a consensus target price of $101.56.

Get Our Latest Analysis on SYNA

Synaptics Trading Up 8.4 %

SYNA stock traded up $6.25 during mid-day trading on Friday, reaching $80.89. 892,891 shares of the stock traded hands, compared to its average volume of 310,200. The stock's fifty day moving average is $73.80 and its 200-day moving average is $82.45. The company has a market cap of $3.23 billion, a P/E ratio of 26.18 and a beta of 1.47. The company has a current ratio of 4.19, a quick ratio of 3.78 and a debt-to-equity ratio of 0.66. Synaptics has a 52-week low of $67.83 and a 52-week high of $121.37.

Synaptics (NASDAQ:SYNA - Get Free Report) last posted its quarterly earnings data on Thursday, August 8th. The software maker reported $0.64 EPS for the quarter, topping analysts' consensus estimates of $0.55 by $0.09. Synaptics had a net margin of 13.09% and a negative return on equity of 0.54%. The firm had revenue of $247.40 million during the quarter, compared to analyst estimates of $245.17 million. During the same quarter last year, the business posted $0.01 EPS. The company's revenue was up 8.8% on a year-over-year basis. As a group, sell-side analysts expect that Synaptics will post 0.81 earnings per share for the current year.

Insider Transactions at Synaptics

In other Synaptics news, insider Vikram Gupta sold 1,008 shares of the stock in a transaction on Wednesday, August 28th. The shares were sold at an average price of $80.00, for a total value of $80,640.00. Following the completion of the sale, the insider now directly owns 45,789 shares of the company's stock, valued at $3,663,120. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Over the last quarter, insiders have sold 5,609 shares of company stock worth $448,720. Insiders own 1.30% of the company's stock.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of SYNA. GAMMA Investing LLC boosted its position in shares of Synaptics by 261.8% during the 3rd quarter. GAMMA Investing LLC now owns 369 shares of the software maker's stock valued at $29,000 after acquiring an additional 267 shares in the last quarter. Migdal Insurance & Financial Holdings Ltd. acquired a new stake in Synaptics during the second quarter valued at approximately $67,000. Innealta Capital LLC bought a new stake in shares of Synaptics in the 2nd quarter valued at approximately $83,000. CWM LLC grew its stake in shares of Synaptics by 58.1% in the 3rd quarter. CWM LLC now owns 1,151 shares of the software maker's stock valued at $89,000 after purchasing an additional 423 shares during the period. Finally, Van ECK Associates Corp acquired a new position in shares of Synaptics in the 3rd quarter worth approximately $132,000. 99.43% of the stock is owned by institutional investors.

About Synaptics

(

Get Free Report)

Synaptics Incorporated develops, markets, and sells semiconductor products worldwide. The company offers AudioSmart for voice and audio processing; ConnectSmart for high-speed video/audio/data connectivity; DisplayLink for transmitting compressed video frames across low bandwidth connections; VideoSmart that enables set-top boxes, over-the-top, streaming devices, soundbars, surveillance cameras, and smart displays; and ImagingSmart solutions.

See Also

Before you consider Synaptics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synaptics wasn't on the list.

While Synaptics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.