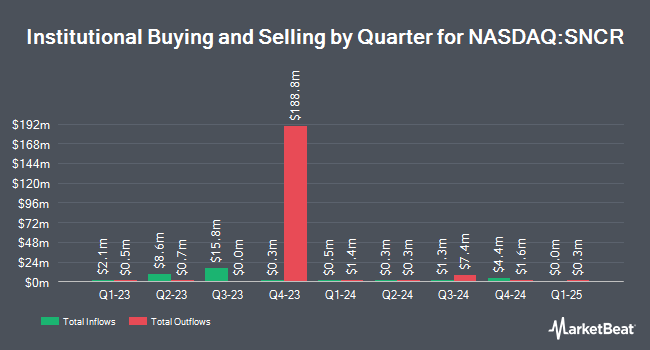

B. Riley Financial Inc. decreased its holdings in shares of Synchronoss Technologies, Inc. (NASDAQ:SNCR - Free Report) by 46.7% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 753,222 shares of the software maker's stock after selling 660,630 shares during the period. Synchronoss Technologies makes up about 7.7% of B. Riley Financial Inc.'s holdings, making the stock its 3rd biggest position. B. Riley Financial Inc. owned approximately 6.96% of Synchronoss Technologies worth $11,513,000 as of its most recent SEC filing.

A number of other large investors have also modified their holdings of the business. GSA Capital Partners LLP purchased a new position in shares of Synchronoss Technologies in the 3rd quarter valued at about $165,000. Allspring Global Investments Holdings LLC boosted its stake in shares of Synchronoss Technologies by 2.5% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 563,976 shares of the software maker's stock worth $8,395,000 after acquiring an additional 13,984 shares in the last quarter. Renaissance Technologies LLC grew its holdings in shares of Synchronoss Technologies by 9.3% in the 2nd quarter. Renaissance Technologies LLC now owns 78,974 shares of the software maker's stock worth $734,000 after acquiring an additional 6,700 shares during the period. Finally, Dimensional Fund Advisors LP increased its position in shares of Synchronoss Technologies by 40.6% in the second quarter. Dimensional Fund Advisors LP now owns 70,504 shares of the software maker's stock valued at $654,000 after buying an additional 20,368 shares in the last quarter. 51.71% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

SNCR has been the subject of a number of recent research reports. Roth Capital raised shares of Synchronoss Technologies from a "hold" rating to a "strong-buy" rating in a research note on Monday, November 25th. StockNews.com cut Synchronoss Technologies from a "buy" rating to a "hold" rating in a report on Friday, August 16th. Finally, Roth Mkm raised Synchronoss Technologies from a "neutral" rating to a "buy" rating and increased their price objective for the company from $11.00 to $13.00 in a research note on Monday, November 25th.

Get Our Latest Research Report on Synchronoss Technologies

Insider Transactions at Synchronoss Technologies

In related news, CFO Lou Ferraro sold 5,768 shares of the firm's stock in a transaction on Thursday, September 12th. The shares were sold at an average price of $13.60, for a total transaction of $78,444.80. Following the completion of the sale, the chief financial officer now directly owns 83,556 shares of the company's stock, valued at approximately $1,136,361.60. This trade represents a 6.46 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Jeffrey George Miller sold 12,000 shares of the firm's stock in a transaction dated Tuesday, September 10th. The shares were sold at an average price of $13.50, for a total value of $162,000.00. Following the sale, the chief executive officer now owns 284,462 shares of the company's stock, valued at $3,840,237. This represents a 4.05 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 37,165 shares of company stock valued at $513,165 over the last 90 days. Corporate insiders own 17.90% of the company's stock.

Synchronoss Technologies Trading Up 0.7 %

Synchronoss Technologies stock traded up $0.07 during midday trading on Friday, reaching $9.88. The stock had a trading volume of 9,864 shares, compared to its average volume of 92,500. The stock has a market capitalization of $107.10 million, a PE ratio of -2.55 and a beta of 1.99. The company has a debt-to-equity ratio of 5.75, a quick ratio of 1.88 and a current ratio of 1.88. The stock's 50-day simple moving average is $11.37 and its 200 day simple moving average is $10.87. Synchronoss Technologies, Inc. has a twelve month low of $3.55 and a twelve month high of $15.46.

Synchronoss Technologies Company Profile

(

Free Report)

Synchronoss Technologies, Inc provides cloud, messaging, digital, and network management solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers Synchronoss Personal Cloud platform that allows customers' subscribers to backup and protect, engage with, and manage their personal content.

Further Reading

Before you consider Synchronoss Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synchronoss Technologies wasn't on the list.

While Synchronoss Technologies currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.