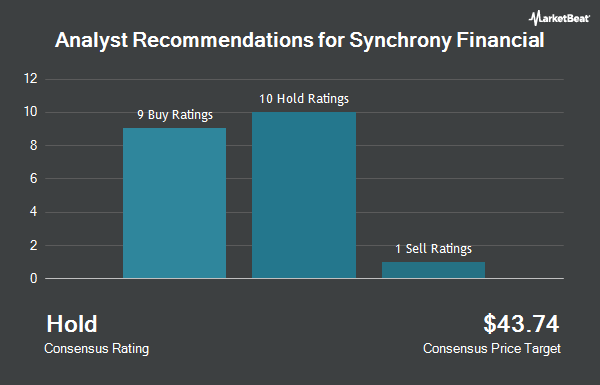

Shares of Synchrony Financial (NYSE:SYF - Get Free Report) have received an average recommendation of "Moderate Buy" from the twenty-two brokerages that are covering the stock, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, six have assigned a hold rating, fourteen have assigned a buy rating and one has issued a strong buy rating on the company. The average 1 year price target among analysts that have updated their coverage on the stock in the last year is $61.53.

A number of equities analysts recently weighed in on the company. Evercore ISI raised their price objective on Synchrony Financial from $58.00 to $65.00 and gave the company an "outperform" rating in a report on Wednesday, October 30th. Keefe, Bruyette & Woods upped their price target on shares of Synchrony Financial from $62.00 to $82.00 and gave the company an "outperform" rating in a research report on Monday, December 9th. Morgan Stanley boosted their target price on Synchrony Financial from $37.00 to $40.00 and gave the company an "underweight" rating in a research note on Thursday, October 17th. BTIG Research lowered Synchrony Financial from a "buy" rating to a "neutral" rating in a research report on Monday, September 16th. Finally, Wells Fargo & Company raised Synchrony Financial from an "equal weight" rating to an "overweight" rating and lifted their price target for the stock from $60.00 to $85.00 in a research note on Tuesday, December 3rd.

Get Our Latest Stock Analysis on SYF

Insider Buying and Selling at Synchrony Financial

In other Synchrony Financial news, insider Jonathan S. Mothner sold 34,163 shares of the business's stock in a transaction dated Friday, November 15th. The stock was sold at an average price of $64.99, for a total transaction of $2,220,253.37. Following the completion of the sale, the insider now directly owns 127,587 shares in the company, valued at $8,291,879.13. The trade was a 21.12 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, insider Curtis Howse sold 21,934 shares of the stock in a transaction that occurred on Friday, November 1st. The stock was sold at an average price of $55.13, for a total transaction of $1,209,221.42. Following the completion of the transaction, the insider now owns 99,743 shares in the company, valued at $5,498,831.59. This trade represents a 18.03 % decrease in their position. The disclosure for this sale can be found here. Company insiders own 0.33% of the company's stock.

Hedge Funds Weigh In On Synchrony Financial

Several institutional investors and hedge funds have recently bought and sold shares of SYF. Swedbank AB increased its stake in Synchrony Financial by 23.8% in the 2nd quarter. Swedbank AB now owns 99,461 shares of the financial services provider's stock worth $4,694,000 after buying an additional 19,098 shares in the last quarter. National Pension Service grew its position in shares of Synchrony Financial by 22.7% during the third quarter. National Pension Service now owns 957,758 shares of the financial services provider's stock worth $47,773,000 after purchasing an additional 177,051 shares in the last quarter. Alpha DNA Investment Management LLC bought a new stake in Synchrony Financial during the 2nd quarter valued at approximately $951,000. Blue Trust Inc. lifted its holdings in Synchrony Financial by 134.4% in the 2nd quarter. Blue Trust Inc. now owns 2,004 shares of the financial services provider's stock worth $86,000 after purchasing an additional 1,149 shares in the last quarter. Finally, Ensign Peak Advisors Inc boosted its stake in Synchrony Financial by 9.1% in the 2nd quarter. Ensign Peak Advisors Inc now owns 443,251 shares of the financial services provider's stock worth $20,917,000 after purchasing an additional 36,865 shares during the period. 96.48% of the stock is currently owned by hedge funds and other institutional investors.

Synchrony Financial Price Performance

NYSE:SYF traded down $0.47 during mid-day trading on Friday, hitting $68.06. 2,035,754 shares of the stock traded hands, compared to its average volume of 3,930,572. Synchrony Financial has a 12-month low of $35.29 and a 12-month high of $69.39. The company has a quick ratio of 1.25, a current ratio of 1.25 and a debt-to-equity ratio of 1.06. The company has a market cap of $26.50 billion, a PE ratio of 8.88, a price-to-earnings-growth ratio of 0.82 and a beta of 1.63. The business's 50-day moving average price is $61.22 and its 200 day moving average price is $52.12.

Synchrony Financial (NYSE:SYF - Get Free Report) last released its quarterly earnings results on Wednesday, October 16th. The financial services provider reported $1.94 earnings per share for the quarter, beating the consensus estimate of $1.77 by $0.17. Synchrony Financial had a return on equity of 16.64% and a net margin of 13.98%. The firm had revenue of $3.81 billion for the quarter, compared to analysts' expectations of $3.76 billion. During the same quarter last year, the firm posted $1.48 EPS. The company's revenue was up 9.8% compared to the same quarter last year. On average, analysts expect that Synchrony Financial will post 6.51 EPS for the current fiscal year.

Synchrony Financial Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, November 15th. Investors of record on Monday, November 4th were issued a $0.25 dividend. The ex-dividend date of this dividend was Monday, November 4th. This represents a $1.00 annualized dividend and a yield of 1.47%. Synchrony Financial's payout ratio is 13.05%.

Synchrony Financial Company Profile

(

Get Free ReportSynchrony Financial, together with its subsidiaries, operates as a consumer financial services company in the United States. It provides credit products, such as credit cards, commercial credit products, and consumer installment loans. The company also offers private label credit cards, dual co-brand and general purpose credit cards, short- and long-term installment loans, and consumer banking products; and deposit products, including certificates of deposit, individual retirement accounts, money market accounts, and savings accounts, and sweep and affinity deposits, as well as accepts deposits through third-party securities brokerage firms.

Featured Stories

Before you consider Synchrony Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synchrony Financial wasn't on the list.

While Synchrony Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report