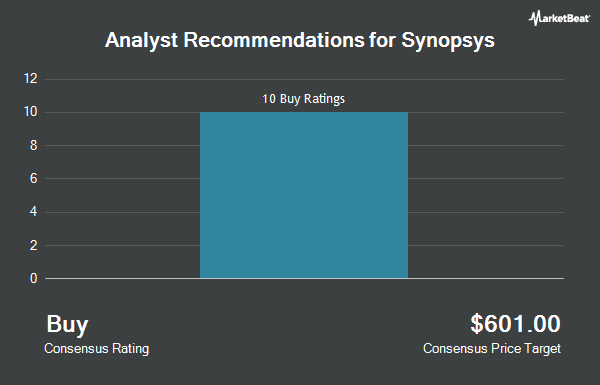

Shares of Synopsys, Inc. (NASDAQ:SNPS - Get Free Report) have been given an average rating of "Moderate Buy" by the ten analysts that are currently covering the stock, Marketbeat.com reports. One analyst has rated the stock with a hold rating and nine have given a buy rating to the company. The average 12 month price target among brokers that have issued a report on the stock in the last year is $649.00.

Several equities research analysts have weighed in on the company. JPMorgan Chase & Co. boosted their price objective on Synopsys from $655.00 to $685.00 and gave the stock an "overweight" rating in a research note on Thursday, August 22nd. Wells Fargo & Company assumed coverage on Synopsys in a research report on Friday, November 22nd. They set an "equal weight" rating and a $570.00 target price on the stock. Piper Sandler dropped their price objective on shares of Synopsys from $670.00 to $655.00 and set an "overweight" rating for the company in a research note on Friday, December 6th. Mizuho began coverage on shares of Synopsys in a research note on Tuesday, October 22nd. They issued an "outperform" rating and a $650.00 target price on the stock. Finally, Robert W. Baird dropped their price target on shares of Synopsys from $644.00 to $630.00 and set an "outperform" rating for the company in a research note on Thursday, December 5th.

Check Out Our Latest Stock Report on SNPS

Institutional Investors Weigh In On Synopsys

Large investors have recently modified their holdings of the business. Davidson Capital Management Inc. grew its stake in Synopsys by 33,828.6% in the third quarter. Davidson Capital Management Inc. now owns 4,750 shares of the semiconductor company's stock valued at $2,405,000 after purchasing an additional 4,736 shares during the last quarter. Peloton Wealth Strategists boosted its stake in Synopsys by 221.2% in the third quarter. Peloton Wealth Strategists now owns 2,881 shares of the semiconductor company's stock valued at $1,459,000 after acquiring an additional 1,984 shares in the last quarter. Swiss National Bank grew its holdings in Synopsys by 0.7% in the third quarter. Swiss National Bank now owns 454,800 shares of the semiconductor company's stock worth $230,306,000 after purchasing an additional 3,200 shares during the last quarter. Parnassus Investments LLC acquired a new position in shares of Synopsys during the third quarter worth $633,469,000. Finally, Harvest Portfolios Group Inc. lifted its holdings in shares of Synopsys by 3.7% during the 3rd quarter. Harvest Portfolios Group Inc. now owns 42,121 shares of the semiconductor company's stock valued at $21,330,000 after purchasing an additional 1,496 shares during the last quarter. Institutional investors own 85.47% of the company's stock.

Synopsys Stock Down 0.7 %

Synopsys stock traded down $3.45 during mid-day trading on Friday, reaching $508.28. 1,215,481 shares of the company's stock traded hands, compared to its average volume of 1,077,946. Synopsys has a 12-month low of $457.52 and a 12-month high of $629.38. The company has a market cap of $78.08 billion, a price-to-earnings ratio of 35.01, a PEG ratio of 3.43 and a beta of 1.08. The stock has a 50 day moving average of $530.98 and a two-hundred day moving average of $542.58.

About Synopsys

(

Get Free ReportSynopsys, Inc provides electronic design automation software products used to design and test integrated circuits. It operates in three segments: Design Automation, Design IP, and Software Integrity. The company offers Digital and Custom IC Design solution that provides digital design implementation solutions; Verification solution that offers virtual prototyping, static and formal verification, simulation, emulation, field programmable gate array (FPGA)-based prototyping, and debug solutions; and FPGA design products that are programmed to perform specific functions.

Featured Stories

Before you consider Synopsys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synopsys wasn't on the list.

While Synopsys currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.