Synovus Financial Corp purchased a new position in shares of nCino, Inc. (NASDAQ:NCNO - Free Report) during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 20,763 shares of the company's stock, valued at approximately $656,000.

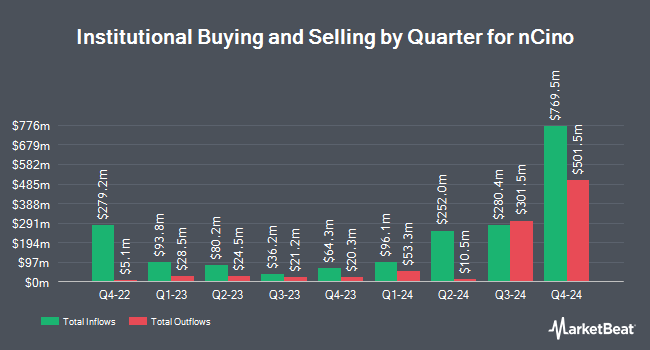

A number of other institutional investors and hedge funds also recently bought and sold shares of the business. Asset Management One Co. Ltd. raised its holdings in nCino by 21.1% during the third quarter. Asset Management One Co. Ltd. now owns 1,956 shares of the company's stock worth $62,000 after purchasing an additional 341 shares in the last quarter. Malaga Cove Capital LLC raised its stake in nCino by 3.0% during the 3rd quarter. Malaga Cove Capital LLC now owns 13,614 shares of the company's stock worth $430,000 after acquiring an additional 400 shares in the last quarter. Northwestern Mutual Wealth Management Co. lifted its position in nCino by 3.6% in the second quarter. Northwestern Mutual Wealth Management Co. now owns 14,602 shares of the company's stock valued at $459,000 after acquiring an additional 508 shares during the last quarter. Precision Wealth Strategies LLC lifted its position in nCino by 4.5% in the third quarter. Precision Wealth Strategies LLC now owns 13,564 shares of the company's stock valued at $428,000 after acquiring an additional 589 shares during the last quarter. Finally, Crewe Advisors LLC purchased a new position in shares of nCino during the second quarter worth about $26,000. 94.76% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at nCino

In other news, CFO Gregory Orenstein sold 3,885 shares of the business's stock in a transaction that occurred on Monday, October 14th. The stock was sold at an average price of $35.05, for a total transaction of $136,169.25. Following the completion of the transaction, the chief financial officer now directly owns 276,892 shares in the company, valued at approximately $9,705,064.60. The trade was a 1.38 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director William J. Ruh sold 10,000 shares of nCino stock in a transaction on Monday, October 21st. The shares were sold at an average price of $37.50, for a total value of $375,000.00. Following the sale, the director now directly owns 226,201 shares in the company, valued at $8,482,537.50. The trade was a 4.23 % decrease in their position. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 4,944,079 shares of company stock valued at $180,523,026. Corporate insiders own 28.40% of the company's stock.

nCino Stock Down 2.9 %

Shares of NCNO stock traded down $1.02 during mid-day trading on Wednesday, reaching $34.38. 6,102,965 shares of the company were exchanged, compared to its average volume of 1,121,365. The business's 50 day simple moving average is $38.61 and its 200 day simple moving average is $33.95. The company has a market capitalization of $3.98 billion, a P/E ratio of -202.22, a P/E/G ratio of 16.82 and a beta of 0.59. nCino, Inc. has a fifty-two week low of $28.09 and a fifty-two week high of $43.20. The company has a debt-to-equity ratio of 0.20, a quick ratio of 1.95 and a current ratio of 1.95.

Analyst Upgrades and Downgrades

NCNO has been the subject of a number of research reports. JMP Securities reiterated a "market outperform" rating and issued a $43.00 price objective on shares of nCino in a research note on Wednesday, August 28th. Stephens increased their price target on shares of nCino from $35.00 to $38.00 and gave the stock an "equal weight" rating in a research note on Thursday, December 5th. Truist Financial restated a "buy" rating and issued a $44.00 price objective (up from $37.00) on shares of nCino in a research note on Monday, October 21st. Morgan Stanley decreased their target price on shares of nCino from $41.00 to $39.00 and set an "equal weight" rating for the company in a research note on Friday, December 6th. Finally, Piper Sandler restated a "neutral" rating and issued a $38.00 price target on shares of nCino in a research report on Thursday, December 5th. Five investment analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $42.50.

Read Our Latest Stock Analysis on NCNO

About nCino

(

Free Report)

nCino, Inc, a software-as-a-service company, provides cloud-based software applications to financial institutions in the United States and internationally. Its nCino Bank Operating System connects financial institution employees, clients and third parties on a single cloud-based platform which include client onboarding, deposit account opening, loan origination, end-to-end mortgage suite, and powerful ecosystem.

Featured Articles

Before you consider nCino, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and nCino wasn't on the list.

While nCino currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.