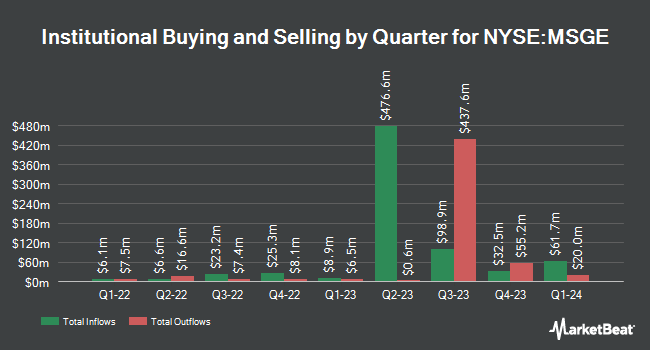

Systematic Financial Management LP increased its position in Madison Square Garden Entertainment Corp. (NYSE:MSGE - Free Report) by 5.3% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 891,493 shares of the company's stock after buying an additional 45,261 shares during the period. Madison Square Garden Entertainment comprises 1.0% of Systematic Financial Management LP's portfolio, making the stock its 23rd largest holding. Systematic Financial Management LP owned approximately 1.86% of Madison Square Garden Entertainment worth $37,915,000 at the end of the most recent quarter.

Other institutional investors and hedge funds have also modified their holdings of the company. Principal Financial Group Inc. acquired a new position in shares of Madison Square Garden Entertainment in the 3rd quarter valued at about $788,000. Maverick Capital Ltd. acquired a new position in shares of Madison Square Garden Entertainment during the 2nd quarter valued at $1,494,000. Bank of New York Mellon Corp increased its holdings in Madison Square Garden Entertainment by 11.9% in the 2nd quarter. Bank of New York Mellon Corp now owns 167,073 shares of the company's stock valued at $5,719,000 after purchasing an additional 17,793 shares in the last quarter. Radnor Capital Management LLC purchased a new position in Madison Square Garden Entertainment in the third quarter valued at about $1,005,000. Finally, Renaissance Technologies LLC raised its position in Madison Square Garden Entertainment by 182.5% in the second quarter. Renaissance Technologies LLC now owns 82,200 shares of the company's stock valued at $2,814,000 after purchasing an additional 53,100 shares during the period. Hedge funds and other institutional investors own 96.86% of the company's stock.

Insider Activity at Madison Square Garden Entertainment

In related news, EVP Philip Gerard D'ambrosio sold 6,000 shares of the business's stock in a transaction that occurred on Monday, September 30th. The stock was sold at an average price of $42.43, for a total transaction of $254,580.00. Following the completion of the transaction, the executive vice president now owns 12,192 shares in the company, valued at $517,306.56. The trade was a 32.98 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Corporate insiders own 17.85% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms have recently issued reports on MSGE. Macquarie lowered their target price on Madison Square Garden Entertainment from $47.00 to $45.00 and set an "outperform" rating for the company in a research note on Monday, November 11th. Bank of America boosted their target price on shares of Madison Square Garden Entertainment from $43.00 to $48.00 and gave the stock a "buy" rating in a research report on Monday, August 19th. Guggenheim lowered their price target on shares of Madison Square Garden Entertainment from $49.00 to $48.00 and set a "buy" rating for the company in a report on Tuesday, November 12th. Finally, Morgan Stanley cut their price objective on shares of Madison Square Garden Entertainment from $45.00 to $44.00 and set an "equal weight" rating on the stock in a report on Monday, November 11th. One research analyst has rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus price target of $46.00.

Get Our Latest Analysis on Madison Square Garden Entertainment

Madison Square Garden Entertainment Trading Down 3.0 %

NYSE MSGE traded down $1.16 during trading hours on Thursday, reaching $37.49. 168,686 shares of the company traded hands, compared to its average volume of 405,441. The company has a 50 day moving average of $40.23 and a two-hundred day moving average of $38.46. The stock has a market capitalization of $1.80 billion, a PE ratio of 10.56, a PEG ratio of 3.54 and a beta of -0.04. Madison Square Garden Entertainment Corp. has a 12 month low of $30.00 and a 12 month high of $44.14.

Madison Square Garden Entertainment (NYSE:MSGE - Get Free Report) last posted its quarterly earnings results on Friday, November 8th. The company reported ($0.40) EPS for the quarter, topping analysts' consensus estimates of ($0.79) by $0.39. Madison Square Garden Entertainment had a negative return on equity of 261.70% and a net margin of 18.38%. The business had revenue of $138.70 million during the quarter, compared to the consensus estimate of $139.46 million. During the same period last year, the firm earned ($0.73) earnings per share. The company's revenue for the quarter was down 2.5% compared to the same quarter last year. On average, equities research analysts anticipate that Madison Square Garden Entertainment Corp. will post 1.58 earnings per share for the current year.

Madison Square Garden Entertainment Profile

(

Free Report)

Madison Square Garden Entertainment Corp. engages in live entertainment business. The company produces, presents, and hosts live entertainment events, including concerts, sports events, and other live events, such as family shows, performing arts events, and special events. Its operations include a collection of venues, the entertainment and sports bookings business, and the Christmas Spectacular Starring the Radio City Rockettes production.

Featured Articles

Before you consider Madison Square Garden Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madison Square Garden Entertainment wasn't on the list.

While Madison Square Garden Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.