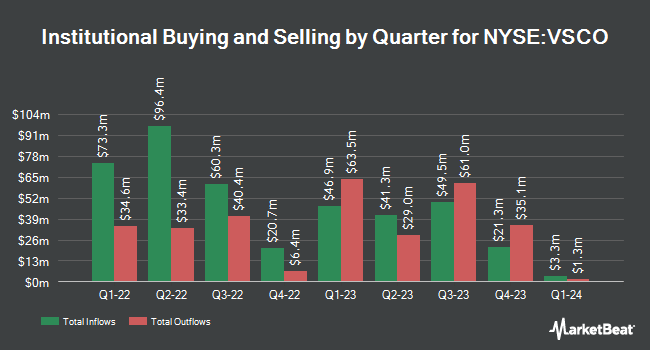

Systematic Financial Management LP purchased a new position in shares of Victoria's Secret & Co. (NYSE:VSCO - Free Report) in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 23,676 shares of the company's stock, valued at approximately $608,000.

A number of other institutional investors also recently added to or reduced their stakes in VSCO. Dark Forest Capital Management LP bought a new stake in shares of Victoria's Secret & Co. in the 2nd quarter worth about $589,000. Forest Avenue Capital Management LP acquired a new position in Victoria's Secret & Co. in the third quarter valued at about $40,861,000. Aristeia Capital L.L.C. bought a new stake in Victoria's Secret & Co. during the second quarter worth about $1,171,000. Alpha DNA Investment Management LLC acquired a new stake in shares of Victoria's Secret & Co. during the second quarter worth approximately $408,000. Finally, MetLife Investment Management LLC raised its stake in shares of Victoria's Secret & Co. by 129.1% in the third quarter. MetLife Investment Management LLC now owns 45,652 shares of the company's stock valued at $1,173,000 after acquiring an additional 25,723 shares during the last quarter. 90.29% of the stock is owned by institutional investors and hedge funds.

Victoria's Secret & Co. Trading Up 11.6 %

Shares of NYSE:VSCO traded up $5.00 during trading on Friday, hitting $48.02. 6,017,096 shares of the company's stock were exchanged, compared to its average volume of 1,905,661. The company has a current ratio of 1.00, a quick ratio of 0.31 and a debt-to-equity ratio of 2.27. The firm has a market cap of $3.77 billion, a P/E ratio of 24.88 and a beta of 2.19. The firm has a 50-day moving average price of $32.31 and a two-hundred day moving average price of $24.70. Victoria's Secret & Co. has a 1-year low of $15.12 and a 1-year high of $48.70.

Victoria's Secret & Co. (NYSE:VSCO - Get Free Report) last released its earnings results on Thursday, December 5th. The company reported ($0.50) EPS for the quarter, topping analysts' consensus estimates of ($0.62) by $0.12. The firm had revenue of $1.35 billion during the quarter, compared to analyst estimates of $1.29 billion. Victoria's Secret & Co. had a net margin of 2.25% and a return on equity of 44.06%. The business's quarterly revenue was up 6.5% compared to the same quarter last year. During the same quarter in the previous year, the business earned ($0.86) EPS. Equities analysts predict that Victoria's Secret & Co. will post 2.01 earnings per share for the current year.

Analyst Ratings Changes

A number of equities research analysts recently commented on VSCO shares. Telsey Advisory Group restated a "market perform" rating and set a $40.00 price target on shares of Victoria's Secret & Co. in a research report on Friday. TD Cowen raised their target price on Victoria's Secret & Co. from $20.00 to $26.00 and gave the company a "hold" rating in a research note on Friday, August 30th. Barclays raised Victoria's Secret & Co. from an "underweight" rating to an "equal weight" rating and lifted their price target for the company from $23.00 to $25.00 in a report on Wednesday, September 18th. Bank of America increased their price objective on shares of Victoria's Secret & Co. from $18.00 to $21.00 and gave the stock an "underperform" rating in a report on Friday, August 30th. Finally, Morgan Stanley boosted their target price on shares of Victoria's Secret & Co. from $23.00 to $31.00 and gave the stock an "equal weight" rating in a research note on Thursday. Four investment analysts have rated the stock with a sell rating, four have issued a hold rating and three have assigned a buy rating to the company's stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $28.64.

View Our Latest Stock Report on VSCO

Victoria's Secret & Co. Profile

(

Free Report)

Victoria's Secret & Co operates as a specialty retailer of women's intimate, and other apparel and beauty products worldwide. It offers bras, panties, lingerie, casual sleepwear, and athleisure and swim, as well as fragrances and body care; and loungewear, knit tops, activewear, and accessories and beauty under the Victoria's Secret, PINK, and Adore Me brands.

Further Reading

Before you consider Victoria's Secret & Co., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Victoria's Secret & Co. wasn't on the list.

While Victoria's Secret & Co. currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.