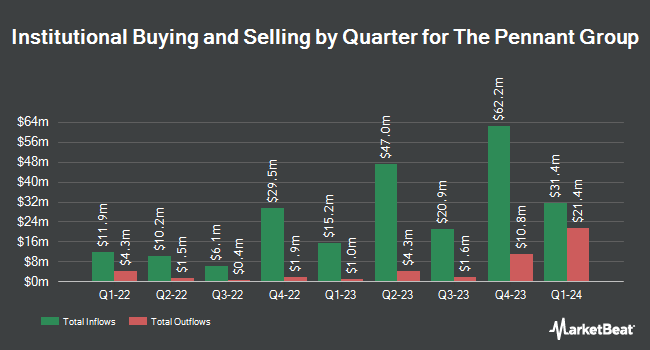

Systematic Financial Management LP acquired a new stake in shares of The Pennant Group, Inc. (NASDAQ:PNTG - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 29,950 shares of the company's stock, valued at approximately $1,069,000. Systematic Financial Management LP owned 0.09% of The Pennant Group as of its most recent SEC filing.

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Quarry LP raised its position in The Pennant Group by 371.6% in the third quarter. Quarry LP now owns 1,014 shares of the company's stock worth $36,000 after acquiring an additional 799 shares during the period. Point72 Asia Singapore Pte. Ltd. raised its position in The Pennant Group by 460.2% in the third quarter. Point72 Asia Singapore Pte. Ltd. now owns 3,311 shares of the company's stock worth $118,000 after acquiring an additional 2,720 shares during the period. USA Financial Formulas bought a new position in The Pennant Group in the third quarter worth approximately $121,000. Intech Investment Management LLC bought a new position in The Pennant Group in the third quarter worth approximately $232,000. Finally, Bailard Inc. bought a new position in The Pennant Group in the second quarter worth approximately $253,000. Institutional investors own 85.88% of the company's stock.

Analyst Upgrades and Downgrades

A number of analysts have recently issued reports on the stock. Truist Financial increased their price objective on shares of The Pennant Group from $34.00 to $38.00 and gave the stock a "hold" rating in a research note on Monday, October 7th. Stephens reissued an "overweight" rating and issued a $40.00 price objective on shares of The Pennant Group in a research note on Wednesday, October 9th. Royal Bank of Canada increased their price objective on shares of The Pennant Group from $26.00 to $38.00 and gave the stock an "outperform" rating in a research note on Wednesday, October 23rd. Finally, Oppenheimer increased their price objective on shares of The Pennant Group from $34.00 to $37.00 and gave the stock an "outperform" rating in a research note on Friday, November 8th.

Check Out Our Latest Report on PNTG

The Pennant Group Price Performance

Shares of NASDAQ:PNTG traded up $0.09 on Friday, reaching $29.92. The company's stock had a trading volume of 186,621 shares, compared to its average volume of 200,475. The Pennant Group, Inc. has a 52-week low of $13.24 and a 52-week high of $37.13. The company has a market cap of $1.03 billion, a P/E ratio of 44.00, a PEG ratio of 3.16 and a beta of 1.95. The company has a 50-day simple moving average of $32.77 and a 200 day simple moving average of $29.75. The company has a debt-to-equity ratio of 0.58, a quick ratio of 1.12 and a current ratio of 1.12.

The Pennant Group Profile

(

Free Report)

The Pennant Group, Inc provides healthcare services in the United States. It operates in two segments, Home Health and Hospice Services, and Senior Living Services. The company offers home health services, including clinical services, such as nursing, speech, occupational and physical therapy, medical social work, and home health aide services; and hospice services comprising clinical care, education, and counseling services for the physical, spiritual, and psychosocial needs of terminally ill patients and their families.

Featured Articles

Before you consider The Pennant Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and The Pennant Group wasn't on the list.

While The Pennant Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.