T. Rowe Price Group (NASDAQ:TROW - Get Free Report) had its price target boosted by analysts at Deutsche Bank Aktiengesellschaft from $115.00 to $120.00 in a report released on Monday,Benzinga reports. The brokerage presently has a "hold" rating on the asset manager's stock. Deutsche Bank Aktiengesellschaft's price objective would indicate a potential upside of 1.76% from the stock's previous close.

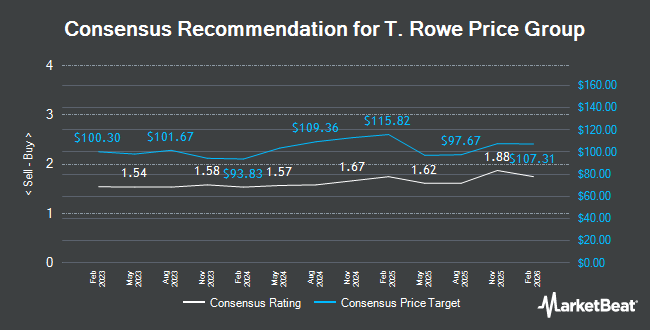

TROW has been the subject of a number of other research reports. StockNews.com cut shares of T. Rowe Price Group from a "buy" rating to a "hold" rating in a research note on Monday, July 29th. Keefe, Bruyette & Woods reissued a "market perform" rating and set a $120.00 target price (down previously from $121.00) on shares of T. Rowe Price Group in a research note on Monday, July 29th. Wells Fargo & Company boosted their target price on shares of T. Rowe Price Group from $109.00 to $112.00 and gave the stock an "equal weight" rating in a research note on Wednesday, October 9th. Evercore ISI boosted their target price on shares of T. Rowe Price Group from $112.00 to $113.00 and gave the stock an "in-line" rating in a research note on Thursday. Finally, TD Cowen cut their target price on shares of T. Rowe Price Group from $120.00 to $116.00 and set a "hold" rating for the company in a research note on Monday, November 4th. Four research analysts have rated the stock with a sell rating and eight have assigned a hold rating to the company's stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and an average target price of $115.55.

Read Our Latest Stock Analysis on TROW

T. Rowe Price Group Trading Up 0.3 %

Shares of T. Rowe Price Group stock traded up $0.31 during trading hours on Monday, reaching $117.93. The stock had a trading volume of 943,775 shares, compared to its average volume of 1,262,443. The stock's 50 day moving average is $109.33 and its 200 day moving average is $111.93. The firm has a market capitalization of $26.20 billion, a PE ratio of 13.04, a PEG ratio of 1.71 and a beta of 1.41. T. Rowe Price Group has a twelve month low of $91.40 and a twelve month high of $122.27.

T. Rowe Price Group (NASDAQ:TROW - Get Free Report) last issued its quarterly earnings data on Friday, November 1st. The asset manager reported $2.57 earnings per share for the quarter, topping analysts' consensus estimates of $2.36 by $0.21. The business had revenue of $1.79 billion during the quarter, compared to the consensus estimate of $1.84 billion. T. Rowe Price Group had a net margin of 30.35% and a return on equity of 20.35%. The company's revenue was up 6.9% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $2.17 earnings per share. As a group, sell-side analysts predict that T. Rowe Price Group will post 9.32 earnings per share for the current year.

Insider Buying and Selling

In other news, insider Jessica M. Hiebler sold 484 shares of the company's stock in a transaction on Friday, September 13th. The stock was sold at an average price of $104.73, for a total value of $50,689.32. Following the transaction, the insider now owns 13,939 shares of the company's stock, valued at $1,459,831.47. This represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. In other T. Rowe Price Group news, VP Andrew Justin Mackenzi Thomson sold 11,969 shares of the company's stock in a transaction on Friday, September 6th. The stock was sold at an average price of $102.83, for a total transaction of $1,230,772.27. Following the transaction, the vice president now directly owns 123,624 shares in the company, valued at $12,712,255.92. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Jessica M. Hiebler sold 484 shares of T. Rowe Price Group stock in a transaction on Friday, September 13th. The shares were sold at an average price of $104.73, for a total value of $50,689.32. Following the completion of the sale, the insider now directly owns 13,939 shares of the company's stock, valued at $1,459,831.47. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 2.00% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On T. Rowe Price Group

Hedge funds have recently bought and sold shares of the company. Forsta AP Fonden boosted its stake in shares of T. Rowe Price Group by 32.3% in the second quarter. Forsta AP Fonden now owns 70,100 shares of the asset manager's stock valued at $8,083,000 after purchasing an additional 17,100 shares during the period. Mizuho Markets Americas LLC boosted its position in T. Rowe Price Group by 90.0% in the 1st quarter. Mizuho Markets Americas LLC now owns 90,688 shares of the asset manager's stock valued at $11,057,000 after buying an additional 42,949 shares during the period. Savant Capital LLC grew its stake in shares of T. Rowe Price Group by 36.6% in the second quarter. Savant Capital LLC now owns 32,887 shares of the asset manager's stock worth $3,792,000 after acquiring an additional 8,816 shares in the last quarter. CANADA LIFE ASSURANCE Co increased its position in shares of T. Rowe Price Group by 4.1% during the first quarter. CANADA LIFE ASSURANCE Co now owns 171,259 shares of the asset manager's stock worth $20,890,000 after acquiring an additional 6,780 shares during the period. Finally, State Board of Administration of Florida Retirement System raised its stake in shares of T. Rowe Price Group by 3.8% in the first quarter. State Board of Administration of Florida Retirement System now owns 257,796 shares of the asset manager's stock valued at $29,105,000 after acquiring an additional 9,519 shares in the last quarter. Institutional investors and hedge funds own 73.39% of the company's stock.

T. Rowe Price Group Company Profile

(

Get Free Report)

T. Rowe Price Group, Inc is a publicly owned investment manager. The firm provides its services to individuals, institutional investors, retirement plans, financial intermediaries, and institutions. It launches and manages equity and fixed income mutual funds. The firm invests in the public equity and fixed income markets across the globe.

Featured Stories

Before you consider T. Rowe Price Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T. Rowe Price Group wasn't on the list.

While T. Rowe Price Group currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.