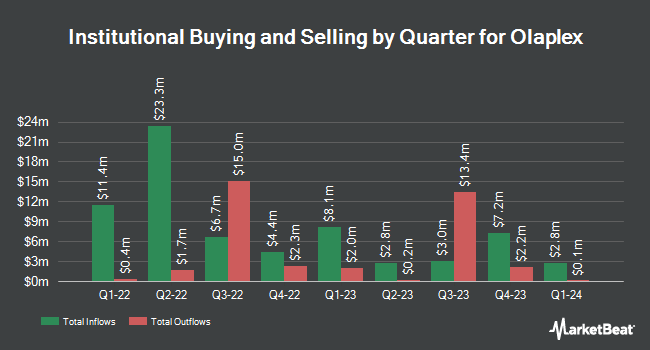

T. Rowe Price Investment Management Inc. raised its stake in shares of Olaplex Holdings, Inc. (NASDAQ:OLPX - Free Report) by 181.6% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 24,500,600 shares of the company's stock after buying an additional 15,800,642 shares during the period. T. Rowe Price Investment Management Inc. owned 3.70% of Olaplex worth $42,387,000 at the end of the most recent quarter.

Other institutional investors also recently bought and sold shares of the company. Chemistry Wealth Management LLC acquired a new position in shares of Olaplex during the 4th quarter valued at about $25,000. Hsbc Holdings PLC acquired a new position in Olaplex during the fourth quarter valued at approximately $34,000. Cornerstone Wealth Management LLC acquired a new position in Olaplex during the fourth quarter valued at approximately $36,000. Parkside Financial Bank & Trust raised its position in shares of Olaplex by 290.1% in the fourth quarter. Parkside Financial Bank & Trust now owns 21,395 shares of the company's stock valued at $37,000 after purchasing an additional 15,911 shares during the period. Finally, KLP Kapitalforvaltning AS acquired a new stake in shares of Olaplex in the fourth quarter worth $43,000. 87.37% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on OLPX. Barclays lifted their target price on shares of Olaplex from $1.50 to $1.70 and gave the stock an "equal weight" rating in a report on Wednesday, March 5th. Piper Sandler lifted their price objective on Olaplex from $1.50 to $2.00 and gave the stock a "neutral" rating in a research note on Monday, January 6th. Finally, Telsey Advisory Group reissued a "market perform" rating and set a $2.00 price objective on shares of Olaplex in a research report on Wednesday, March 12th.

Check Out Our Latest Analysis on Olaplex

Olaplex Price Performance

NASDAQ:OLPX opened at $1.30 on Friday. The company has a debt-to-equity ratio of 0.73, a current ratio of 11.84 and a quick ratio of 10.32. The stock has a market cap of $865.48 million, a P/E ratio of 21.67 and a beta of 2.39. The company has a fifty day moving average price of $1.33 and a 200 day moving average price of $1.64. Olaplex Holdings, Inc. has a one year low of $1.01 and a one year high of $2.77.

Insider Activity

In related news, General Counsel John C. Duffy sold 35,013 shares of the business's stock in a transaction dated Friday, March 7th. The stock was sold at an average price of $1.44, for a total transaction of $50,418.72. Following the transaction, the general counsel now directly owns 348,630 shares in the company, valued at $502,027.20. The trade was a 9.13 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Trisha L. Fox sold 26,526 shares of the firm's stock in a transaction that occurred on Friday, March 7th. The stock was sold at an average price of $1.44, for a total value of $38,197.44. Following the completion of the sale, the insider now owns 461,548 shares of the company's stock, valued at $664,629.12. This represents a 5.43 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 73,269 shares of company stock valued at $103,161. Insiders own 4.20% of the company's stock.

About Olaplex

(

Free Report)

Olaplex Holdings, Inc develops, manufactures, and sells hair care products in the United States and internationally. The company offers hair care shampoos and conditioners for use in treatment, maintenance, and protection of hair, as well as oil, moisture mask, and nourishing hair serum. It provides hair care products to professional hair salons, retailers, and everyday consumers.

Read More

Want to see what other hedge funds are holding OLPX? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Olaplex Holdings, Inc. (NASDAQ:OLPX - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Olaplex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Olaplex wasn't on the list.

While Olaplex currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.