Taconic Capital Advisors LP raised its holdings in Unity Software Inc. (NYSE:U - Free Report) by 50.0% in the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 75,000 shares of the company's stock after purchasing an additional 25,000 shares during the quarter. Unity Software accounts for 0.9% of Taconic Capital Advisors LP's investment portfolio, making the stock its 13th largest position. Taconic Capital Advisors LP's holdings in Unity Software were worth $1,696,000 as of its most recent SEC filing.

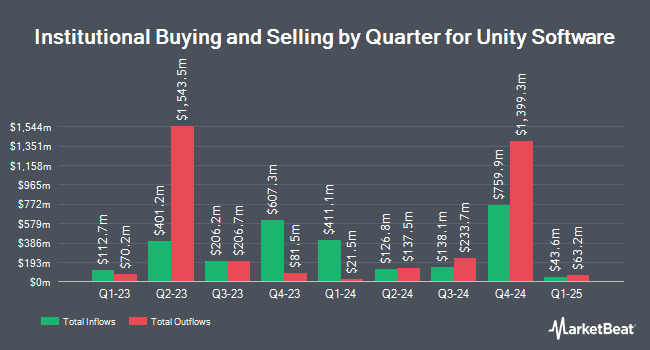

Several other large investors have also recently made changes to their positions in the business. Farther Finance Advisors LLC raised its holdings in shares of Unity Software by 4.0% in the 3rd quarter. Farther Finance Advisors LLC now owns 13,947 shares of the company's stock worth $315,000 after purchasing an additional 538 shares during the period. Advisors Asset Management Inc. increased its position in Unity Software by 31.6% in the first quarter. Advisors Asset Management Inc. now owns 2,338 shares of the company's stock worth $62,000 after buying an additional 562 shares during the last quarter. Venturi Wealth Management LLC raised its stake in shares of Unity Software by 28.7% in the third quarter. Venturi Wealth Management LLC now owns 3,923 shares of the company's stock valued at $89,000 after buying an additional 876 shares during the period. GAMMA Investing LLC lifted its position in shares of Unity Software by 343.8% during the 3rd quarter. GAMMA Investing LLC now owns 1,225 shares of the company's stock valued at $28,000 after buying an additional 949 shares during the last quarter. Finally, Intech Investment Management LLC grew its stake in shares of Unity Software by 8.2% during the 2nd quarter. Intech Investment Management LLC now owns 13,270 shares of the company's stock worth $216,000 after acquiring an additional 1,010 shares during the period. 73.46% of the stock is owned by hedge funds and other institutional investors.

Insider Activity

In other Unity Software news, SVP Felix The sold 11,719 shares of the firm's stock in a transaction dated Monday, November 25th. The shares were sold at an average price of $24.39, for a total transaction of $285,826.41. Following the completion of the sale, the senior vice president now directly owns 411,960 shares in the company, valued at approximately $10,047,704.40. This trade represents a 2.77 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director David Helgason sold 250,000 shares of the firm's stock in a transaction that occurred on Friday, September 13th. The shares were sold at an average price of $20.59, for a total transaction of $5,147,500.00. Following the sale, the director now directly owns 8,201,851 shares of the company's stock, valued at $168,876,112.09. This trade represents a 2.96 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 554,381 shares of company stock worth $10,631,723. Insiders own 6.30% of the company's stock.

Analysts Set New Price Targets

U has been the topic of a number of recent research reports. Benchmark upped their price target on shares of Unity Software from $10.00 to $15.00 and gave the company a "sell" rating in a research note on Friday, November 8th. The Goldman Sachs Group dropped their target price on Unity Software from $26.00 to $22.50 and set a "neutral" rating on the stock in a research report on Friday, August 9th. UBS Group lifted their price target on Unity Software from $15.00 to $20.00 and gave the company a "neutral" rating in a research report on Friday, October 18th. JMP Securities reiterated a "market perform" rating on shares of Unity Software in a research note on Friday, September 13th. Finally, Morgan Stanley upgraded Unity Software from an "equal weight" rating to an "overweight" rating and set a $22.00 target price for the company in a research note on Tuesday, September 3rd. Two equities research analysts have rated the stock with a sell rating, eight have issued a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $23.35.

Check Out Our Latest Report on Unity Software

Unity Software Stock Up 2.8 %

Unity Software stock traded up $0.65 on Friday, hitting $24.12. 7,475,549 shares of the stock traded hands, compared to its average volume of 10,583,529. Unity Software Inc. has a 1 year low of $13.90 and a 1 year high of $43.54. The firm has a market cap of $9.72 billion, a P/E ratio of -11.82 and a beta of 2.29. The company has a current ratio of 2.41, a quick ratio of 2.41 and a debt-to-equity ratio of 0.70. The business's fifty day simple moving average is $21.31 and its 200 day simple moving average is $18.68.

About Unity Software

(

Free Report)

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

Further Reading

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.