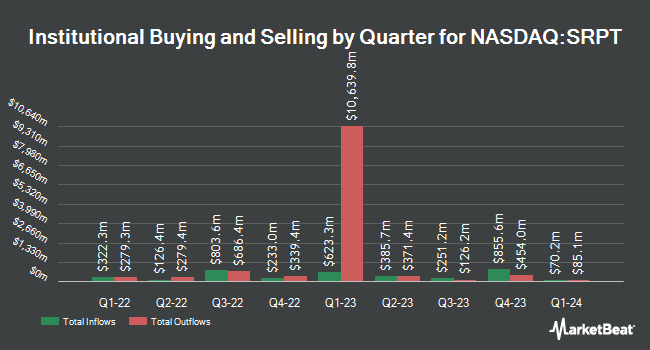

Taconic Capital Advisors LP bought a new stake in shares of Sarepta Therapeutics, Inc. (NASDAQ:SRPT - Free Report) in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund bought 5,000 shares of the biotechnology company's stock, valued at approximately $624,000. Sarepta Therapeutics accounts for 0.3% of Taconic Capital Advisors LP's holdings, making the stock its 15th biggest holding.

A number of other hedge funds and other institutional investors have also added to or reduced their stakes in the business. Riggs Asset Managment Co. Inc. lifted its position in shares of Sarepta Therapeutics by 33.3% during the 2nd quarter. Riggs Asset Managment Co. Inc. now owns 300 shares of the biotechnology company's stock valued at $47,000 after buying an additional 75 shares in the last quarter. CIBC Asset Management Inc lifted its holdings in Sarepta Therapeutics by 3.3% during the third quarter. CIBC Asset Management Inc now owns 2,712 shares of the biotechnology company's stock valued at $339,000 after purchasing an additional 86 shares in the last quarter. EP Wealth Advisors LLC increased its stake in shares of Sarepta Therapeutics by 2.1% in the second quarter. EP Wealth Advisors LLC now owns 4,899 shares of the biotechnology company's stock worth $774,000 after purchasing an additional 103 shares in the last quarter. Cambridge Investment Research Advisors Inc. raised its position in shares of Sarepta Therapeutics by 1.9% during the 2nd quarter. Cambridge Investment Research Advisors Inc. now owns 6,331 shares of the biotechnology company's stock valued at $1,000,000 after purchasing an additional 120 shares during the period. Finally, Oppenheimer Asset Management Inc. lifted its stake in shares of Sarepta Therapeutics by 3.4% during the 3rd quarter. Oppenheimer Asset Management Inc. now owns 4,457 shares of the biotechnology company's stock valued at $557,000 after buying an additional 145 shares in the last quarter. 86.68% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of brokerages have issued reports on SRPT. Guggenheim increased their price target on Sarepta Therapeutics from $148.00 to $150.00 and gave the stock a "buy" rating in a research note on Thursday, November 7th. Royal Bank of Canada reiterated an "outperform" rating and set a $182.00 target price on shares of Sarepta Therapeutics in a research report on Monday, October 21st. Needham & Company LLC lowered their price target on Sarepta Therapeutics from $205.00 to $202.00 and set a "buy" rating on the stock in a report on Wednesday. Barclays cut their price objective on shares of Sarepta Therapeutics from $226.00 to $203.00 and set an "overweight" rating for the company in a report on Thursday, August 8th. Finally, UBS Group raised their target price on shares of Sarepta Therapeutics from $173.00 to $188.00 and gave the company a "buy" rating in a research note on Tuesday, September 17th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating, twenty have issued a buy rating and one has given a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $175.77.

Check Out Our Latest Stock Analysis on Sarepta Therapeutics

Sarepta Therapeutics Trading Down 3.3 %

Sarepta Therapeutics stock traded down $4.60 during mid-day trading on Friday, hitting $133.34. The company's stock had a trading volume of 777,534 shares, compared to its average volume of 1,246,366. The company has a debt-to-equity ratio of 0.93, a quick ratio of 3.03 and a current ratio of 3.84. The company has a 50 day moving average of $122.37 and a 200-day moving average of $131.48. Sarepta Therapeutics, Inc. has a one year low of $78.67 and a one year high of $173.25. The stock has a market cap of $12.74 billion, a PE ratio of 106.67 and a beta of 0.81.

Sarepta Therapeutics Company Profile

(

Free Report)

Sarepta Therapeutics, Inc, a commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases. It offers EXONDYS 51 injection to treat duchenne muscular dystrophy (duchenne) in patients with confirmed mutation of the dystrophin gene that is amenable to exon 51 skipping; VYONDYS 53 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene that is amenable to exon 53 skipping; AMONDYS 45 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene; and ELEVIDYS, an adeno-associated virus based gene therapy for the treatment of ambulatory pediatric patients aged 4 through 5 years with duchenne with a confirmed mutation in the duchenne gene.

Further Reading

Before you consider Sarepta Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sarepta Therapeutics wasn't on the list.

While Sarepta Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.