Taconic Capital Advisors LP lowered its stake in HubSpot, Inc. (NYSE:HUBS - Free Report) by 85.6% during the third quarter, according to the company in its most recent filing with the SEC. The fund owned 4,197 shares of the software maker's stock after selling 25,000 shares during the period. HubSpot makes up 1.2% of Taconic Capital Advisors LP's portfolio, making the stock its 11th largest holding. Taconic Capital Advisors LP's holdings in HubSpot were worth $2,231,000 as of its most recent filing with the SEC.

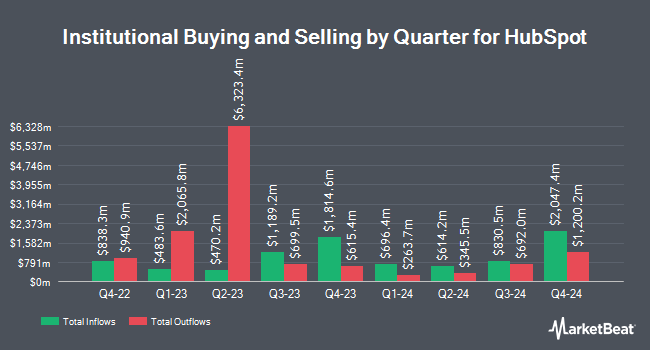

Several other large investors have also recently bought and sold shares of HUBS. Janus Henderson Group PLC lifted its holdings in shares of HubSpot by 2.9% during the first quarter. Janus Henderson Group PLC now owns 24,521 shares of the software maker's stock worth $15,364,000 after buying an additional 689 shares in the last quarter. Jacobs Levy Equity Management Inc. boosted its position in HubSpot by 2.8% in the first quarter. Jacobs Levy Equity Management Inc. now owns 1,114 shares of the software maker's stock valued at $698,000 after buying an additional 30 shares in the last quarter. B. Riley Wealth Advisors Inc. grew its stake in shares of HubSpot by 36.8% during the first quarter. B. Riley Wealth Advisors Inc. now owns 1,092 shares of the software maker's stock worth $684,000 after buying an additional 294 shares during the last quarter. Comerica Bank increased its holdings in shares of HubSpot by 4.0% during the first quarter. Comerica Bank now owns 15,806 shares of the software maker's stock worth $9,903,000 after buying an additional 608 shares in the last quarter. Finally, Swedbank AB bought a new position in shares of HubSpot in the 1st quarter valued at $15,844,000. 90.39% of the stock is owned by institutional investors.

HubSpot Trading Down 0.2 %

HubSpot stock traded down $1.34 during midday trading on Friday, reaching $721.42. The stock had a trading volume of 174,747 shares, compared to its average volume of 591,014. The company has a fifty day moving average price of $597.13 and a two-hundred day moving average price of $556.38. HubSpot, Inc. has a 12 month low of $434.84 and a 12 month high of $754.56. The company has a market capitalization of $37.24 billion, a P/E ratio of -2,671.83, a PEG ratio of 87.86 and a beta of 1.63.

HubSpot (NYSE:HUBS - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The software maker reported $2.18 EPS for the quarter, beating the consensus estimate of $1.91 by $0.27. HubSpot had a negative return on equity of 1.16% and a negative net margin of 0.56%. The firm had revenue of $669.72 million during the quarter, compared to the consensus estimate of $646.97 million. During the same quarter in the previous year, the company posted ($0.04) earnings per share. The company's quarterly revenue was up 20.1% on a year-over-year basis. On average, equities research analysts predict that HubSpot, Inc. will post 0.4 earnings per share for the current fiscal year.

Insiders Place Their Bets

In other news, insider Dawson Alyssa Harvey sold 573 shares of the firm's stock in a transaction that occurred on Tuesday, November 12th. The stock was sold at an average price of $700.00, for a total value of $401,100.00. Following the transaction, the insider now owns 7,603 shares in the company, valued at $5,322,100. This trade represents a 7.01 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Yamini Rangan sold 116 shares of the company's stock in a transaction on Wednesday, September 4th. The stock was sold at an average price of $491.19, for a total value of $56,978.04. Following the sale, the chief executive officer now owns 67,203 shares of the company's stock, valued at $33,009,441.57. This trade represents a 0.17 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 44,391 shares of company stock worth $29,101,488. Insiders own 4.50% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities analysts have issued reports on HUBS shares. Oppenheimer upped their target price on HubSpot from $625.00 to $740.00 and gave the stock an "outperform" rating in a report on Thursday, November 7th. Piper Sandler downgraded shares of HubSpot from an "overweight" rating to a "neutral" rating and lifted their target price for the stock from $570.00 to $640.00 in a research report on Thursday, November 7th. The Goldman Sachs Group upped their price target on shares of HubSpot from $626.00 to $690.00 and gave the company a "buy" rating in a research report on Thursday, November 7th. Raymond James cut their price target on shares of HubSpot from $725.00 to $675.00 and set an "outperform" rating on the stock in a report on Thursday, August 8th. Finally, Barclays increased their price objective on HubSpot from $500.00 to $650.00 and gave the company an "equal weight" rating in a report on Friday, November 8th. Five analysts have rated the stock with a hold rating and eighteen have given a buy rating to the stock. According to MarketBeat.com, HubSpot presently has an average rating of "Moderate Buy" and an average price target of $672.68.

Read Our Latest Research Report on HubSpot

About HubSpot

(

Free Report)

HubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Further Reading

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.