Taika Capital LP bought a new stake in Universal Health Services, Inc. (NYSE:UHS - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm bought 5,971 shares of the health services provider's stock, valued at approximately $1,367,000. Universal Health Services makes up approximately 1.0% of Taika Capital LP's portfolio, making the stock its 28th biggest holding.

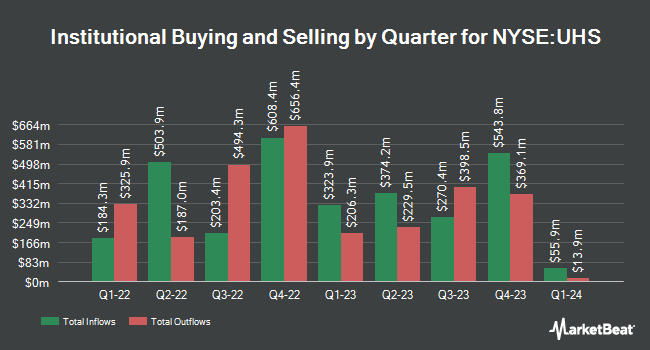

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in UHS. State Street Corp grew its position in shares of Universal Health Services by 0.6% during the third quarter. State Street Corp now owns 2,724,075 shares of the health services provider's stock worth $623,840,000 after acquiring an additional 17,527 shares during the last quarter. Quadrature Capital Ltd grew its position in shares of Universal Health Services by 71.1% during the third quarter. Quadrature Capital Ltd now owns 32,194 shares of the health services provider's stock worth $7,375,000 after acquiring an additional 13,380 shares during the last quarter. Quantinno Capital Management LP grew its position in Universal Health Services by 80.1% in the 3rd quarter. Quantinno Capital Management LP now owns 32,239 shares of the health services provider's stock valued at $7,383,000 after buying an additional 14,342 shares during the last quarter. Quarry LP grew its position in Universal Health Services by 14.4% in the 3rd quarter. Quarry LP now owns 516 shares of the health services provider's stock valued at $118,000 after buying an additional 65 shares during the last quarter. Finally, Redwood Investment Management LLC grew its position in Universal Health Services by 3.9% in the 3rd quarter. Redwood Investment Management LLC now owns 7,768 shares of the health services provider's stock valued at $1,786,000 after buying an additional 294 shares during the last quarter. Institutional investors and hedge funds own 86.05% of the company's stock.

Universal Health Services Stock Down 1.5 %

NYSE UHS traded down $3.02 on Friday, reaching $193.03. The company had a trading volume of 309,359 shares, compared to its average volume of 682,357. The firm has a market capitalization of $12.73 billion, a PE ratio of 13.11, a P/E/G ratio of 0.63 and a beta of 1.28. Universal Health Services, Inc. has a 1 year low of $133.70 and a 1 year high of $243.25. The firm has a 50-day moving average of $211.44 and a 200-day moving average of $207.63. The company has a debt-to-equity ratio of 0.69, a current ratio of 1.39 and a quick ratio of 1.28.

Universal Health Services (NYSE:UHS - Get Free Report) last released its quarterly earnings results on Thursday, October 24th. The health services provider reported $3.71 earnings per share for the quarter, missing analysts' consensus estimates of $3.75 by ($0.04). The company had revenue of $3.96 billion during the quarter, compared to analysts' expectations of $3.90 billion. Universal Health Services had a return on equity of 15.75% and a net margin of 6.66%. The firm's revenue was up 11.3% compared to the same quarter last year. During the same quarter in the prior year, the company earned $2.55 EPS. On average, equities research analysts anticipate that Universal Health Services, Inc. will post 15.88 EPS for the current fiscal year.

Universal Health Services Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 17th. Shareholders of record on Tuesday, December 3rd will be given a $0.20 dividend. This represents a $0.80 dividend on an annualized basis and a dividend yield of 0.41%. The ex-dividend date is Tuesday, December 3rd. Universal Health Services's payout ratio is 5.32%.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on UHS shares. UBS Group lifted their price objective on shares of Universal Health Services from $247.00 to $267.00 and gave the company a "buy" rating in a research report on Wednesday, August 14th. Bank of America assumed coverage on shares of Universal Health Services in a research report on Wednesday, November 6th. They set a "neutral" rating and a $223.00 target price on the stock. Robert W. Baird lifted their price target on Universal Health Services from $236.00 to $274.00 and gave the stock an "outperform" rating in a research note on Wednesday, September 4th. TD Cowen cut their price target on Universal Health Services from $275.00 to $251.00 and set a "buy" rating for the company in a research note on Tuesday, November 26th. Finally, StockNews.com downgraded Universal Health Services from a "strong-buy" rating to a "buy" rating in a research note on Saturday, November 9th. Six analysts have rated the stock with a hold rating, ten have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, Universal Health Services currently has an average rating of "Moderate Buy" and a consensus price target of $225.50.

Check Out Our Latest Report on Universal Health Services

About Universal Health Services

(

Free Report)

Universal Health Services, Inc, through its subsidiaries, owns and operates acute care hospitals, and outpatient and behavioral health care facilities. It operates through Acute Care Hospital Services and Behavioral Health Care Services segments. The company's hospitals offer general and specialty surgery, internal medicine, obstetrics, emergency room care, radiology, oncology, diagnostic and coronary care, pediatric services, pharmacy services, and/or behavioral health services.

Read More

Before you consider Universal Health Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Universal Health Services wasn't on the list.

While Universal Health Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.