Taika Capital LP acquired a new stake in Chewy, Inc. (NYSE:CHWY - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor acquired 60,023 shares of the company's stock, valued at approximately $1,758,000. Chewy comprises approximately 1.3% of Taika Capital LP's portfolio, making the stock its 26th biggest position.

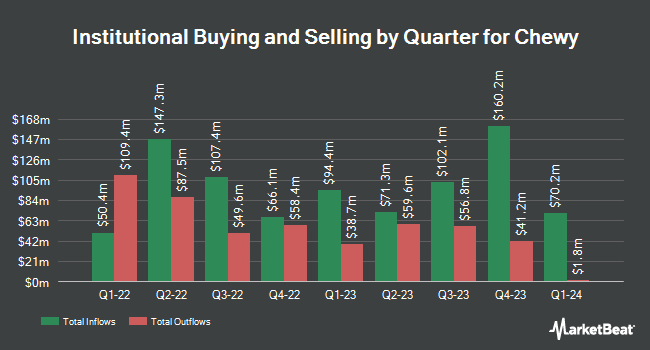

Several other hedge funds also recently bought and sold shares of CHWY. Stifel Financial Corp raised its stake in Chewy by 5.6% in the third quarter. Stifel Financial Corp now owns 378,339 shares of the company's stock worth $11,082,000 after buying an additional 19,938 shares in the last quarter. Quadrature Capital Ltd purchased a new position in Chewy in the third quarter worth $13,699,000. Polar Asset Management Partners Inc. purchased a new stake in shares of Chewy during the third quarter valued at $6,684,000. Maven Securities LTD purchased a new stake in shares of Chewy during the third quarter valued at $1,464,000. Finally, Integrated Wealth Concepts LLC purchased a new stake in shares of Chewy during the third quarter valued at $210,000. Institutional investors own 93.09% of the company's stock.

Chewy Stock Performance

NYSE:CHWY traded up $0.88 during mid-day trading on Friday, reaching $31.95. The stock had a trading volume of 3,434,366 shares, compared to its average volume of 8,616,190. The firm has a market capitalization of $13.36 billion, a price-to-earnings ratio of 37.88, a PEG ratio of 3.15 and a beta of 1.12. Chewy, Inc. has a twelve month low of $14.69 and a twelve month high of $39.10. The business has a 50 day simple moving average of $30.42 and a 200 day simple moving average of $27.06.

Chewy (NYSE:CHWY - Get Free Report) last posted its quarterly earnings results on Wednesday, December 4th. The company reported $0.20 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.05 by $0.15. Chewy had a net margin of 3.20% and a return on equity of 21.00%. The company had revenue of $2.89 billion during the quarter, compared to the consensus estimate of $2.86 billion. During the same period last year, the firm earned ($0.08) EPS. The company's revenue for the quarter was up 5.2% on a year-over-year basis. As a group, sell-side analysts expect that Chewy, Inc. will post 0.33 earnings per share for the current year.

Insider Buying and Selling at Chewy

In related news, major shareholder Argos Holdings Gp Llc sold 26,870,748 shares of Chewy stock in a transaction on Monday, September 23rd. The shares were sold at an average price of $29.40, for a total transaction of $789,999,991.20. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CTO Satish Mehta sold 8,056 shares of the business's stock in a transaction on Monday, December 2nd. The stock was sold at an average price of $33.47, for a total transaction of $269,634.32. Following the completion of the transaction, the chief technology officer now owns 585,962 shares in the company, valued at $19,612,148.14. This represents a 1.36 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 28,128,804 shares of company stock worth $827,019,626 in the last quarter. 2.10% of the stock is owned by insiders.

Wall Street Analyst Weigh In

A number of research analysts recently issued reports on the stock. Raymond James downgraded shares of Chewy from an "outperform" rating to a "market perform" rating in a research report on Wednesday, August 21st. Barclays boosted their target price on shares of Chewy from $34.00 to $40.00 and gave the company an "overweight" rating in a research report on Monday, November 18th. Bank of America upgraded shares of Chewy from an "underperform" rating to a "buy" rating and boosted their target price for the company from $24.00 to $40.00 in a research report on Wednesday, November 20th. JPMorgan Chase & Co. raised their target price on Chewy from $37.00 to $38.00 and gave the company an "overweight" rating in a research report on Thursday. Finally, Piper Sandler lifted their price target on Chewy from $35.00 to $40.00 and gave the company an "overweight" rating in a research note on Monday. Nine investment analysts have rated the stock with a hold rating and fourteen have given a buy rating to the company's stock. According to data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $34.15.

View Our Latest Stock Analysis on Chewy

Chewy Company Profile

(

Free Report)

Chewy, Inc, together with its subsidiaries, engages in the pure play e-commerce business in the United States. It provides pet food and treats, pet supplies and pet medications, and other pet-health products, as well as pet services for dogs, cats, fish, birds, small pets, horses, and reptiles through its retail websites and mobile applications.

Featured Articles

Before you consider Chewy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chewy wasn't on the list.

While Chewy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.