Taikang Asset Management Hong Kong Co Ltd lifted its position in shares of Alibaba Group Holding Limited (NYSE:BABA - Free Report) by 8.3% during the 4th quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 130,000 shares of the specialty retailer's stock after purchasing an additional 10,000 shares during the quarter. Alibaba Group comprises 1.6% of Taikang Asset Management Hong Kong Co Ltd's investment portfolio, making the stock its 13th biggest holding. Taikang Asset Management Hong Kong Co Ltd's holdings in Alibaba Group were worth $11,023,000 at the end of the most recent reporting period.

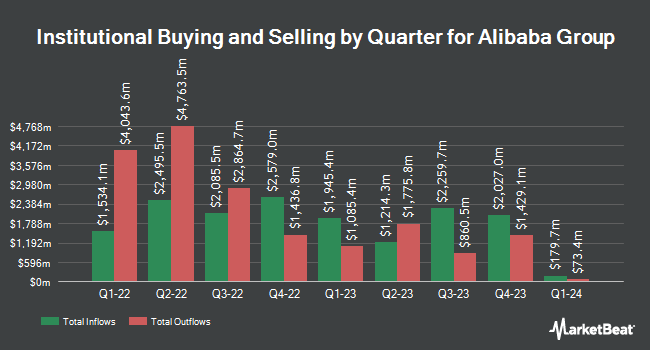

Other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Riposte Capital LLC purchased a new position in shares of Alibaba Group during the fourth quarter valued at approximately $2,120,000. Congress Wealth Management LLC DE increased its position in Alibaba Group by 2.3% during the 4th quarter. Congress Wealth Management LLC DE now owns 6,325 shares of the specialty retailer's stock valued at $536,000 after buying an additional 141 shares in the last quarter. Cedar Wealth Management LLC raised its stake in Alibaba Group by 21.1% during the fourth quarter. Cedar Wealth Management LLC now owns 9,655 shares of the specialty retailer's stock valued at $819,000 after buying an additional 1,682 shares during the last quarter. Mosley Wealth Management boosted its holdings in Alibaba Group by 9.3% in the fourth quarter. Mosley Wealth Management now owns 5,499 shares of the specialty retailer's stock worth $466,000 after acquiring an additional 466 shares in the last quarter. Finally, Harbor Advisors LLC grew its stake in shares of Alibaba Group by 50.0% in the fourth quarter. Harbor Advisors LLC now owns 4,500 shares of the specialty retailer's stock worth $382,000 after acquiring an additional 1,500 shares during the last quarter. 13.47% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities analysts recently issued reports on the stock. JPMorgan Chase & Co. upped their price target on shares of Alibaba Group from $125.00 to $170.00 and gave the stock an "overweight" rating in a research note on Friday, February 21st. Benchmark upped their target price on shares of Alibaba Group from $118.00 to $190.00 and gave the stock a "buy" rating in a research note on Friday, February 21st. Bank of America raised their price target on shares of Alibaba Group from $117.00 to $150.00 and gave the company a "buy" rating in a research report on Friday, February 21st. Sanford C. Bernstein raised Alibaba Group from a "market perform" rating to an "outperform" rating and upped their price objective for the company from $104.00 to $165.00 in a research report on Tuesday, February 25th. Finally, Citigroup lifted their target price on Alibaba Group from $133.00 to $138.00 and gave the stock a "buy" rating in a report on Friday, January 10th. One investment analyst has rated the stock with a hold rating, fourteen have assigned a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Buy" and a consensus target price of $148.14.

Read Our Latest Research Report on Alibaba Group

Alibaba Group Stock Performance

BABA stock traded down $3.14 during midday trading on Friday, reaching $132.49. 13,233,872 shares of the company's stock traded hands, compared to its average volume of 19,457,327. The stock's 50-day moving average is $121.60 and its 200 day moving average is $102.45. The stock has a market cap of $314.80 billion, a P/E ratio of 19.15, a PEG ratio of 0.61 and a beta of 0.28. Alibaba Group Holding Limited has a 52-week low of $68.36 and a 52-week high of $148.43. The company has a current ratio of 1.48, a quick ratio of 1.48 and a debt-to-equity ratio of 0.19.

Alibaba Group (NYSE:BABA - Get Free Report) last announced its earnings results on Thursday, February 20th. The specialty retailer reported $2.77 EPS for the quarter, missing analysts' consensus estimates of $2.84 by ($0.07). The company had revenue of $38.38 billion during the quarter, compared to the consensus estimate of $38.19 billion. Alibaba Group had a return on equity of 12.89% and a net margin of 12.29%. As a group, analysts anticipate that Alibaba Group Holding Limited will post 7.86 EPS for the current year.

Alibaba Group Company Profile

(

Free Report)

Alibaba Group Holding Limited, through its subsidiaries, provides technology infrastructure and marketing reach to help merchants, brands, retailers, and other businesses to engage with their users and customers in the People's Republic of China and internationally. The company operates through seven segments: China Commerce, International Commerce, Local Consumer Services, Cainiao, Cloud, Digital Media and Entertainment, and Innovation Initiatives and Others.

Further Reading

Before you consider Alibaba Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alibaba Group wasn't on the list.

While Alibaba Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.