Jennison Associates LLC grew its position in Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM - Free Report) by 8.2% in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 4,018,311 shares of the semiconductor company's stock after acquiring an additional 304,566 shares during the period. Jennison Associates LLC owned 0.08% of Taiwan Semiconductor Manufacturing worth $697,860,000 at the end of the most recent reporting period.

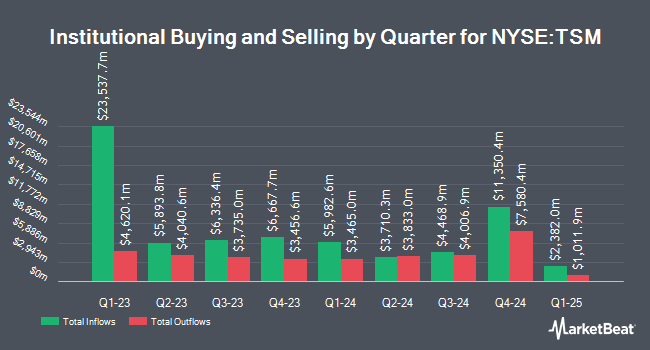

Other institutional investors and hedge funds have also modified their holdings of the company. Capital World Investors lifted its holdings in Taiwan Semiconductor Manufacturing by 1.7% during the 1st quarter. Capital World Investors now owns 42,061,083 shares of the semiconductor company's stock worth $5,722,410,000 after buying an additional 704,804 shares in the last quarter. Capital International Investors increased its stake in shares of Taiwan Semiconductor Manufacturing by 40.2% in the 1st quarter. Capital International Investors now owns 19,695,714 shares of the semiconductor company's stock valued at $2,679,602,000 after acquiring an additional 5,643,949 shares during the last quarter. Van ECK Associates Corp raised its holdings in Taiwan Semiconductor Manufacturing by 0.7% in the third quarter. Van ECK Associates Corp now owns 18,289,993 shares of the semiconductor company's stock worth $3,176,423,000 after purchasing an additional 122,828 shares during the period. WCM Investment Management LLC boosted its position in shares of Taiwan Semiconductor Manufacturing by 14.1% during the third quarter. WCM Investment Management LLC now owns 9,738,181 shares of the semiconductor company's stock worth $1,733,104,000 after purchasing an additional 1,206,359 shares in the last quarter. Finally, Price T Rowe Associates Inc. MD grew its holdings in shares of Taiwan Semiconductor Manufacturing by 3.9% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 7,873,873 shares of the semiconductor company's stock valued at $1,071,242,000 after buying an additional 296,892 shares during the period. 16.51% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

TSM has been the topic of a number of research analyst reports. StockNews.com lowered Taiwan Semiconductor Manufacturing from a "buy" rating to a "hold" rating in a research report on Sunday. Susquehanna restated a "buy" rating on shares of Taiwan Semiconductor Manufacturing in a research note on Friday, October 18th. Barclays raised their price target on shares of Taiwan Semiconductor Manufacturing from $215.00 to $240.00 and gave the stock an "overweight" rating in a research note on Monday. Finally, Needham & Company LLC restated a "buy" rating and issued a $210.00 price objective on shares of Taiwan Semiconductor Manufacturing in a report on Thursday, October 17th. Two equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, Taiwan Semiconductor Manufacturing presently has an average rating of "Moderate Buy" and an average target price of $214.00.

Read Our Latest Research Report on TSM

Taiwan Semiconductor Manufacturing Stock Performance

Shares of TSM stock traded down $1.31 during midday trading on Wednesday, hitting $188.36. 9,999,953 shares of the company were exchanged, compared to its average volume of 15,351,947. The firm has a market capitalization of $976.91 billion, a P/E ratio of 29.79, a PEG ratio of 0.87 and a beta of 1.12. The company has a debt-to-equity ratio of 0.24, a quick ratio of 2.30 and a current ratio of 2.57. Taiwan Semiconductor Manufacturing Company Limited has a 52 week low of $95.25 and a 52 week high of $212.60. The firm's 50 day moving average price is $186.82 and its two-hundred day moving average price is $173.13.

Taiwan Semiconductor Manufacturing (NYSE:TSM - Get Free Report) last posted its earnings results on Thursday, October 17th. The semiconductor company reported $1.94 EPS for the quarter, beating the consensus estimate of $1.74 by $0.20. The company had revenue of $23.50 billion for the quarter, compared to the consensus estimate of $22.72 billion. Taiwan Semiconductor Manufacturing had a return on equity of 27.44% and a net margin of 39.10%. As a group, equities research analysts anticipate that Taiwan Semiconductor Manufacturing Company Limited will post 6.84 earnings per share for the current year.

Taiwan Semiconductor Manufacturing Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, April 10th. Stockholders of record on Tuesday, March 18th will be given a $0.5484 dividend. This represents a $2.19 dividend on an annualized basis and a dividend yield of 1.16%. The ex-dividend date of this dividend is Tuesday, March 18th. This is a boost from Taiwan Semiconductor Manufacturing's previous quarterly dividend of $0.49. Taiwan Semiconductor Manufacturing's payout ratio is presently 31.57%.

Taiwan Semiconductor Manufacturing Profile

(

Free Report)

Taiwan Semiconductor Manufacturing Company Limited, together with its subsidiaries, manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally. It provides a range of wafer fabrication processes, including processes to manufacture complementary metal- oxide-semiconductor (CMOS) logic, mixed-signal, radio frequency, embedded memory, bipolar CMOS mixed-signal, and others.

Read More

Before you consider Taiwan Semiconductor Manufacturing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Taiwan Semiconductor Manufacturing wasn't on the list.

While Taiwan Semiconductor Manufacturing currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.