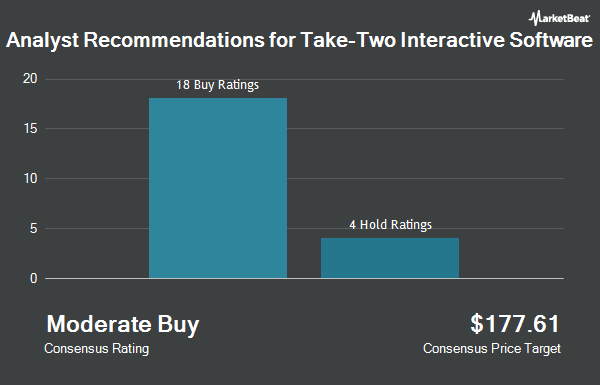

Shares of Take-Two Interactive Software, Inc. (NASDAQ:TTWO - Get Free Report) have received a consensus rating of "Moderate Buy" from the twenty-one brokerages that are presently covering the company, Marketbeat Ratings reports. Two analysts have rated the stock with a hold recommendation, eighteen have assigned a buy recommendation and one has given a strong buy recommendation to the company. The average 1-year target price among brokers that have issued a report on the stock in the last year is $191.75.

A number of brokerages recently commented on TTWO. BMO Capital Markets lifted their price objective on Take-Two Interactive Software from $185.00 to $190.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Robert W. Baird lifted their price target on Take-Two Interactive Software from $172.00 to $181.00 and gave the stock an "outperform" rating in a report on Thursday, November 7th. Redburn Atlantic assumed coverage on shares of Take-Two Interactive Software in a research report on Thursday, August 29th. They set a "buy" rating and a $194.00 price target on the stock. JPMorgan Chase & Co. reduced their target price on shares of Take-Two Interactive Software from $200.00 to $195.00 and set an "overweight" rating on the stock in a research note on Tuesday, October 22nd. Finally, HSBC upgraded shares of Take-Two Interactive Software from a "hold" rating to a "buy" rating and set a $179.00 target price on the stock in a report on Monday, August 12th.

Read Our Latest Report on Take-Two Interactive Software

Take-Two Interactive Software Price Performance

Shares of Take-Two Interactive Software stock traded up $2.82 on Friday, hitting $188.38. 679,636 shares of the company were exchanged, compared to its average volume of 1,618,105. The stock has a market capitalization of $33.09 billion, a price-to-earnings ratio of -8.90, a price-to-earnings-growth ratio of 5.68 and a beta of 0.85. The company has a 50-day moving average price of $165.66 and a 200 day moving average price of $157.93. Take-Two Interactive Software has a 1-year low of $135.24 and a 1-year high of $190.43. The company has a quick ratio of 0.85, a current ratio of 0.85 and a debt-to-equity ratio of 0.53.

Insider Transactions at Take-Two Interactive Software

In other news, Director Laverne Evans Srinivasan sold 2,000 shares of the company's stock in a transaction on Friday, November 8th. The stock was sold at an average price of $179.17, for a total transaction of $358,340.00. Following the sale, the director now owns 9,692 shares of the company's stock, valued at approximately $1,736,515.64. This represents a 17.11 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Corporate insiders own 1.45% of the company's stock.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently bought and sold shares of the stock. Ninety One UK Ltd increased its position in shares of Take-Two Interactive Software by 473.2% in the 2nd quarter. Ninety One UK Ltd now owns 1,269,428 shares of the company's stock valued at $197,383,000 after purchasing an additional 1,047,979 shares during the last quarter. State Street Corp increased its holdings in Take-Two Interactive Software by 8.8% in the third quarter. State Street Corp now owns 10,899,267 shares of the company's stock valued at $1,675,241,000 after buying an additional 880,816 shares during the last quarter. Point72 Asset Management L.P. raised its stake in Take-Two Interactive Software by 3,786.4% in the second quarter. Point72 Asset Management L.P. now owns 826,048 shares of the company's stock valued at $128,442,000 after buying an additional 804,793 shares in the last quarter. Ameriprise Financial Inc. lifted its holdings in Take-Two Interactive Software by 17.6% during the 2nd quarter. Ameriprise Financial Inc. now owns 4,460,891 shares of the company's stock worth $694,173,000 after buying an additional 666,198 shares during the last quarter. Finally, Massachusetts Financial Services Co. MA boosted its position in shares of Take-Two Interactive Software by 13.7% during the 3rd quarter. Massachusetts Financial Services Co. MA now owns 5,393,233 shares of the company's stock worth $828,994,000 after acquiring an additional 648,982 shares in the last quarter. 95.46% of the stock is owned by institutional investors and hedge funds.

About Take-Two Interactive Software

(

Get Free ReportTake-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

Featured Articles

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.