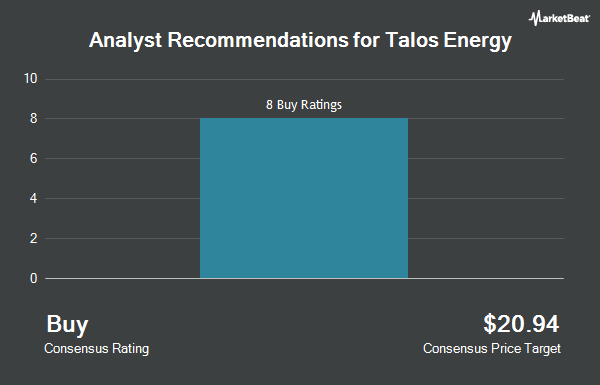

Talos Energy Inc. (NYSE:TALO - Get Free Report) has been given an average recommendation of "Moderate Buy" by the ten ratings firms that are presently covering the stock, Marketbeat Ratings reports. One research analyst has rated the stock with a hold recommendation and nine have given a buy recommendation to the company. The average 12-month price objective among analysts that have updated their coverage on the stock in the last year is $18.45.

A number of research analysts have recently commented on the stock. BMO Capital Markets cut their price objective on shares of Talos Energy from $14.00 to $13.00 and set a "market perform" rating for the company in a research report on Friday, October 4th. Benchmark reaffirmed a "buy" rating and set a $20.00 price objective on shares of Talos Energy in a research report on Tuesday, November 12th. Citigroup upped their target price on shares of Talos Energy from $12.50 to $14.50 and gave the company a "buy" rating in a research note on Thursday. Mizuho began coverage on shares of Talos Energy in a research note on Thursday, September 19th. They issued an "outperform" rating and a $16.00 target price on the stock. Finally, The Goldman Sachs Group began coverage on shares of Talos Energy in a research note on Monday, July 22nd. They issued a "buy" rating and a $14.00 target price on the stock.

View Our Latest Research Report on TALO

Insider Activity at Talos Energy

In other news, insider Control Empresarial De Capital acquired 547,000 shares of the firm's stock in a transaction dated Tuesday, September 3rd. The stock was bought at an average price of $10.92 per share, with a total value of $5,973,240.00. Following the transaction, the insider now directly owns 40,685,904 shares in the company, valued at approximately $444,290,071.68. The trade was a 1.36 % increase in their position. The purchase was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Over the last 90 days, insiders acquired 1,220,000 shares of company stock valued at $13,135,560. Corporate insiders own 0.77% of the company's stock.

Institutional Trading of Talos Energy

A number of hedge funds have recently modified their holdings of the stock. Signaturefd LLC lifted its stake in shares of Talos Energy by 51.9% during the 2nd quarter. Signaturefd LLC now owns 2,685 shares of the company's stock worth $33,000 after buying an additional 917 shares during the last quarter. Everence Capital Management Inc. raised its stake in Talos Energy by 8.6% in the 3rd quarter. Everence Capital Management Inc. now owns 22,050 shares of the company's stock worth $228,000 after purchasing an additional 1,740 shares in the last quarter. US Bancorp DE raised its stake in Talos Energy by 113.3% in the 3rd quarter. US Bancorp DE now owns 3,440 shares of the company's stock worth $36,000 after purchasing an additional 1,827 shares in the last quarter. CIBC Asset Management Inc raised its stake in Talos Energy by 13.8% in the 2nd quarter. CIBC Asset Management Inc now owns 15,195 shares of the company's stock worth $185,000 after purchasing an additional 1,838 shares in the last quarter. Finally, Nisa Investment Advisors LLC raised its stake in Talos Energy by 91.1% in the 2nd quarter. Nisa Investment Advisors LLC now owns 4,689 shares of the company's stock worth $57,000 after purchasing an additional 2,235 shares in the last quarter. Institutional investors and hedge funds own 89.35% of the company's stock.

Talos Energy Stock Down 3.3 %

Talos Energy stock opened at $11.28 on Friday. The firm has a market cap of $2.03 billion, a price-to-earnings ratio of 20.89 and a beta of 1.92. The company has a debt-to-equity ratio of 0.47, a current ratio of 0.97 and a quick ratio of 0.80. Talos Energy has a fifty-two week low of $9.44 and a fifty-two week high of $14.80. The firm has a fifty day moving average price of $10.79 and a two-hundred day moving average price of $11.33.

Talos Energy (NYSE:TALO - Get Free Report) last announced its quarterly earnings data on Monday, November 11th. The company reported ($0.14) EPS for the quarter, missing analysts' consensus estimates of ($0.07) by ($0.07). The company had revenue of $509.29 million for the quarter, compared to analyst estimates of $504.44 million. Talos Energy had a net margin of 3.95% and a negative return on equity of 1.98%. The firm's quarterly revenue was up 32.9% on a year-over-year basis. During the same period in the prior year, the company posted $0.14 EPS. As a group, analysts forecast that Talos Energy will post -0.2 earnings per share for the current year.

Talos Energy Company Profile

(

Get Free ReportTalos Energy Inc, through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico. It also engages in the development of carbon capture and sequestration. Talos Energy Inc was founded in 2011 and is headquartered in Houston, Texas.

Read More

Before you consider Talos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talos Energy wasn't on the list.

While Talos Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.