American Century Companies Inc. lifted its stake in shares of Talos Energy Inc. (NYSE:TALO - Free Report) by 14.9% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund owned 4,427,546 shares of the company's stock after buying an additional 575,096 shares during the period. American Century Companies Inc. owned about 2.46% of Talos Energy worth $42,991,000 at the end of the most recent quarter.

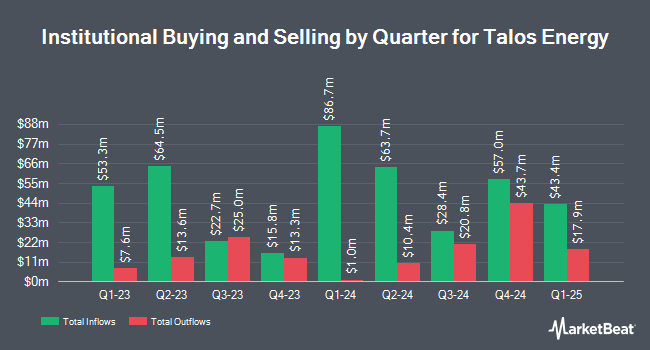

Several other hedge funds have also recently made changes to their positions in the company. Assenagon Asset Management S.A. boosted its position in Talos Energy by 2.0% during the 4th quarter. Assenagon Asset Management S.A. now owns 111,892 shares of the company's stock valued at $1,086,000 after buying an additional 2,192 shares during the period. New York State Common Retirement Fund increased its stake in Talos Energy by 4.1% in the 4th quarter. New York State Common Retirement Fund now owns 56,474 shares of the company's stock worth $548,000 after acquiring an additional 2,200 shares during the last quarter. KBC Group NV raised its holdings in Talos Energy by 46.1% during the 4th quarter. KBC Group NV now owns 7,970 shares of the company's stock valued at $77,000 after buying an additional 2,515 shares during the period. Virtus Investment Advisers Inc. bought a new stake in Talos Energy during the 3rd quarter valued at $31,000. Finally, FMR LLC boosted its holdings in shares of Talos Energy by 119.2% in the 3rd quarter. FMR LLC now owns 10,395 shares of the company's stock valued at $108,000 after buying an additional 5,653 shares in the last quarter. 89.35% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

TALO has been the subject of a number of recent research reports. Mizuho reduced their price objective on Talos Energy from $16.00 to $14.00 and set an "outperform" rating for the company in a research note on Monday, December 16th. JPMorgan Chase & Co. lowered their target price on Talos Energy from $14.00 to $12.00 and set a "neutral" rating on the stock in a report on Thursday, March 13th. Stephens lowered their price target on shares of Talos Energy from $21.00 to $20.00 and set an "overweight" rating for the company in a report on Wednesday, February 5th. Finally, Citigroup reduced their price objective on Talos Energy from $14.50 to $12.00 and set a "buy" rating for the company in a research report on Tuesday, March 4th. Two analysts have rated the stock with a hold rating and seven have given a buy rating to the company. According to data from MarketBeat, Talos Energy has a consensus rating of "Moderate Buy" and an average target price of $15.56.

Read Our Latest Stock Report on TALO

Talos Energy Stock Up 2.7 %

Shares of NYSE TALO traded up $0.26 during trading on Monday, hitting $9.77. The stock had a trading volume of 833,948 shares, compared to its average volume of 1,976,016. The company has a market capitalization of $1.76 billion, a PE ratio of 18.08 and a beta of 1.79. The company has a debt-to-equity ratio of 0.47, a current ratio of 0.97 and a quick ratio of 0.97. The firm has a fifty day moving average of $9.29 and a two-hundred day moving average of $10.11. Talos Energy Inc. has a 12 month low of $8.05 and a 12 month high of $14.67.

About Talos Energy

(

Free Report)

Talos Energy Inc, through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico. It also engages in the development of carbon capture and sequestration. Talos Energy Inc was founded in 2011 and is headquartered in Houston, Texas.

Further Reading

Before you consider Talos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talos Energy wasn't on the list.

While Talos Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.