Tamar Securities LLC increased its holdings in shares of NVIDIA Co. (NASDAQ:NVDA - Free Report) by 30.0% during the third quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 21,634 shares of the computer hardware maker's stock after acquiring an additional 4,998 shares during the period. Tamar Securities LLC's holdings in NVIDIA were worth $2,627,000 as of its most recent SEC filing.

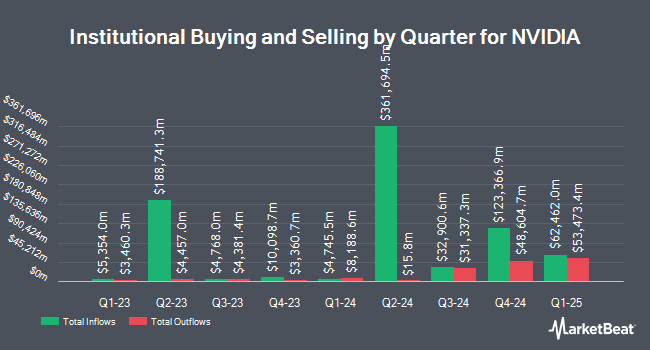

A number of other institutional investors have also recently modified their holdings of the business. FLC Capital Advisors boosted its holdings in NVIDIA by 7.3% in the 3rd quarter. FLC Capital Advisors now owns 26,356 shares of the computer hardware maker's stock worth $3,201,000 after buying an additional 1,796 shares during the last quarter. Horizon Wealth Management LLC boosted its holdings in NVIDIA by 2.0% in the 3rd quarter. Horizon Wealth Management LLC now owns 37,698 shares of the computer hardware maker's stock worth $4,578,000 after buying an additional 724 shares during the last quarter. Cornerstone Wealth Management LLC lifted its stake in NVIDIA by 3.8% in the 3rd quarter. Cornerstone Wealth Management LLC now owns 240,441 shares of the computer hardware maker's stock worth $29,199,000 after purchasing an additional 8,801 shares in the last quarter. SPC Financial Inc. lifted its stake in NVIDIA by 172.3% in the 3rd quarter. SPC Financial Inc. now owns 26,797 shares of the computer hardware maker's stock worth $3,254,000 after purchasing an additional 16,957 shares in the last quarter. Finally, B.O.S.S. Retirement Advisors LLC lifted its stake in NVIDIA by 20.1% in the 3rd quarter. B.O.S.S. Retirement Advisors LLC now owns 183,695 shares of the computer hardware maker's stock worth $22,308,000 after purchasing an additional 30,726 shares in the last quarter. 65.27% of the stock is currently owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, Director Tench Coxe sold 1,000,000 shares of the company's stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $119.27, for a total transaction of $119,270,000.00. Following the completion of the sale, the director now directly owns 5,852,480 shares of the company's stock, valued at approximately $698,025,289.60. This represents a 14.59 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Mark A. Stevens sold 155,000 shares of the company's stock in a transaction dated Wednesday, October 9th. The shares were sold at an average price of $132.27, for a total transaction of $20,501,850.00. Following the completion of the transaction, the director now directly owns 8,100,117 shares of the company's stock, valued at approximately $1,071,402,475.59. The trade was a 1.88 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 2,156,270 shares of company stock valued at $254,784,327 over the last quarter. 4.23% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

A number of research analysts have weighed in on the stock. Melius Research raised their target price on shares of NVIDIA from $165.00 to $185.00 and gave the stock a "buy" rating in a research note on Monday, November 11th. Benchmark reissued a "buy" rating and issued a $170.00 target price on shares of NVIDIA in a research note on Thursday, August 29th. Susquehanna lifted their price target on shares of NVIDIA from $160.00 to $180.00 and gave the company a "positive" rating in a research report on Thursday, November 14th. Raymond James lifted their price target on shares of NVIDIA from $140.00 to $170.00 and gave the company a "strong-buy" rating in a research report on Thursday, November 14th. Finally, Mizuho lifted their price target on shares of NVIDIA from $140.00 to $165.00 and gave the company an "outperform" rating in a research report on Tuesday, November 12th. Five equities research analysts have rated the stock with a hold rating, thirty-eight have assigned a buy rating and two have issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $154.63.

Read Our Latest Stock Analysis on NVDA

NVIDIA Stock Down 0.8 %

Shares of NVDA opened at $145.89 on Thursday. The company has a market capitalization of $3.58 trillion, a price-to-earnings ratio of 68.43, a PEG ratio of 1.54 and a beta of 1.66. NVIDIA Co. has a 52 week low of $45.01 and a 52 week high of $149.77. The company has a quick ratio of 3.79, a current ratio of 4.27 and a debt-to-equity ratio of 0.15. The stock's 50-day moving average price is $133.00 and its 200-day moving average price is $121.54.

NVIDIA (NASDAQ:NVDA - Get Free Report) last issued its quarterly earnings data on Wednesday, November 20th. The computer hardware maker reported $0.81 earnings per share for the quarter, topping the consensus estimate of $0.69 by $0.12. The company had revenue of $35.08 billion during the quarter, compared to analyst estimates of $33.15 billion. NVIDIA had a return on equity of 113.50% and a net margin of 55.04%. The firm's revenue for the quarter was up 93.6% compared to the same quarter last year. During the same period in the prior year, the business posted $0.38 earnings per share. On average, sell-side analysts predict that NVIDIA Co. will post 2.68 EPS for the current year.

NVIDIA announced that its Board of Directors has approved a stock repurchase plan on Wednesday, August 28th that permits the company to repurchase $50.00 billion in outstanding shares. This repurchase authorization permits the computer hardware maker to reacquire up to 1.6% of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's management believes its shares are undervalued.

NVIDIA Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, December 27th. Investors of record on Thursday, December 5th will be issued a dividend of $0.01 per share. This represents a $0.04 dividend on an annualized basis and a dividend yield of 0.03%. NVIDIA's dividend payout ratio is currently 1.88%.

About NVIDIA

(

Free Report)

NVIDIA Corporation provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU or vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building and operating metaverse and 3D internet applications.

Read More

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.