Tandem Investment Advisors Inc. lowered its holdings in MarketAxess Holdings Inc. (NASDAQ:MKTX - Free Report) by 82.4% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 38,942 shares of the financial services provider's stock after selling 181,924 shares during the period. Tandem Investment Advisors Inc. owned 0.10% of MarketAxess worth $9,977,000 as of its most recent SEC filing.

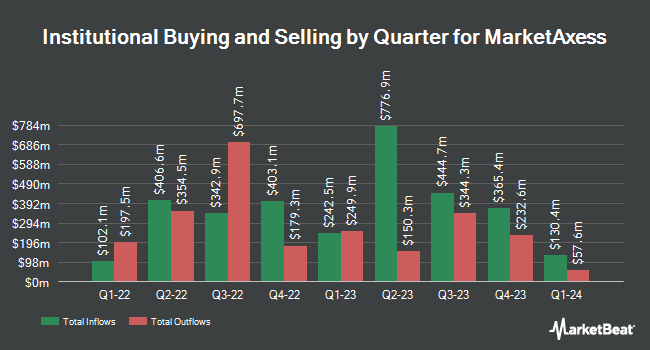

Other institutional investors have also recently added to or reduced their stakes in the company. Larson Financial Group LLC boosted its holdings in shares of MarketAxess by 2,428.6% in the 1st quarter. Larson Financial Group LLC now owns 177 shares of the financial services provider's stock valued at $39,000 after purchasing an additional 170 shares during the last quarter. SG Americas Securities LLC increased its stake in MarketAxess by 174.2% during the first quarter. SG Americas Securities LLC now owns 6,743 shares of the financial services provider's stock worth $1,478,000 after acquiring an additional 4,284 shares during the last quarter. Retirement Planning Co of New England Inc. increased its stake in MarketAxess by 18.0% during the first quarter. Retirement Planning Co of New England Inc. now owns 1,522 shares of the financial services provider's stock worth $334,000 after acquiring an additional 232 shares during the last quarter. Choate Investment Advisors purchased a new position in shares of MarketAxess in the 1st quarter worth about $752,000. Finally, Inspire Investing LLC lifted its stake in shares of MarketAxess by 20.7% in the 1st quarter. Inspire Investing LLC now owns 6,874 shares of the financial services provider's stock valued at $1,507,000 after purchasing an additional 1,179 shares in the last quarter. 99.01% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on MKTX shares. Morgan Stanley raised their price target on shares of MarketAxess from $262.00 to $314.00 and gave the company an "equal weight" rating in a report on Thursday, October 17th. Piper Sandler restated a "neutral" rating and set a $265.00 target price on shares of MarketAxess in a report on Thursday. Deutsche Bank Aktiengesellschaft increased their price target on MarketAxess from $218.00 to $223.00 and gave the company a "hold" rating in a report on Thursday, August 15th. Keefe, Bruyette & Woods boosted their price objective on MarketAxess from $270.00 to $276.00 and gave the stock a "market perform" rating in a research note on Thursday. Finally, StockNews.com raised MarketAxess from a "sell" rating to a "hold" rating in a research report on Wednesday, August 7th. Two equities research analysts have rated the stock with a sell rating, seven have assigned a hold rating and three have given a buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $263.40.

View Our Latest Stock Analysis on MarketAxess

MarketAxess Stock Up 0.1 %

MKTX stock traded up $0.27 during midday trading on Friday, hitting $274.68. 386,697 shares of the company's stock were exchanged, compared to its average volume of 408,815. The firm has a 50 day moving average price of $269.85 and a 200-day moving average price of $232.80. MarketAxess Holdings Inc. has a 12-month low of $192.42 and a 12-month high of $297.97. The stock has a market capitalization of $10.37 billion, a price-to-earnings ratio of 39.54, a price-to-earnings-growth ratio of 9.04 and a beta of 1.05. The company has a current ratio of 2.91, a quick ratio of 2.91 and a debt-to-equity ratio of 0.01.

MarketAxess (NASDAQ:MKTX - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The financial services provider reported $1.90 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.82 by $0.08. The business had revenue of $206.70 million during the quarter, compared to analyst estimates of $207.17 million. MarketAxess had a net margin of 33.71% and a return on equity of 20.43%. The business's revenue was up 20.0% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $1.46 earnings per share. On average, analysts anticipate that MarketAxess Holdings Inc. will post 7.26 EPS for the current year.

MarketAxess announced that its board has initiated a stock buyback plan on Tuesday, August 6th that permits the company to buyback $250.00 million in outstanding shares. This buyback authorization permits the financial services provider to purchase up to 2.8% of its shares through open market purchases. Shares buyback plans are often an indication that the company's management believes its stock is undervalued.

MarketAxess Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 4th. Stockholders of record on Wednesday, November 20th will be given a dividend of $0.74 per share. The ex-dividend date of this dividend is Wednesday, November 20th. This represents a $2.96 annualized dividend and a dividend yield of 1.08%. MarketAxess's payout ratio is 42.65%.

MarketAxess Profile

(

Free Report)

MarketAxess Holdings Inc, together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. The company offers trading technology that provides liquidity access in U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, eurobonds, municipal bonds, U.S.

Recommended Stories

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.