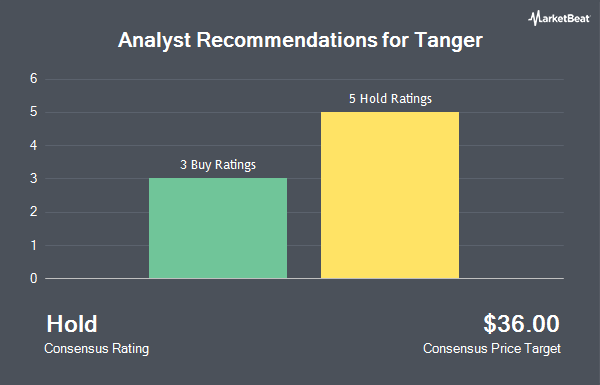

Tanger Inc. (NYSE:SKT - Get Free Report) has received an average rating of "Hold" from the eight ratings firms that are covering the firm, Marketbeat reports. Five equities research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. The average 12-month price target among brokerages that have issued ratings on the stock in the last year is $36.00.

SKT has been the topic of a number of recent research reports. Deutsche Bank Aktiengesellschaft initiated coverage on Tanger in a report on Tuesday, December 17th. They set a "hold" rating and a $37.00 price objective on the stock. BMO Capital Markets initiated coverage on Tanger in a report on Tuesday, January 28th. They set a "market perform" rating and a $36.00 price objective on the stock.

Get Our Latest Report on SKT

Tanger Stock Performance

SKT stock traded down $0.34 during trading on Wednesday, reaching $31.87. 1,323,226 shares of the stock were exchanged, compared to its average volume of 682,065. Tanger has a twelve month low of $25.94 and a twelve month high of $37.57. The company has a market capitalization of $3.59 billion, a P/E ratio of 36.63, a price-to-earnings-growth ratio of 2.97 and a beta of 1.88. The stock has a 50 day simple moving average of $33.65 and a 200-day simple moving average of $33.92. The company has a current ratio of 0.44, a quick ratio of 0.13 and a debt-to-equity ratio of 2.09.

Tanger (NYSE:SKT - Get Free Report) last released its earnings results on Wednesday, February 19th. The real estate investment trust reported $0.54 earnings per share for the quarter, topping analysts' consensus estimates of $0.52 by $0.02. Tanger had a return on equity of 16.16% and a net margin of 18.65%. The business had revenue of $132.17 million for the quarter, compared to the consensus estimate of $129.10 million. As a group, sell-side analysts anticipate that Tanger will post 2.24 earnings per share for the current year.

Tanger Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Friday, February 14th. Stockholders of record on Friday, January 31st were issued a $0.275 dividend. This represents a $1.10 annualized dividend and a dividend yield of 3.45%. The ex-dividend date of this dividend was Friday, January 31st. Tanger's payout ratio is currently 126.44%.

Insider Buying and Selling

In related news, COO Gallardo Leslie Swanson sold 12,500 shares of the business's stock in a transaction that occurred on Tuesday, March 11th. The shares were sold at an average price of $32.38, for a total value of $404,750.00. Following the completion of the transaction, the chief operating officer now owns 113,158 shares in the company, valued at $3,664,056.04. The trade was a 9.95 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. 5.80% of the stock is currently owned by corporate insiders.

Institutional Inflows and Outflows

Several institutional investors have recently bought and sold shares of the stock. Mutual of America Capital Management LLC raised its position in Tanger by 1.9% in the 4th quarter. Mutual of America Capital Management LLC now owns 16,767 shares of the real estate investment trust's stock worth $572,000 after purchasing an additional 319 shares during the last quarter. Maryland State Retirement & Pension System raised its position in shares of Tanger by 0.9% during the 4th quarter. Maryland State Retirement & Pension System now owns 37,277 shares of the real estate investment trust's stock valued at $1,272,000 after acquiring an additional 349 shares during the last quarter. FIL Ltd raised its position in shares of Tanger by 16.2% during the 4th quarter. FIL Ltd now owns 2,874 shares of the real estate investment trust's stock valued at $98,000 after acquiring an additional 401 shares during the last quarter. DAVENPORT & Co LLC raised its position in shares of Tanger by 1.4% during the 4th quarter. DAVENPORT & Co LLC now owns 31,462 shares of the real estate investment trust's stock valued at $1,074,000 after acquiring an additional 425 shares during the last quarter. Finally, Pictet Asset Management Holding SA raised its position in shares of Tanger by 1.5% during the 4th quarter. Pictet Asset Management Holding SA now owns 32,851 shares of the real estate investment trust's stock valued at $1,121,000 after acquiring an additional 480 shares during the last quarter. Institutional investors own 85.23% of the company's stock.

Tanger Company Profile

(

Get Free ReportTanger Inc NYSE: SKT is a leading owner and operator of outlet and open-air retail shopping destinations, with over 43 years of expertise in the retail and outlet shopping industries. Tanger's portfolio of 38 outlet centers, one adjacent managed center and one open-air lifestyle center comprises over 15 million square feet well positioned across tourist destinations and vibrant markets in 20 U.S.

Read More

Before you consider Tanger, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tanger wasn't on the list.

While Tanger currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.