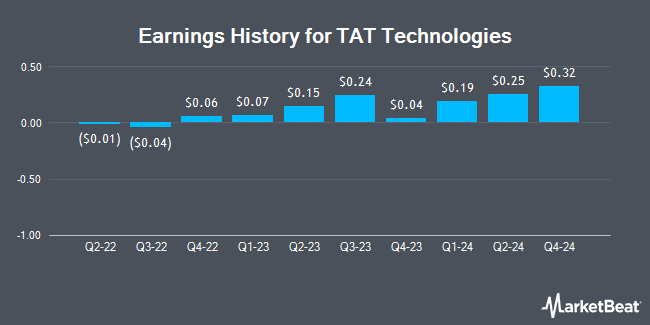

TAT Technologies (NASDAQ:TATT - Get Free Report) will likely be issuing its Q4 2024 quarterly earnings data after the market closes on Wednesday, March 26th. Analysts expect the company to announce earnings of $0.29 per share and revenue of $38.00 million for the quarter.

TAT Technologies (NASDAQ:TATT - Get Free Report) last posted its quarterly earnings results on Wednesday, March 26th. The aerospace company reported $0.32 EPS for the quarter, topping analysts' consensus estimates of $0.29 by $0.03. TAT Technologies had a return on equity of 8.23% and a net margin of 5.58%. The firm had revenue of $38.00 million during the quarter, compared to analyst estimates of $38.00 million.

TAT Technologies Price Performance

Shares of TATT stock traded up $0.23 on Friday, reaching $28.20. The company's stock had a trading volume of 101,513 shares, compared to its average volume of 27,088. The company has a market capitalization of $308.51 million, a P/E ratio of 38.11 and a beta of 0.99. The company has a quick ratio of 1.29, a current ratio of 3.04 and a debt-to-equity ratio of 0.10. The stock's 50 day simple moving average is $27.60 and its 200-day simple moving average is $23.64. TAT Technologies has a 12-month low of $10.61 and a 12-month high of $33.37.

Analysts Set New Price Targets

TATT has been the topic of a number of analyst reports. Benchmark assumed coverage on shares of TAT Technologies in a research report on Thursday, December 5th. They issued a "buy" rating and a $30.00 target price on the stock. StockNews.com upgraded shares of TAT Technologies from a "hold" rating to a "buy" rating in a report on Saturday.

Get Our Latest Stock Analysis on TATT

About TAT Technologies

(

Get Free Report)

TAT Technologies Ltd., together with its subsidiaries, provides solutions and services to the commercial and military aerospace, and ground defense industries in the United States, Israel, and internationally. The company operates through four segments: Original Equipment Manufacturing (OEM) of Heat Transfer Solutions and Aviation Accessories; Maintenance, Repair, and Overhaul (MRO) Services for Heat Transfer Components and OEM of Heat Transfer Solutions; MRO Services for Aviation Components; and Overhaul and Coating of Jet Engine Components.

Featured Articles

Before you consider TAT Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TAT Technologies wasn't on the list.

While TAT Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Enter your email address and below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.