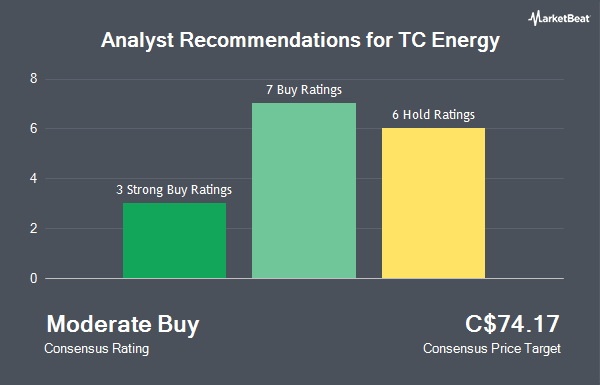

TC Energy Co. (TSE:TRP - Get Free Report) NYSE: TRP has been given an average rating of "Hold" by the fourteen ratings firms that are covering the stock, Marketbeat.com reports. Two research analysts have rated the stock with a sell recommendation, five have issued a hold recommendation, six have given a buy recommendation and one has issued a strong buy recommendation on the company. The average 12-month price objective among brokers that have updated their coverage on the stock in the last year is C$69.54.

Several research firms have recently weighed in on TRP. Scotiabank increased their price target on TC Energy from C$74.00 to C$75.00 in a report on Wednesday. UBS Group raised TC Energy from a "hold" rating to a "strong-buy" rating in a research report on Monday, September 30th. JPMorgan Chase & Co. raised their price objective on shares of TC Energy from C$70.00 to C$79.00 in a report on Monday. Royal Bank of Canada boosted their price objective on shares of TC Energy from C$67.00 to C$71.00 in a research report on Friday, November 8th. Finally, Barclays raised their target price on TC Energy from C$67.00 to C$74.00 in a report on Wednesday.

Check Out Our Latest Stock Analysis on TC Energy

Insider Activity

In other TC Energy news, Director Greg Grant sold 12,000 shares of TC Energy stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of C$62.62, for a total value of C$751,384.80. Also, Director Mark Yeomans sold 6,500 shares of the business's stock in a transaction dated Thursday, August 29th. The stock was sold at an average price of C$61.58, for a total transaction of C$400,297.95. Over the last 90 days, insiders have sold 89,490 shares of company stock worth $5,749,355. Company insiders own 0.03% of the company's stock.

TC Energy Price Performance

TC Energy stock traded down C$0.81 during midday trading on Wednesday, hitting C$68.79. 3,108,978 shares of the company's stock were exchanged, compared to its average volume of 6,862,180. TC Energy has a 52-week low of C$43.83 and a 52-week high of C$70.24. The company has a market cap of C$71.54 billion, a P/E ratio of 20.78, a PEG ratio of 1.69 and a beta of 0.82. The company has a debt-to-equity ratio of 160.84, a quick ratio of 0.40 and a current ratio of 0.76. The stock has a 50-day moving average price of C$64.70 and a two-hundred day moving average price of C$58.75.

TC Energy (TSE:TRP - Get Free Report) NYSE: TRP last issued its earnings results on Thursday, November 7th. The company reported C$1.03 earnings per share (EPS) for the quarter, topping the consensus estimate of C$0.97 by C$0.06. The firm had revenue of C$4.08 billion for the quarter, compared to analysts' expectations of C$3.90 billion. TC Energy had a net margin of 21.38% and a return on equity of 10.68%. On average, equities research analysts forecast that TC Energy will post 3.5490515 earnings per share for the current year.

TC Energy Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 31st. Shareholders of record on Tuesday, December 31st will be issued a dividend of $1.113 per share. This is an increase from TC Energy's previous quarterly dividend of $0.96. This represents a $4.45 annualized dividend and a yield of 6.47%. The ex-dividend date is Tuesday, December 31st. TC Energy's dividend payout ratio (DPR) is presently 116.01%.

About TC Energy

(

Get Free ReportTC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Energy Solutions. The company builds and operates a network of 93,600 kilometers of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses.

Featured Articles

Before you consider TC Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TC Energy wasn't on the list.

While TC Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.