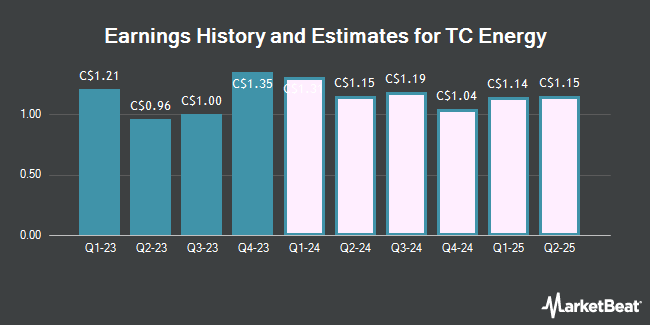

TC Energy Co. (TSE:TRP - Free Report) NYSE: TRP - Equities researchers at National Bank Financial boosted their FY2024 earnings per share estimates for TC Energy in a research note issued on Monday, January 6th. National Bank Financial analyst P. Kenny now forecasts that the company will post earnings of $4.15 per share for the year, up from their prior forecast of $4.12. The consensus estimate for TC Energy's current full-year earnings is $3.55 per share. National Bank Financial also issued estimates for TC Energy's FY2025 earnings at $4.06 EPS and FY2028 earnings at $4.74 EPS.

TC Energy (TSE:TRP - Get Free Report) NYSE: TRP last posted its quarterly earnings results on Thursday, November 7th. The company reported C$1.03 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of C$0.97 by C$0.06. TC Energy had a net margin of 21.38% and a return on equity of 10.68%. The business had revenue of C$4.08 billion during the quarter, compared to analyst estimates of C$3.90 billion.

TRP has been the subject of a number of other research reports. National Bankshares upped their target price on TC Energy from C$70.00 to C$71.00 in a research report on Wednesday, November 20th. Royal Bank of Canada upped their price objective on shares of TC Energy from C$67.00 to C$71.00 in a report on Friday, November 8th. JPMorgan Chase & Co. lifted their target price on shares of TC Energy from C$70.00 to C$79.00 in a report on Monday, November 18th. Barclays upped their price target on shares of TC Energy from C$67.00 to C$74.00 in a report on Wednesday, November 20th. Finally, Scotiabank lifted their price objective on TC Energy from C$74.00 to C$75.00 in a research note on Wednesday, November 20th. Two analysts have rated the stock with a sell rating, six have issued a hold rating, six have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of C$69.77.

Check Out Our Latest Research Report on TC Energy

TC Energy Stock Up 0.2 %

Shares of TSE:TRP traded up C$0.11 during midday trading on Wednesday, hitting C$68.68. 8,501,129 shares of the stock were exchanged, compared to its average volume of 6,574,363. The company has a market capitalization of C$71.43 billion, a PE ratio of 20.75, a P/E/G ratio of 1.69 and a beta of 0.82. TC Energy has a 52-week low of C$43.83 and a 52-week high of C$70.32. The company has a debt-to-equity ratio of 160.84, a quick ratio of 0.40 and a current ratio of 0.76. The business's fifty day simple moving average is C$67.35 and its two-hundred day simple moving average is C$62.14.

TC Energy Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Friday, January 31st. Stockholders of record on Tuesday, December 31st will be issued a $1.113 dividend. This is a positive change from TC Energy's previous quarterly dividend of $0.96. The ex-dividend date is Tuesday, December 31st. This represents a $4.45 annualized dividend and a dividend yield of 6.48%. TC Energy's payout ratio is 116.01%.

Insider Activity at TC Energy

In other news, Senior Officer Stanley G. Chapman Iii sold 267,435 shares of the company's stock in a transaction dated Thursday, December 12th. The stock was sold at an average price of C$66.51, for a total transaction of C$17,785,898.39. Also, Director Alexander (Alex) Oehler purchased 6,540 shares of TC Energy stock in a transaction on Monday, December 30th. The shares were purchased at an average cost of C$66.05 per share, with a total value of C$431,947.64. Insiders sold a total of 420,911 shares of company stock worth $28,259,105 in the last quarter. Corporate insiders own 0.03% of the company's stock.

TC Energy Company Profile

(

Get Free Report)

TC Energy Corporation operates as an energy infrastructure company in North America. It operates through five segments: Canadian Natural Gas Pipelines; U.S. Natural Gas Pipelines; Mexico Natural Gas Pipelines; Liquids Pipelines; and Power and Energy Solutions. The company builds and operates a network of 93,600 kilometers of natural gas pipelines, which transports natural gas from supply basins to local distribution companies, power generation plants, industrial facilities, interconnecting pipelines, LNG export terminals, and other businesses.

Featured Articles

Before you consider TC Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TC Energy wasn't on the list.

While TC Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.