TCW Group Inc. grew its position in DuPont de Nemours, Inc. (NYSE:DD - Free Report) by 7.2% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The firm owned 651,706 shares of the basic materials company's stock after purchasing an additional 44,024 shares during the period. TCW Group Inc. owned about 0.16% of DuPont de Nemours worth $58,074,000 at the end of the most recent reporting period.

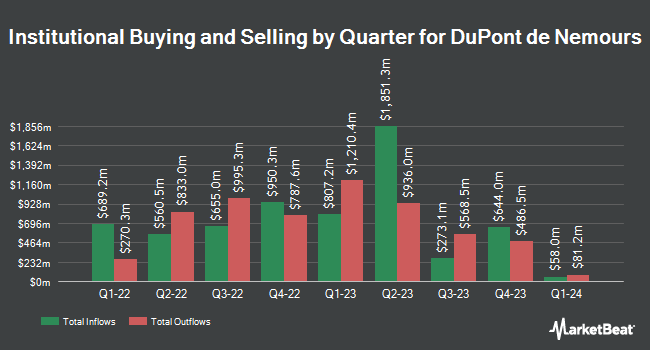

A number of other hedge funds and other institutional investors also recently made changes to their positions in DD. Arete Wealth Advisors LLC raised its stake in DuPont de Nemours by 39.4% during the 3rd quarter. Arete Wealth Advisors LLC now owns 13,819 shares of the basic materials company's stock worth $1,226,000 after buying an additional 3,903 shares during the period. Empire Financial Management Company LLC increased its holdings in shares of DuPont de Nemours by 294.3% in the third quarter. Empire Financial Management Company LLC now owns 20,632 shares of the basic materials company's stock worth $1,839,000 after acquiring an additional 15,400 shares in the last quarter. Coldstream Capital Management Inc. raised its position in shares of DuPont de Nemours by 12.3% during the third quarter. Coldstream Capital Management Inc. now owns 12,197 shares of the basic materials company's stock worth $1,085,000 after purchasing an additional 1,340 shares during the period. Geode Capital Management LLC lifted its holdings in shares of DuPont de Nemours by 1.0% during the 3rd quarter. Geode Capital Management LLC now owns 9,952,115 shares of the basic materials company's stock valued at $883,821,000 after purchasing an additional 100,198 shares in the last quarter. Finally, M&T Bank Corp grew its position in shares of DuPont de Nemours by 0.7% in the 3rd quarter. M&T Bank Corp now owns 1,734,503 shares of the basic materials company's stock valued at $154,562,000 after purchasing an additional 11,870 shares during the period. 73.96% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

A number of brokerages have weighed in on DD. StockNews.com lowered shares of DuPont de Nemours from a "buy" rating to a "hold" rating in a research note on Tuesday. Barclays boosted their price objective on shares of DuPont de Nemours from $84.00 to $85.00 and gave the company an "underweight" rating in a research report on Wednesday, November 6th. Morgan Stanley increased their target price on DuPont de Nemours from $88.00 to $94.00 and gave the stock an "equal weight" rating in a report on Monday, October 21st. Royal Bank of Canada boosted their price target on DuPont de Nemours from $102.00 to $104.00 and gave the company an "outperform" rating in a report on Thursday, November 7th. Finally, Wells Fargo & Company increased their price objective on DuPont de Nemours from $105.00 to $107.00 and gave the stock an "overweight" rating in a report on Wednesday, November 6th. Two analysts have rated the stock with a sell rating, three have assigned a hold rating and nine have given a buy rating to the company. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $95.42.

Check Out Our Latest Stock Report on DuPont de Nemours

DuPont de Nemours Stock Performance

NYSE DD traded down $0.16 during trading on Wednesday, reaching $81.92. 1,638,898 shares of the company's stock were exchanged, compared to its average volume of 2,455,584. DuPont de Nemours, Inc. has a fifty-two week low of $61.14 and a fifty-two week high of $90.06. The stock has a market capitalization of $34.24 billion, a P/E ratio of 43.18, a PEG ratio of 2.01 and a beta of 1.34. The business has a 50 day moving average price of $84.07 and a 200-day moving average price of $82.12. The company has a debt-to-equity ratio of 0.29, a current ratio of 2.28 and a quick ratio of 1.49.

DuPont de Nemours (NYSE:DD - Get Free Report) last announced its quarterly earnings results on Tuesday, November 5th. The basic materials company reported $1.18 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.03 by $0.15. The business had revenue of $3.19 billion during the quarter, compared to the consensus estimate of $3.20 billion. DuPont de Nemours had a return on equity of 6.64% and a net margin of 6.35%. The company's quarterly revenue was up 4.4% on a year-over-year basis. During the same quarter last year, the firm posted $0.92 EPS. Sell-side analysts forecast that DuPont de Nemours, Inc. will post 3.89 earnings per share for the current fiscal year.

DuPont de Nemours Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Friday, November 29th will be issued a dividend of $0.38 per share. This represents a $1.52 dividend on an annualized basis and a dividend yield of 1.86%. The ex-dividend date of this dividend is Friday, November 29th. DuPont de Nemours's dividend payout ratio is presently 80.00%.

DuPont de Nemours Profile

(

Free Report)

DuPont de Nemours, Inc provides technology-based materials and solutions in the United States, Canada, the Asia Pacific, Latin America, Europe, the Middle East, and Africa. It operates through Electronics & Industrial, Water & Protection, and Corporate & Other segments. The Electronics & Industrial segment supplies materials and solutions for the fabrication of semiconductors and integrated circuits.

Read More

Before you consider DuPont de Nemours, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DuPont de Nemours wasn't on the list.

While DuPont de Nemours currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.