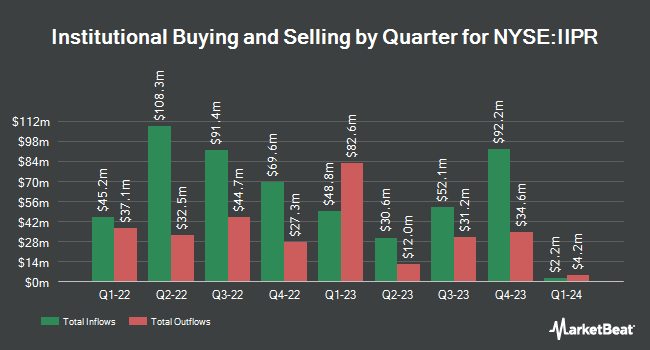

TCW Group Inc. bought a new position in shares of Innovative Industrial Properties, Inc. (NYSE:IIPR - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor bought 19,107 shares of the company's stock, valued at approximately $2,572,000. TCW Group Inc. owned about 0.07% of Innovative Industrial Properties at the end of the most recent quarter.

Other hedge funds have also added to or reduced their stakes in the company. USA Financial Formulas acquired a new position in shares of Innovative Industrial Properties during the 3rd quarter worth approximately $25,000. Canton Hathaway LLC bought a new stake in Innovative Industrial Properties during the third quarter worth $55,000. Loomis Sayles & Co. L P lifted its stake in Innovative Industrial Properties by 3,130.8% in the third quarter. Loomis Sayles & Co. L P now owns 420 shares of the company's stock valued at $57,000 after acquiring an additional 407 shares during the last quarter. US Bancorp DE grew its position in shares of Innovative Industrial Properties by 75.3% in the 3rd quarter. US Bancorp DE now owns 440 shares of the company's stock valued at $59,000 after acquiring an additional 189 shares during the period. Finally, Blue Trust Inc. increased its stake in shares of Innovative Industrial Properties by 2,085.7% during the 2nd quarter. Blue Trust Inc. now owns 459 shares of the company's stock worth $48,000 after purchasing an additional 438 shares during the last quarter. Institutional investors own 70.58% of the company's stock.

Analysts Set New Price Targets

Several brokerages recently issued reports on IIPR. Roth Capital upgraded shares of Innovative Industrial Properties to a "strong-buy" rating in a research note on Monday, November 11th. Compass Point upgraded Innovative Industrial Properties from a "neutral" rating to a "buy" rating and set a $125.00 target price for the company in a research note on Friday, November 8th. Piper Sandler decreased their target price on Innovative Industrial Properties from $120.00 to $118.00 and set a "neutral" rating on the stock in a report on Friday, November 8th. Finally, Wolfe Research raised Innovative Industrial Properties to a "hold" rating in a report on Monday, September 23rd. Two research analysts have rated the stock with a hold rating, two have issued a buy rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $127.67.

View Our Latest Stock Analysis on Innovative Industrial Properties

Innovative Industrial Properties Stock Performance

IIPR stock traded up $0.99 during mid-day trading on Friday, hitting $104.80. 122,309 shares of the company were exchanged, compared to its average volume of 202,572. Innovative Industrial Properties, Inc. has a 1-year low of $87.52 and a 1-year high of $138.35. The business has a 50 day simple moving average of $117.98 and a 200-day simple moving average of $118.30. The company has a current ratio of 11.53, a quick ratio of 11.53 and a debt-to-equity ratio of 0.15. The stock has a market capitalization of $2.97 billion, a PE ratio of 18.65 and a beta of 1.30.

Innovative Industrial Properties (NYSE:IIPR - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $1.37 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.13 by ($0.76). The firm had revenue of $76.53 million during the quarter, compared to the consensus estimate of $77.30 million. Innovative Industrial Properties had a net margin of 52.51% and a return on equity of 8.44%. The business's revenue for the quarter was down 1.7% compared to the same quarter last year. During the same quarter last year, the firm earned $2.29 earnings per share. On average, equities analysts forecast that Innovative Industrial Properties, Inc. will post 8.36 earnings per share for the current year.

Innovative Industrial Properties Company Profile

(

Free Report)

Innovative Industrial Properties, Inc is a self-advised Maryland corporation focused on the acquisition, ownership and management of specialized properties leased to experienced, state-licensed operators for their regulated cannabis facilities. Innovative Industrial Properties, Inc has elected to be taxed as a real estate investment trust, commencing with the year ended December 31, 2017.

Featured Articles

Before you consider Innovative Industrial Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Innovative Industrial Properties wasn't on the list.

While Innovative Industrial Properties currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.