United Airlines (NASDAQ:UAL - Get Free Report) had its price target hoisted by equities research analysts at TD Cowen from $100.00 to $125.00 in a research note issued on Tuesday, MarketBeat.com reports. The firm currently has a "buy" rating on the transportation company's stock. TD Cowen's target price points to a potential upside of 32.60% from the stock's previous close.

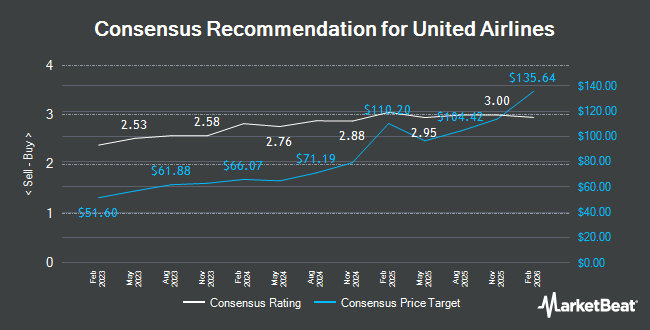

Other equities research analysts have also recently issued research reports about the company. Susquehanna increased their price objective on United Airlines from $70.00 to $85.00 and gave the stock a "positive" rating in a report on Thursday, October 17th. Barclays boosted their price target on United Airlines from $75.00 to $150.00 and gave the company an "overweight" rating in a research note on Thursday, November 14th. The Goldman Sachs Group reiterated a "buy" rating and set a $119.00 price target on shares of United Airlines in a research note on Friday. Jefferies Financial Group lifted their target price on United Airlines from $75.00 to $95.00 and gave the company a "buy" rating in a research report on Monday, October 21st. Finally, Morgan Stanley upped their price target on United Airlines from $80.00 to $88.00 and gave the stock an "overweight" rating in a research report on Thursday, October 17th. Two equities research analysts have rated the stock with a hold rating and fourteen have issued a buy rating to the stock. According to data from MarketBeat, United Airlines currently has an average rating of "Moderate Buy" and an average target price of $88.28.

Check Out Our Latest Analysis on UAL

United Airlines Trading Up 4.3 %

NASDAQ UAL traded up $3.89 during trading on Tuesday, hitting $94.27. 6,015,206 shares of the company's stock traded hands, compared to its average volume of 8,453,789. The firm has a market cap of $31.00 billion, a P/E ratio of 10.88, a PEG ratio of 1.08 and a beta of 1.39. The stock has a fifty day moving average of $67.78 and a two-hundred day moving average of $54.77. The company has a debt-to-equity ratio of 1.95, a current ratio of 0.79 and a quick ratio of 0.72. United Airlines has a 12-month low of $37.02 and a 12-month high of $95.19.

United Airlines (NASDAQ:UAL - Get Free Report) last announced its quarterly earnings results on Tuesday, October 15th. The transportation company reported $3.33 EPS for the quarter, topping analysts' consensus estimates of $3.10 by $0.23. United Airlines had a return on equity of 30.72% and a net margin of 4.94%. The business had revenue of $14.84 billion for the quarter, compared to analysts' expectations of $14.76 billion. During the same period in the previous year, the firm earned $3.65 EPS. As a group, sell-side analysts expect that United Airlines will post 10.23 EPS for the current year.

United Airlines declared that its board has authorized a share buyback plan on Tuesday, October 15th that permits the company to buyback $1.50 billion in outstanding shares. This buyback authorization permits the transportation company to buy up to 7.1% of its stock through open market purchases. Stock buyback plans are usually a sign that the company's leadership believes its stock is undervalued.

Insider Activity

In other news, EVP Torbjorn J. Enqvist sold 14,500 shares of United Airlines stock in a transaction that occurred on Thursday, October 17th. The shares were sold at an average price of $72.00, for a total transaction of $1,044,000.00. Following the completion of the sale, the executive vice president now owns 30,427 shares of the company's stock, valued at approximately $2,190,744. The trade was a 32.27 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, EVP Kate Gebo sold 17,500 shares of the firm's stock in a transaction on Friday, November 1st. The stock was sold at an average price of $80.44, for a total value of $1,407,700.00. Following the transaction, the executive vice president now owns 40,012 shares in the company, valued at $3,218,565.28. The trade was a 30.43 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.63% of the company's stock.

Hedge Funds Weigh In On United Airlines

A number of large investors have recently bought and sold shares of the business. Price T Rowe Associates Inc. MD raised its position in shares of United Airlines by 5.9% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 1,161,931 shares of the transportation company's stock worth $55,634,000 after acquiring an additional 64,542 shares in the last quarter. Aigen Investment Management LP boosted its holdings in shares of United Airlines by 87.2% in the 3rd quarter. Aigen Investment Management LP now owns 18,912 shares of the transportation company's stock valued at $1,079,000 after buying an additional 8,808 shares in the last quarter. Bessemer Group Inc. grew its position in shares of United Airlines by 47.4% in the 1st quarter. Bessemer Group Inc. now owns 5,471 shares of the transportation company's stock worth $261,000 after buying an additional 1,759 shares during the last quarter. Tidal Investments LLC raised its stake in shares of United Airlines by 16.4% during the 1st quarter. Tidal Investments LLC now owns 17,429 shares of the transportation company's stock worth $835,000 after acquiring an additional 2,456 shares in the last quarter. Finally, Senator Investment Group LP boosted its stake in United Airlines by 39.5% in the second quarter. Senator Investment Group LP now owns 1,046,051 shares of the transportation company's stock valued at $50,901,000 after acquiring an additional 296,051 shares in the last quarter. Institutional investors own 69.69% of the company's stock.

United Airlines Company Profile

(

Get Free Report)

United Airlines Holdings, Inc, through its subsidiaries, provides air transportation services in North America, Asia, Europe, Africa, the Pacific, the Middle East, and Latin America. The company transports people and cargo through its mainline and regional fleets. It also offers catering, ground handling, flight academy, and maintenance services for third parties.

Featured Stories

Before you consider United Airlines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Airlines wasn't on the list.

While United Airlines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.