Alaska Air Group (NYSE:ALK - Free Report) had its target price raised by TD Cowen from $68.00 to $78.00 in a research report released on Wednesday morning. The brokerage currently has a buy rating on the transportation company's stock.

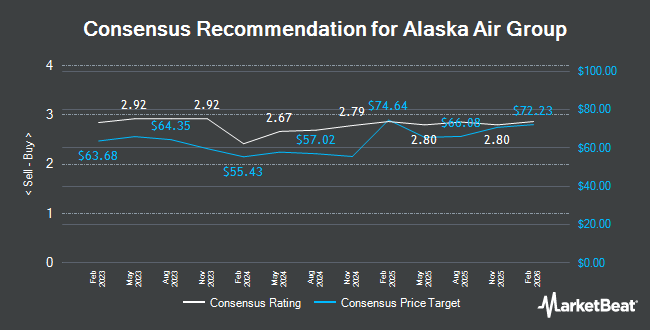

Other equities research analysts have also recently issued research reports about the stock. Morgan Stanley upped their price objective on shares of Alaska Air Group from $70.00 to $90.00 and gave the stock an "overweight" rating in a research report on Wednesday. UBS Group reiterated a "buy" rating and set a $72.00 price target on shares of Alaska Air Group in a research report on Tuesday, November 26th. Susquehanna boosted their price objective on shares of Alaska Air Group from $40.00 to $45.00 and gave the company a "neutral" rating in a research report on Wednesday, October 9th. Melius raised Alaska Air Group from a "hold" rating to a "buy" rating and set a $56.00 target price on the stock in a report on Monday, October 28th. Finally, Citigroup lowered their price target on Alaska Air Group from $51.00 to $48.00 and set a "buy" rating for the company in a report on Thursday, August 29th. Two research analysts have rated the stock with a hold rating and thirteen have given a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus target price of $64.00.

Check Out Our Latest Analysis on ALK

Alaska Air Group Stock Performance

NYSE:ALK traded up $2.79 during mid-day trading on Wednesday, reaching $64.08. 5,101,634 shares of the company's stock were exchanged, compared to its average volume of 2,273,339. The business's fifty day simple moving average is $49.29 and its two-hundred day simple moving average is $42.57. Alaska Air Group has a one year low of $32.62 and a one year high of $65.28. The firm has a market capitalization of $8.13 billion, a PE ratio of 25.34, a price-to-earnings-growth ratio of 1.23 and a beta of 1.60. The company has a debt-to-equity ratio of 0.93, a quick ratio of 0.57 and a current ratio of 0.60.

Alaska Air Group (NYSE:ALK - Get Free Report) last issued its quarterly earnings results on Thursday, October 31st. The transportation company reported $2.25 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.22 by $0.03. The business had revenue of $3.07 billion for the quarter, compared to the consensus estimate of $3 billion. Alaska Air Group had a return on equity of 12.81% and a net margin of 2.99%. The firm's quarterly revenue was up 8.2% compared to the same quarter last year. During the same quarter in the prior year, the business posted $1.83 earnings per share. Analysts anticipate that Alaska Air Group will post 4.26 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. Cetera Advisors LLC acquired a new position in shares of Alaska Air Group in the first quarter worth approximately $227,000. CWM LLC lifted its position in shares of Alaska Air Group by 13.0% in the 2nd quarter. CWM LLC now owns 4,403 shares of the transportation company's stock worth $178,000 after purchasing an additional 507 shares during the period. QRG Capital Management Inc. boosted its stake in shares of Alaska Air Group by 4.7% in the 2nd quarter. QRG Capital Management Inc. now owns 9,029 shares of the transportation company's stock valued at $365,000 after purchasing an additional 406 shares during the last quarter. SG Americas Securities LLC acquired a new stake in shares of Alaska Air Group during the second quarter worth $773,000. Finally, Sequoia Financial Advisors LLC lifted its holdings in Alaska Air Group by 13.0% in the second quarter. Sequoia Financial Advisors LLC now owns 5,714 shares of the transportation company's stock valued at $231,000 after buying an additional 658 shares during the period. 81.90% of the stock is owned by institutional investors and hedge funds.

About Alaska Air Group

(

Get Free Report)

Alaska Air Group, Inc, through its subsidiaries, operates airlines. It operates through three segments: Mainline, Regional, and Horizon. The company offers scheduled air transportation services on Boeing jet aircraft for passengers and cargo in the United States, and in parts of Canada, Mexico, Costa Rica, Belize, Guatemala, and the Bahamas; and for passengers across a shorter distance network within the United States, Canada, and Mexico.

Featured Articles

Before you consider Alaska Air Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alaska Air Group wasn't on the list.

While Alaska Air Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.