Royal Gold (NASDAQ:RGLD - Get Free Report) TSE: RGL had its target price boosted by equities researchers at TD Securities from $181.00 to $185.00 in a research report issued on Thursday,BayStreet.CA reports. The firm presently has a "buy" rating on the basic materials company's stock. TD Securities' price target points to a potential upside of 26.31% from the stock's current price.

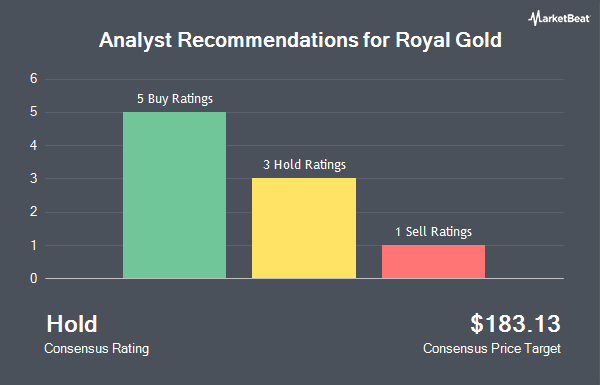

A number of other equities research analysts also recently issued reports on RGLD. Cibc World Mkts upgraded shares of Royal Gold to a "hold" rating in a research note on Wednesday, July 10th. CIBC lifted their price objective on shares of Royal Gold from $166.00 to $175.00 and gave the company a "neutral" rating in a research note on Wednesday, July 10th. BMO Capital Markets upped their target price on Royal Gold from $168.00 to $170.00 and gave the stock an "outperform" rating in a research note on Wednesday, July 10th. Scotiabank lifted their price target on Royal Gold from $148.00 to $157.00 and gave the company a "sector perform" rating in a research note on Monday, August 19th. Finally, Jefferies Financial Group upped their price objective on shares of Royal Gold from $141.00 to $154.00 and gave the stock a "hold" rating in a research report on Friday, October 4th. One analyst has rated the stock with a sell rating, five have given a hold rating and four have assigned a buy rating to the company. According to MarketBeat, the company currently has a consensus rating of "Hold" and an average target price of $163.14.

Check Out Our Latest Stock Analysis on RGLD

Royal Gold Stock Up 1.1 %

Shares of Royal Gold stock traded up $1.63 during trading on Thursday, reaching $146.47. The company's stock had a trading volume of 138,937 shares, compared to its average volume of 364,530. The firm has a market cap of $9.63 billion, a PE ratio of 40.13, a P/E/G ratio of 1.20 and a beta of 0.90. Royal Gold has a 52 week low of $100.55 and a 52 week high of $155.10. The business's 50-day moving average price is $143.30 and its 200-day moving average price is $134.57.

Royal Gold (NASDAQ:RGLD - Get Free Report) TSE: RGL last issued its quarterly earnings results on Wednesday, November 6th. The basic materials company reported $1.47 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.34 by $0.13. Royal Gold had a return on equity of 8.74% and a net margin of 39.15%. The business had revenue of $193.84 million during the quarter, compared to analysts' expectations of $184.12 million. During the same period in the previous year, the company posted $0.76 earnings per share. The firm's revenue for the quarter was up 39.8% compared to the same quarter last year. Equities analysts predict that Royal Gold will post 4.99 earnings per share for the current year.

Insiders Place Their Bets

In other Royal Gold news, Director Ronald J. Vance sold 1,000 shares of the stock in a transaction that occurred on Monday, August 12th. The shares were sold at an average price of $132.16, for a total transaction of $132,160.00. Following the completion of the sale, the director now owns 9,109 shares of the company's stock, valued at approximately $1,203,845.44. This represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In other Royal Gold news, Director Ronald J. Vance sold 1,000 shares of the stock in a transaction dated Monday, August 12th. The stock was sold at an average price of $132.16, for a total transaction of $132,160.00. Following the completion of the sale, the director now directly owns 9,109 shares in the company, valued at approximately $1,203,845.44. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, SVP Randy Shefman sold 4,600 shares of Royal Gold stock in a transaction dated Wednesday, August 28th. The stock was sold at an average price of $140.31, for a total value of $645,426.00. Following the completion of the transaction, the senior vice president now directly owns 7,430 shares of the company's stock, valued at approximately $1,042,503.30. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 8,355 shares of company stock valued at $1,170,315. 0.52% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Large investors have recently made changes to their positions in the business. Thrivent Financial for Lutherans lifted its position in shares of Royal Gold by 5.0% during the third quarter. Thrivent Financial for Lutherans now owns 16,680 shares of the basic materials company's stock valued at $2,340,000 after purchasing an additional 798 shares in the last quarter. Claro Advisors LLC purchased a new stake in Royal Gold in the third quarter worth $229,000. Natixis Advisors LLC boosted its position in Royal Gold by 14.4% during the third quarter. Natixis Advisors LLC now owns 15,300 shares of the basic materials company's stock worth $2,147,000 after purchasing an additional 1,931 shares during the period. MQS Management LLC bought a new position in Royal Gold in the 3rd quarter worth approximately $491,000. Finally, Victory Capital Management Inc. grew its stake in Royal Gold by 0.8% in the 3rd quarter. Victory Capital Management Inc. now owns 194,326 shares of the basic materials company's stock valued at $27,264,000 after buying an additional 1,636 shares in the last quarter. 83.65% of the stock is owned by institutional investors.

Royal Gold Company Profile

(

Get Free Report)

Royal Gold, Inc, together with its subsidiaries, acquires and manages precious metal streams, royalties, and related interests. The company engages in acquiring stream and royalty interests or to finance projects that are in production, development, or in the exploration stage in exchange for stream or royalty interests, which primarily consists of gold, silver, copper, nickel, zinc, lead, and other metals.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Royal Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Royal Gold wasn't on the list.

While Royal Gold currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.