Saputo (TSE:SAP - Get Free Report) had its price target cut by analysts at TD Securities from C$37.00 to C$35.00 in a research report issued to clients and investors on Friday,BayStreet.CA reports. The brokerage currently has a "buy" rating on the stock. TD Securities' price target suggests a potential upside of 42.39% from the stock's current price.

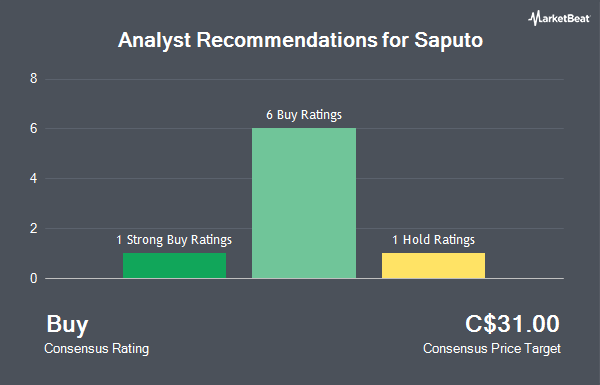

SAP has been the topic of a number of other research reports. National Bankshares decreased their target price on shares of Saputo from C$31.00 to C$28.00 in a report on Wednesday, January 15th. Royal Bank of Canada decreased their price target on shares of Saputo from C$38.00 to C$35.00 and set an "outperform" rating on the stock in a report on Friday, February 7th. Jefferies Financial Group lowered their price objective on Saputo from C$36.00 to C$32.00 and set a "buy" rating on the stock in a research report on Monday, December 23rd. BMO Capital Markets reduced their target price on Saputo from C$30.00 to C$27.00 and set a "market perform" rating for the company in a research report on Friday, January 10th. Finally, Desjardins lowered their price target on Saputo from C$34.00 to C$31.00 and set a "buy" rating on the stock in a report on Monday, February 10th. One analyst has rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat.com, Saputo has an average rating of "Moderate Buy" and an average target price of C$31.00.

Get Our Latest Stock Report on Saputo

Saputo Price Performance

SAP stock traded down C$0.52 during mid-day trading on Friday, reaching C$24.58. 898,835 shares of the company traded hands, compared to its average volume of 801,796. The company has a fifty day moving average price of C$24.67 and a 200-day moving average price of C$26.11. Saputo has a 52-week low of C$22.59 and a 52-week high of C$32.15. The company has a market capitalization of C$10.36 billion, a P/E ratio of -65.81, a P/E/G ratio of 0.56 and a beta of 0.32. The company has a debt-to-equity ratio of 51.68, a current ratio of 1.53 and a quick ratio of 0.67.

About Saputo

(

Get Free Report)

Saputo Inc produces, markets, and distributes dairy products in Canada, the United States, Argentina, Australia, and the United Kingdom. The company offers cheeses, including mozzarella and cheddar; specialty cheeses, such as ricotta, provolone, blue, parmesan, goat cheese, feta, romano, and havarti; fine cheeses comprising brie and camembert; and other cheeses that include brick, colby, farmer, munster, monterey jack, fresh curd, and processed cheeses.

Featured Articles

Before you consider Saputo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Saputo wasn't on the list.

While Saputo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.